Get the free 62A500-C (10-99)

Show details

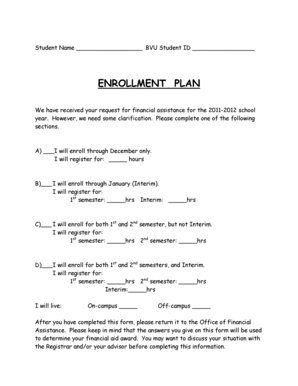

This document is used to report consigned inventory owned by others for tax purposes in Kentucky, specifically for tangible personal property tax returns.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 62a500-c 10-99

Edit your 62a500-c 10-99 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 62a500-c 10-99 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 62a500-c 10-99 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 62a500-c 10-99. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 62a500-c 10-99

How to fill out 62A500-C (10-99)

01

Obtain Form 62A500-C (10-99) from the relevant authority or website.

02

Fill out the entity or individual's name in the designated field.

03

Provide the complete address including city, state, and zip code.

04

Enter the Social Security Number (SSN) or Employer Identification Number (EIN) for tax purposes.

05

Specify the type of income received during the tax year.

06

Clearly state the total amount of income earned.

07

Review all entries for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the form to the appropriate taxing authority.

Who needs 62A500-C (10-99)?

01

Individuals or entities receiving income that needs to be reported for tax purposes.

02

Freelancers or contractors reporting income received from clients.

03

Any taxpayer who requires documentation for their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

Is Missouri getting rid of personal property tax?

Senate Bill 24 gradually reduces personal property tax assessment rates each year until 2026, when the assessment rate would be 0.001%. Throughout his time in the Missouri Senate, Sen. Eigel has filed legislation to eliminate personal property tax, as well as reduce the percentage of income tax collected.

Which state you don't have to pay property taxes?

So, if you've been googling what states don't have property tax, the short answer is: none. Every state has some form of property tax. This is because it's one of the main ways local governments pay for things like schools, police, fire departments, and public roads.

Is a tractor tangible personal property?

Tangible Personal Property includes all furniture, fixtures, tools, machinery, equipment, signs, leasehold improvements, leased equipment, supplies and any other equipment that may be used as part of the ordinary course of business or included inside a rental property.

What states are exempt from personal property tax?

27 States with No Personal Property Tax on Vehicles Delaware. Georgia. Idaho. Iowa. Maryland. New Jersey. New Mexico. New York.

What state has no personal tax?

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming do not levy income taxes. Washington does not tax income but does tax capital gains of certain high earners. States with no income tax may still charge other taxes, such as sales and property taxes.

What is a tangible tax return?

Tangible personal property is anything your business owns that is movable. This property can include office furniture and supplies, machinery, tools, and vehicles. Like real property, tangible personal property tax is assessed based on the presumed value of the assets.

What states freeze property taxes for seniors?

Summary State Property Tax Freeze and Assessment Freeze Programs StateYear EnactedAge Requirement Oklahoma 2004 Age 65 or older Rhode lsland 2009 Age 65 or older South Dakota 1980 Age 65 or older Washington 1995 Age 61 or older7 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 62A500-C (10-99)?

62A500-C (10-99) is a form used by certain entities to report specific financial information to the government, typically related to income paid to independent contractors.

Who is required to file 62A500-C (10-99)?

Entities that have paid $600 or more to an independent contractor or service provider in a tax year are required to file the 62A500-C (10-99) form.

How to fill out 62A500-C (10-99)?

To fill out the 62A500-C (10-99), provide the payer's information, the payee's information, the total amount paid, and any other required details as specified in the form's instructions.

What is the purpose of 62A500-C (10-99)?

The purpose of 62A500-C (10-99) is to document income paid to non-employees and facilitate tax reporting for both the payer and the recipient.

What information must be reported on 62A500-C (10-99)?

The information that must be reported on 62A500-C (10-99) includes the payer's name and identification number, the payee's name and identification number, the total amount paid, and the tax year.

Fill out your 62a500-c 10-99 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

62A500-C 10-99 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.