Get the free LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS

Show details

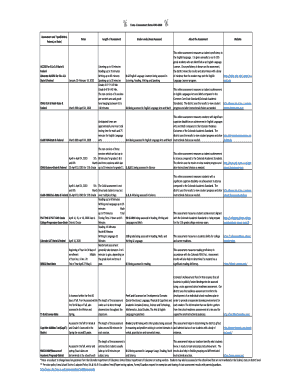

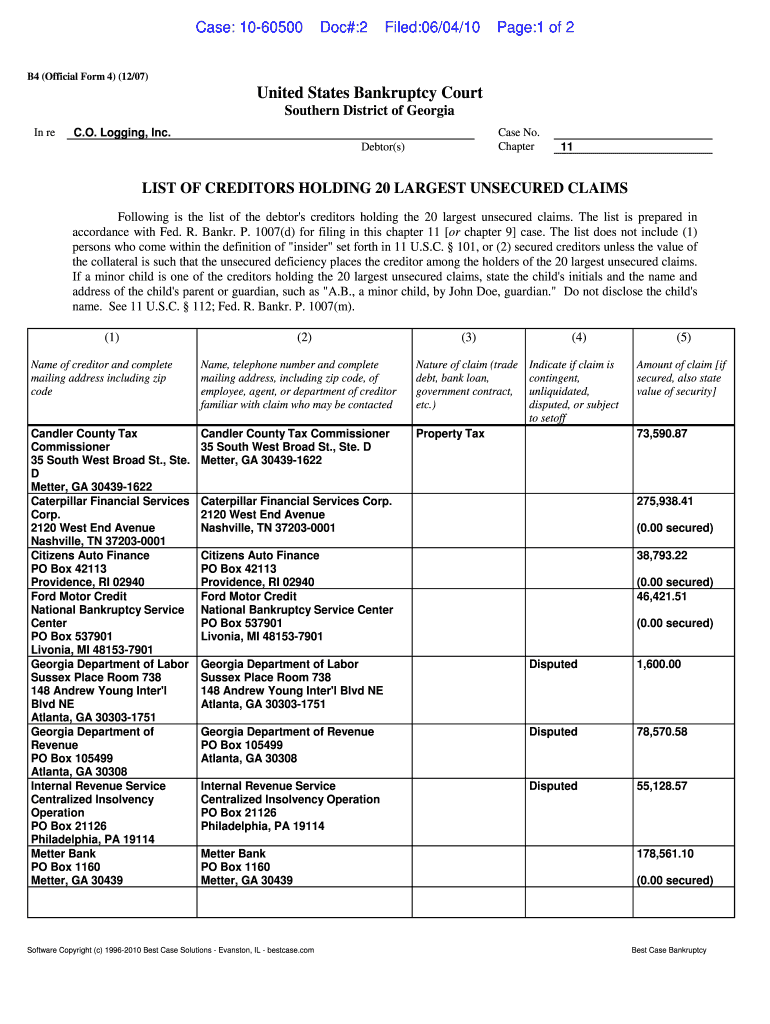

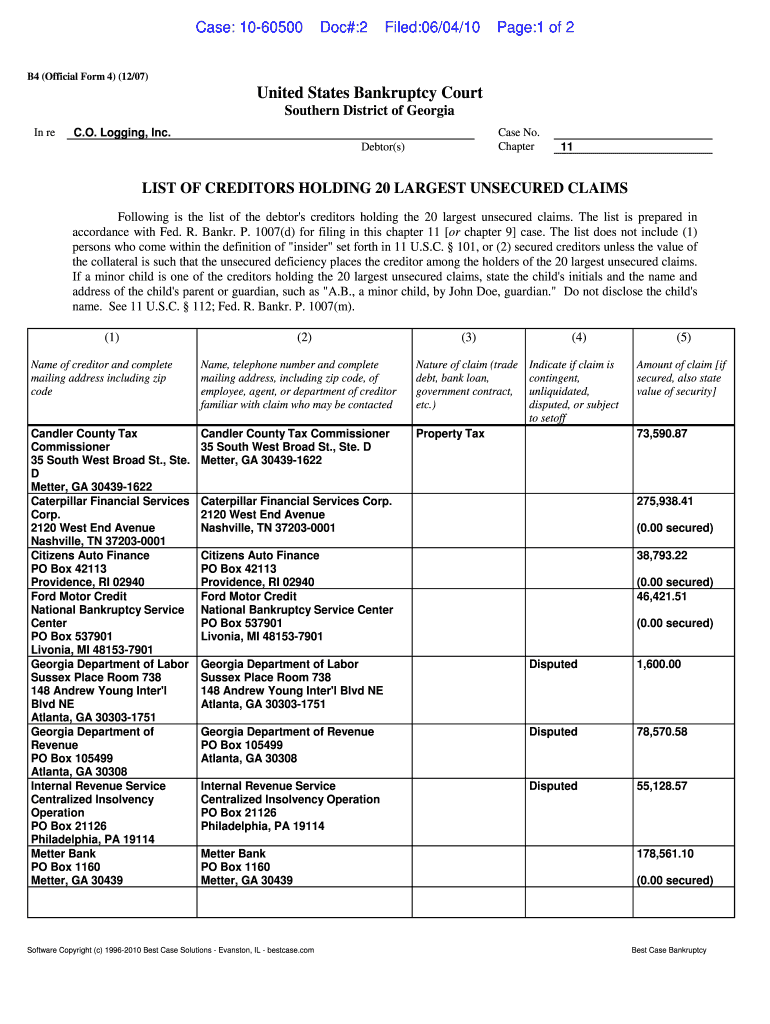

This document lists the creditors of C.O. Logging, Inc., holding the 20 largest unsecured claims in accordance with bankruptcy regulations. It is prepared for filing in a Chapter 11 Bankruptcy case

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign list of creditors holding

Edit your list of creditors holding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your list of creditors holding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing list of creditors holding online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit list of creditors holding. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out list of creditors holding

How to fill out LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS

01

Gather information about all unsecured creditors.

02

Identify the 20 largest unsecured claims from your records.

03

For each creditor, list their name and address.

04

Record the amount of each unsecured claim next to the corresponding creditor.

05

Ensure the total amount accurately reflects your obligations.

06

Double-check for accuracy and completeness before submission.

Who needs LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS?

01

Individuals or businesses filing for bankruptcy.

02

Debtors required to disclose their liabilities.

03

Creditors seeking a detailed list of other claims for assessment.

Fill

form

: Try Risk Free

People Also Ask about

Who are the unsecured creditors in the list?

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

What is the meaning of unsecured creditors?

A creditor who has no security over any of the debtor's assets for the debt due to it. Unsecured creditors in a corporate insolvency process most commonly include trade creditors, the Redundancy Payments Service and HMRC. (As of 1 December 2020, certain debts owing to HMRC will have secondary preferential status.

What does creditors who have unsecured claims mean?

An unsecured claim is a payment request made to the bankruptcy court by a creditor who doesn't have the right to sell property to satisfy the underlying debt. Credit card companies, medical providers, and utility companies often file unsecured claims.

What are creditors who have unsecured claims?

