AZ 600B 2021-2026 free printable template

Show details

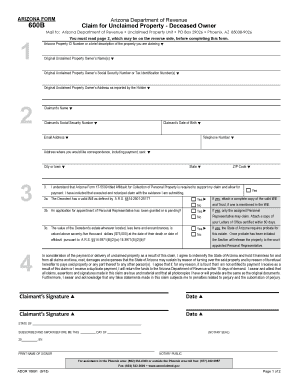

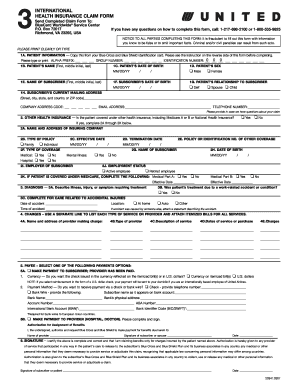

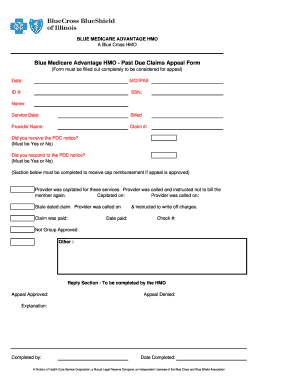

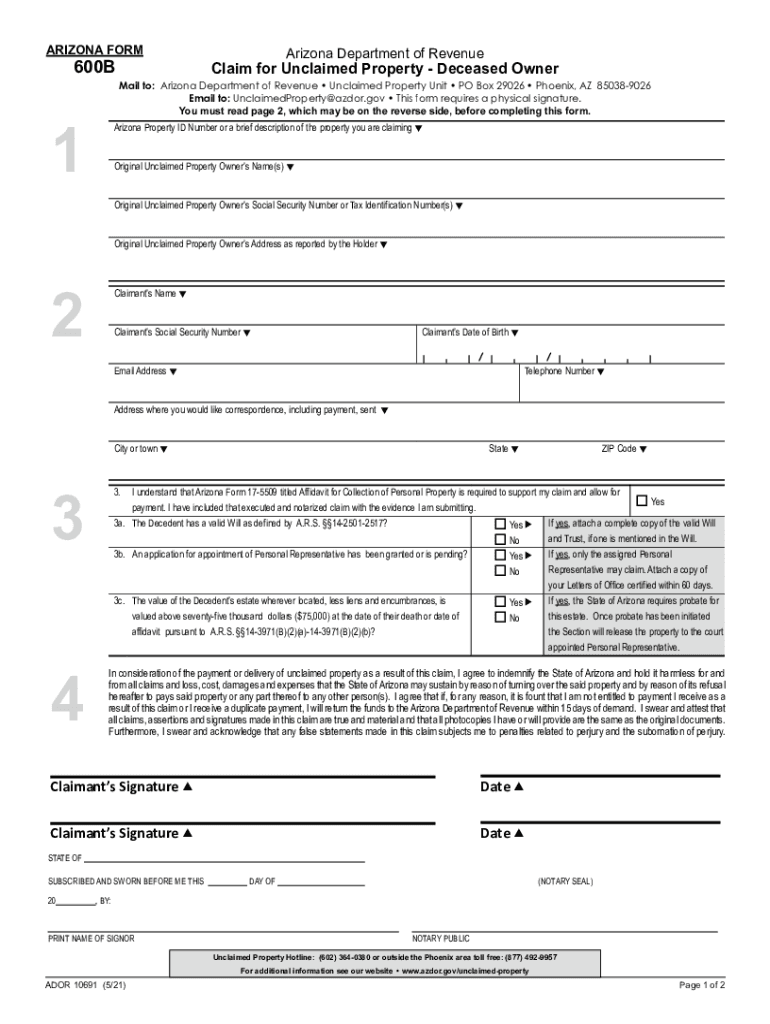

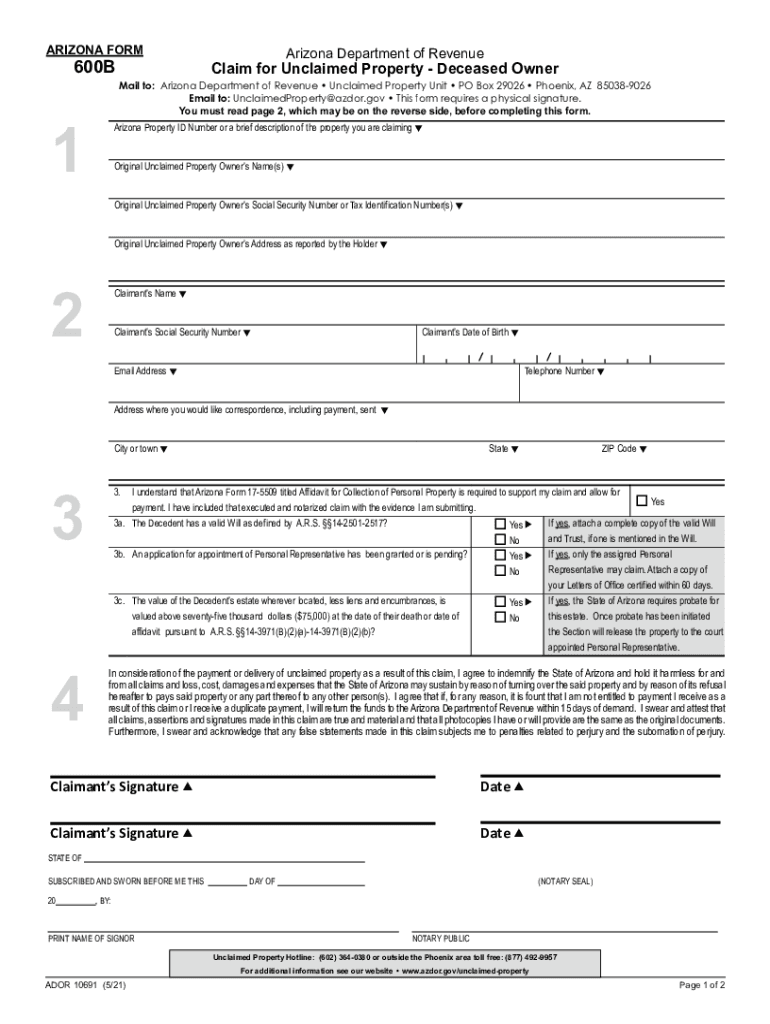

ARIZONA FORM600B1Arizona Department of RevenueClaim for Unclaimed Property Deceased Ownership to: Arizona Department of Revenue Unclaimed Property Unit PO Box 29026 Phoenix, AZ 850389026 Email to:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ 600B

Edit your AZ 600B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ 600B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ 600B online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AZ 600B. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ 600B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ 600B

How to fill out AZ 600B

01

Gather all necessary personal information, including your name, address, and social security number.

02

Review the instructions provided on the form to understand the requirements.

03

Fill out Section 1 with your personal details accurately.

04

Complete Section 2 with the required financial information, ensuring all numbers are correct.

05

Check Section 3 for any additional documentation needed.

06

Sign and date the form where indicated.

07

Make copies of the completed form and any attached documents for your records.

08

Submit the form according to the guidelines provided, either electronically or via mail.

Who needs AZ 600B?

01

Individuals applying for certain government services or benefits.

02

Residents in Arizona needing to verify financial information.

03

Individuals who have received a notice requesting this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the dormancy period in Arizona?

Arizona Dormancy Periods Generally, most property types have a three-year dormancy period. Accounts are considered dormant if the owner of a property has not indicated any interest in the property or if no contact has been made for the allotted dormancy period for that property.

What is Arizona Form 600?

This form should only be used to claim property of which you are the original owner. If you are claiming property as the heir or beneficiary of a deceased owner (Form 600B), the agent of an entity (Form 600C) or the agent of a living owner (Form 600D), you must complete the appropriate form.

How long do you have to claim unclaimed property in Arizona?

