Get the free IT-CA 2008 GEORGIA JOB TAX CREDIT - etax dor ga

Show details

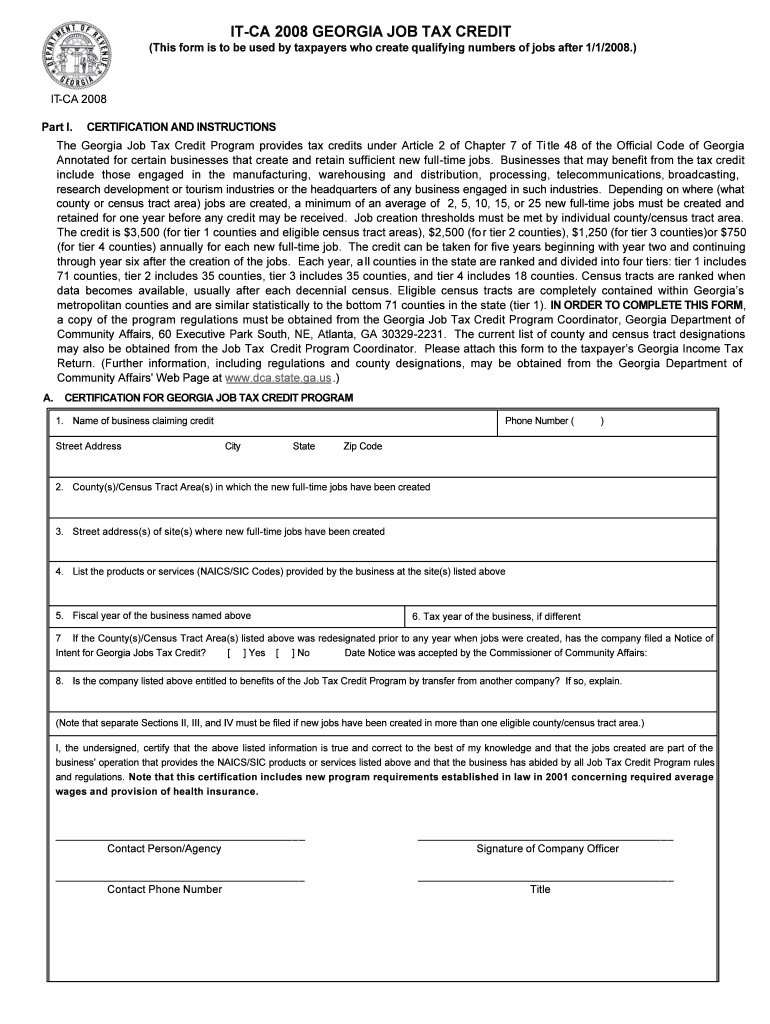

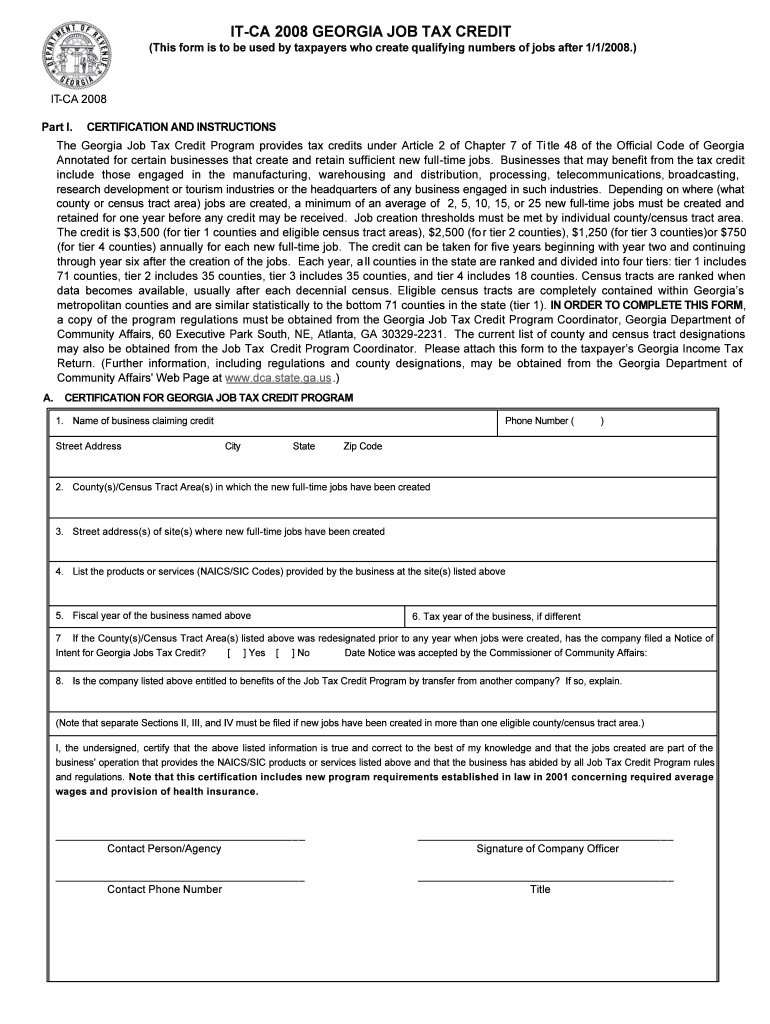

This form is used by taxpayers to apply for the Georgia Job Tax Credit based on the creation of new full-time jobs in eligible areas, outlining the requirements and calculations for credits available.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-ca 2008 georgia job

Edit your it-ca 2008 georgia job form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-ca 2008 georgia job form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it-ca 2008 georgia job online

To use the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit it-ca 2008 georgia job. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-ca 2008 georgia job

How to fill out IT-CA 2008 GEORGIA JOB TAX CREDIT

01

Obtain the IT-CA 2008 form from the Georgia Department of Revenue website.