An unsecured claim is a payment request made to the bankruptcy court by a creditor who doesn't have the right to sell property to satisfy the underlying debt. Credit card companies, medical providers, and utility companies often file unsecured claims.

What is the difference between a secured claim and an unsecured claim?

If you are an unsecured creditor, then: once a bankruptcy trustee or liquidator has realised the debtor's assets, and the costs of the bankruptcy/liquidation and priority payments (e.g. to Secured Creditors) have been made, you will be entitled to receive a share in any available funds left.

How to make a list of creditors?

Identify who your creditors are, including suppliers, lenders, and other third parties Make a list of everyone you owe money to, including suppliers, lenders, and other third parties. Check your credit report for any accounts you may have forgotten. Ask your accountant or bookkeeper for a list of creditors if you have one.

What is the list of creditors template?

A list of creditors template is a document used to list all of an individual or business's creditors and the amounts owed to them. This template is used to keep track of all creditors and the amounts owed, which can help individuals or businesses plan ahead for future financial obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS?

It is a document that lists the names and addresses of the 20 largest creditors holding unsecured claims against a debtor in a bankruptcy case.

Who is required to file LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS?

Debtors who file for bankruptcy under Chapter 7 or Chapter 11 are required to file this list as part of their bankruptcy proceedings.

How to fill out LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS?

To fill out the list, gather information about the creditors, including their names, addresses, the amount of the claim, and the nature of the debt, then organize it in the required format.

What is the purpose of LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS?

The purpose is to provide the bankruptcy court and other interested parties with information about the debtor's largest unsecured creditors, facilitating the administration of the bankruptcy case.

What information must be reported on LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS?

The report must include each creditor's name, address, the amount of the claim, and a brief description of the nature of the debt.

Fill out your list of creditors holding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

List Of Creditors Holding is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.