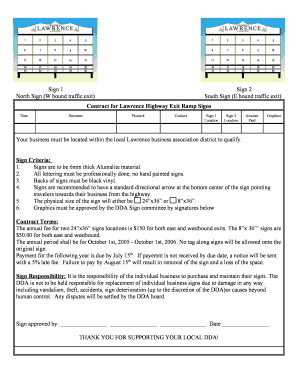

Get the free Self-Directed Custodial Account Agreement

Show details

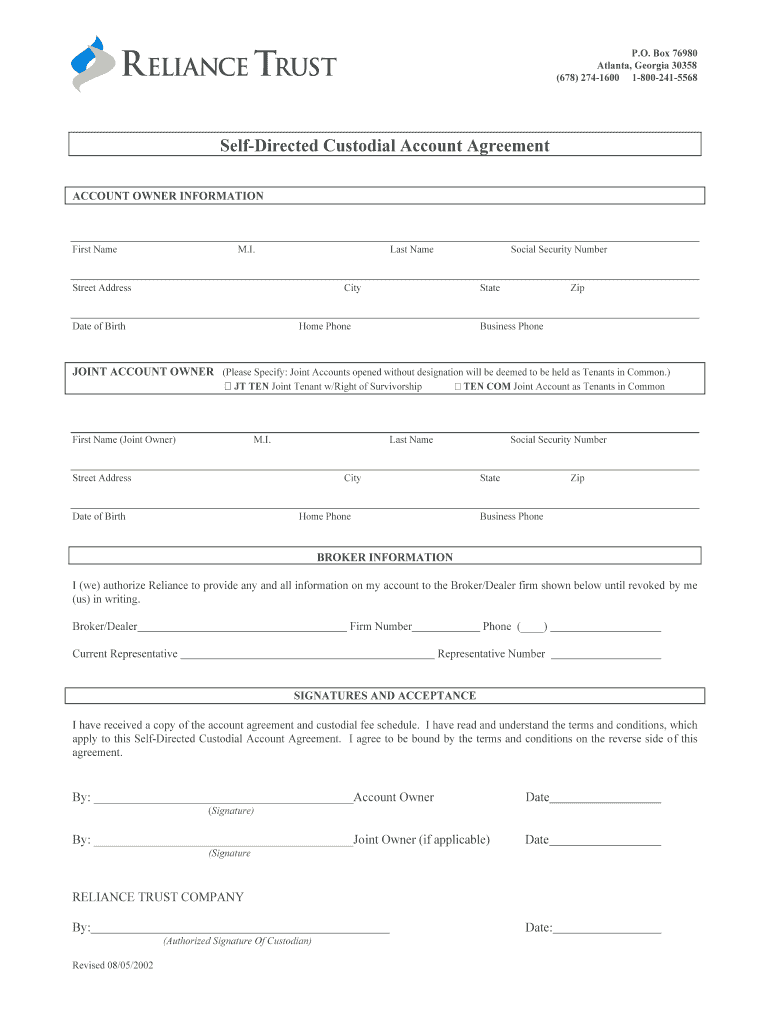

This document outlines the terms and conditions for a self-directed custodial account managed by Reliance Trust Company, detailing owner information, responsibilities, and terms for investment and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-directed custodial account agreement

Edit your self-directed custodial account agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-directed custodial account agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-directed custodial account agreement online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit self-directed custodial account agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-directed custodial account agreement

How to fill out Self-Directed Custodial Account Agreement

01

Begin by downloading the Self-Directed Custodial Account Agreement form from the financial institution's website.

02

Read the instructions provided at the top of the form carefully.

03

Fill in your personal information, including your name, address, and social security number in the designated fields.

04

Specify the type of account or investment you wish to manage within the custodial account.

05

Indicate the beneficiaries, if applicable, providing their names and relationship to you.

06

Review the terms and conditions of the agreement, ensuring you understand your rights and responsibilities.

07

Sign and date the form at the bottom, confirming your agreement to the terms outlined.

08

Submit the completed form to the financial institution along with any additional required documentation.

Who needs Self-Directed Custodial Account Agreement?

01

Individuals looking to manage their own retirement funds in a tax-advantaged account.

02

Investors interested in alternative investments outside of standard brokerage accounts.

03

Persons who want more control over their investment choices and strategies.

Fill

form

: Try Risk Free

People Also Ask about

What is a Morgan Stanley self-directed account?

Access Direct is a self-directed, online brokerage account at Morgan Stanley. A self–directed brokerage account lets you choose from more investment options, and gives you full control over how you invest.

Does Morgan Stanley have self-directed accounts?

E*TRADE offers a self-directed IRA with an easy-to-use interface complete with integrated educational and research tools, and free trades on stocks, ETFs, and mutual funds.

What is a custodial account agreement?

In another example, a parent sets up a custodial account for a minor child. The custodial agreement specifies that a bank will hold and manage the account until the child reaches a certain age. This ensures that the funds are protected and used only for the child's benefit.

How much money do you need to have a Morgan Stanley account?

Rates and Fees Bank YieldsPremium Savings AccountChecking Annual percentage yield ("APY")1 (+) ($0+) Minimum monthly balance No account minimums are required to maintain this account No account minimums are required to maintain this account Monthly fees No monthly account fees No monthly account fees Minimum opening deposit 2 $021 more row

Does Morgan Stanley offer self-directed IRAs?

self-directed IRA, such as the one offered by Morgan Stanley, generally offers you the ability to choose from a wide range of investment products, including stocks, bonds, mutual funds, annuities and more.

Can you self manage at Morgan Stanley?

The Morgan Stanley Access Direct account is a self-directed online brokerage account for U.S. residents where trading and other account activities are undertaken at the client's sole discretion without access to a Financial Advisor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Self-Directed Custodial Account Agreement?

A Self-Directed Custodial Account Agreement is a legal document that establishes the terms and conditions under which a self-directed custodial account is managed. It allows individuals to direct the investment of their funds in various assets, often for retirement purposes, while a custodian ensures compliance with regulations.

Who is required to file Self-Directed Custodial Account Agreement?

Individuals who wish to establish and manage their own custodial accounts, typically for retirement savings or self-directed investments, are required to file a Self-Directed Custodial Account Agreement with the custodian or financial institution handling the account.

How to fill out Self-Directed Custodial Account Agreement?

To fill out a Self-Directed Custodial Account Agreement, individuals should provide their personal information, such as name and address, specify the type of assets they wish to invest in, outline the terms of the account, and sign the agreement in accordance with the custodian's instructions.

What is the purpose of Self-Directed Custodial Account Agreement?

The purpose of the Self-Directed Custodial Account Agreement is to define the responsibilities of both the account holder and the custodian, ensuring clarity in the management of the account and compliance with relevant tax and investment regulations.

What information must be reported on Self-Directed Custodial Account Agreement?

The information that must be reported on a Self-Directed Custodial Account Agreement typically includes personal details of the account holder, account type, investment objectives, asset type, and any related fees or terms associated with the custodial service.

Fill out your self-directed custodial account agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Directed Custodial Account Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.