02

Complete the business information section, including the name, address, and taxpayer identification number.

03

Provide details of the qualified jobs created or retained, including the number of jobs and positions.

04

Fill out the section detailing eligibility criteria, confirming that the business meets all requirements.

05

Calculate the job tax credit amount based on the number of qualified jobs and applicable rates.

06

Attach any necessary documentation to support your application, such as payroll records or forms verifying job creation.

07

Review the form for accuracy and completeness.

08

Submit the completed IT-CA 2008 form to the Georgia Department of Revenue before the deadline.

Who needs IT-CA 2008 GEORGIA JOB TAX CREDIT?

01

Businesses operating in Georgia that create new jobs and wish to claim a tax credit.

02

Companies in specific industries, such as manufacturing or logistics, that qualify for the job tax credit.

03

Businesses looking to reduce their state tax liability while contributing to job growth in the state.

Fill

form

: Try Risk Free

People Also Ask about

What is a job tax credit?

What is WOTC? The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group .

Who gets the work opportunity tax credit?

For TANF recipients, veterans, ex-felons, designated community residents, vocational rehabilitation referrals, summer youth workers, SNAP recipients, SSI recipients, or long-term unemployed: 40% tax credit if the employee works at least 400 hours. 25% tax credit if the employee works 120–399 hours.

How does the Georgia film tax credit work?

To calculate your tax credit, simply multiply your qualified Georgia expenditures by . 20. For example, for a base investment in Georgia of $20,000,000, your savings would be $4,000,000. If you include the GEP Uplift in the finished project, your credit would be at the 30% level, or 20,000,000 x .

Who qualifies for Georgia low income tax credit?

To qualify for the low income credit, your federal adjusted gross income must be less than $20,000, you cannot be claimed as a dependent on another person's return, and you cannot be an inmate in a correctional facility. The low income credit is a nonrefundable credit.

How does the Georgia goal tax credit work?

All Georgia taxpayers are eligible to receive a 100% state income tax credit in exchange for their contributions to Georgia GOAL. Funds raised through GOAL are used to provide tuition assistance for exceptional students desiring to attend eligible private schools.

Who qualifies for Georgia low income tax credit?

To qualify for the low income credit, your federal adjusted gross income must be less than $20,000, you cannot be claimed as a dependent on another person's return, and you cannot be an inmate in a correctional facility. The low income credit is a nonrefundable credit.

What is the job tax credit in Georgia?

Our Job Tax Credit gives you a credit ranging from $1,250 to $4,000 per year for 5 years for every new job created. In certain areas, the credit can also lower your payroll withholding obligations. To qualify: The new jobs must be in a specific industry sector, such as manufacturing, distribution or data processing.

What is the Georgia job tax credit?

Our Job Tax Credit gives you a credit ranging from $1,250 to $4,000 per year for 5 years for every new job created. In certain areas, the credit can also lower your payroll withholding obligations. To qualify: The new jobs must be in a specific industry sector, such as manufacturing, distribution or data processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-CA 2008 GEORGIA JOB TAX CREDIT?

IT-CA 2008 GEORGIA JOB TAX CREDIT is a tax incentive program designed to encourage businesses to create and retain jobs in Georgia. This credit allows eligible employers to receive a tax reduction based on the number of new jobs created and maintained.

Who is required to file IT-CA 2008 GEORGIA JOB TAX CREDIT?

Employers who have created qualified new jobs in Georgia and wish to claim the job tax credit must file IT-CA 2008 GEORGIA JOB TAX CREDIT. This typically includes businesses that meet specific criteria set by the Georgia Department of Revenue.

How to fill out IT-CA 2008 GEORGIA JOB TAX CREDIT?

To fill out IT-CA 2008 GEORGIA JOB TAX CREDIT, businesses must provide information about the number of new jobs created, the wages paid to employees, and other necessary documentation to prove eligibility. The form must be completed accurately and submitted along with the business's tax return.

What is the purpose of IT-CA 2008 GEORGIA JOB TAX CREDIT?

The purpose of IT-CA 2008 GEORGIA JOB TAX CREDIT is to promote job creation and economic development within Georgia by providing financial incentives to businesses that hire new employees and invest in the local workforce.

What information must be reported on IT-CA 2008 GEORGIA JOB TAX CREDIT?

Information to be reported on IT-CA 2008 GEORGIA JOB TAX CREDIT includes the total number of new jobs created, the location where the jobs were created, the wages of the new employees, and any other relevant details regarding the business's compliance with the credit requirements.

Fill out your it-ca 2008 georgia job online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-Ca 2008 Georgia Job is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.