Is there a time limit for filing a claim? Ownership of unclaimed property will not revert to the State until 35 years after it was reported, and you may submit a claim at any time during that period.

What is the escheatment period in Arizona?

As stated above, under Arizona law, A.R.S. §12-886, a person has seven years from the time of sale of the escheated property to collect the proceeds. Some, or all, of the property may no longer be available prior to the department's filing deadline.

What does unclaimed property dormancy period mean?

Unclaimed property dormancy is a period of time during which there is no activity from the unclaimed property owner. The unclaimed property dormancy varies by property type, but is pretty uniform across the states for that type of property.

What is the dormancy period for unclaimed property in Arizona?

Property is considered unclaimed when there has been no owner contact for a specified period of time, usually between 1 and 3 years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AZ 600B in Gmail?

AZ 600B and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make changes in AZ 600B?

The editing procedure is simple with pdfFiller. Open your AZ 600B in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit AZ 600B in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing AZ 600B and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is AZ 600B?

AZ 600B is a form used in Arizona for reporting certain tax-related information, specifically concerning transactions that may affect the sales tax.

Who is required to file AZ 600B?

Businesses operating in Arizona that are involved in taxable sales or transactions and meet specific criteria are required to file AZ 600B.

How to fill out AZ 600B?

To fill out AZ 600B, obtain the form from the Arizona Department of Revenue website, provide the required business information, detail sales transactions, and calculate the tax owed before submitting it.

What is the purpose of AZ 600B?

The purpose of AZ 600B is to provide the Arizona Department of Revenue with accurate data on sales transactions for proper tax assessment and compliance.

What information must be reported on AZ 600B?

The AZ 600B requires businesses to report information such as sales amounts, tax collected, the nature of the transactions, and any applicable deductions.

Fill out your AZ 600B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ 600b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.