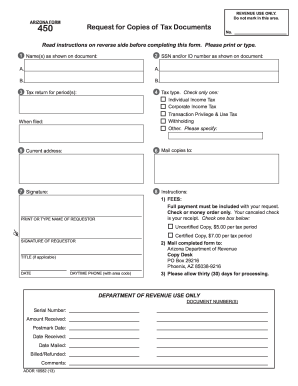

AZ Form 450 2016-2025 free printable template

Get, Create, Make and Sign arizona 450 revenue form

Editing az 450 revenue online

Uncompromising security for your PDF editing and eSignature needs

AZ Form 450 Form Versions

How to fill out 450 form

How to fill out AZ Form 450

Who needs AZ Form 450?

Video instructions and help with filling out and completing arizona form 450

Instructions and Help about arizona form 450 2016-2025

Welcome to the Arizona unclaimed property holder compliance unit presentation of reporting 101 our act is a version of the 1995 model uniform act and was adopted in 2001 our statutes can be found in title 44 chapter 3 you may review these at the Arizona legislative website what is unclaimed property it is defined as any asset which has held issued erode in the course of business that has certain unclaimed by its own first specific period of time ranging from 1 to 15 years each type of property has its own dormancy period but most calling it a three-year category such as insurance policy refunds securities accounts payable cashiers and vendor checks as well as dormant savings and checking accounts however wages and commissions are only one unit please keep in mind everything is both reportable and the minimal including in small amounts down to the penny what is not unclaimed property de minimis property is defined as any account balance of business associations of 50 or less payable to another business association these are commonly vendor checks and accounts payable items gift certificates or properties nominated in value other than currency such as electronic gift cards a non-refundable ticket stored value cards and merchandise points are all exempted by the Arizona statutes real estate both travel trailers and the light are not considered property under our laws the only tangible property that is reportable to us our safe deposit boxes held under lease by financial institutions your responsibilities as a holder are implementation of proper controls performing due diligence filing the report remitting the property and retaining your report records these are the five key elements for compliance with Arizona unclaimed property law why do businesses and governments need to review their records and report simply because it's the law you must review your records annually for potential unclaimed property you will want to ensure your company has policies and procedures in place to comply with applicable state laws and record retention requirements prior to 120 days of reporting you must make an attempt to locate in return property to its owner if there is an address on file and records do not indicate the address is bad and the value of the property is at least 50 after determining your abandoned property and due diligence has been performed you must report and remit the property to us, we encourage you to file reports with the appropriate States but if you are incorporated ardor domiciled in Arizona and you have found you have items for other states which are incidental property meaning less than 1000 and or less than 10 items you may report them to Arizona we will forward the property on to the appropriate state in the future however we cannot accept any property for California Texas or Oklahoma you must file directly with those states because state laws are subject to change we advise you contact any other state to ensure they allow us to accept...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit arizona form 450 2016-2025 online?

How do I edit arizona form 450 2016-2025 straight from my smartphone?

How do I edit arizona form 450 2016-2025 on an Android device?

What is AZ Form 450?

Who is required to file AZ Form 450?

How to fill out AZ Form 450?

What is the purpose of AZ Form 450?

What information must be reported on AZ Form 450?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.