Get the free VALUE ADDED TAX - Department of Inland Revenue - inlandrevenue finance gov

Show details

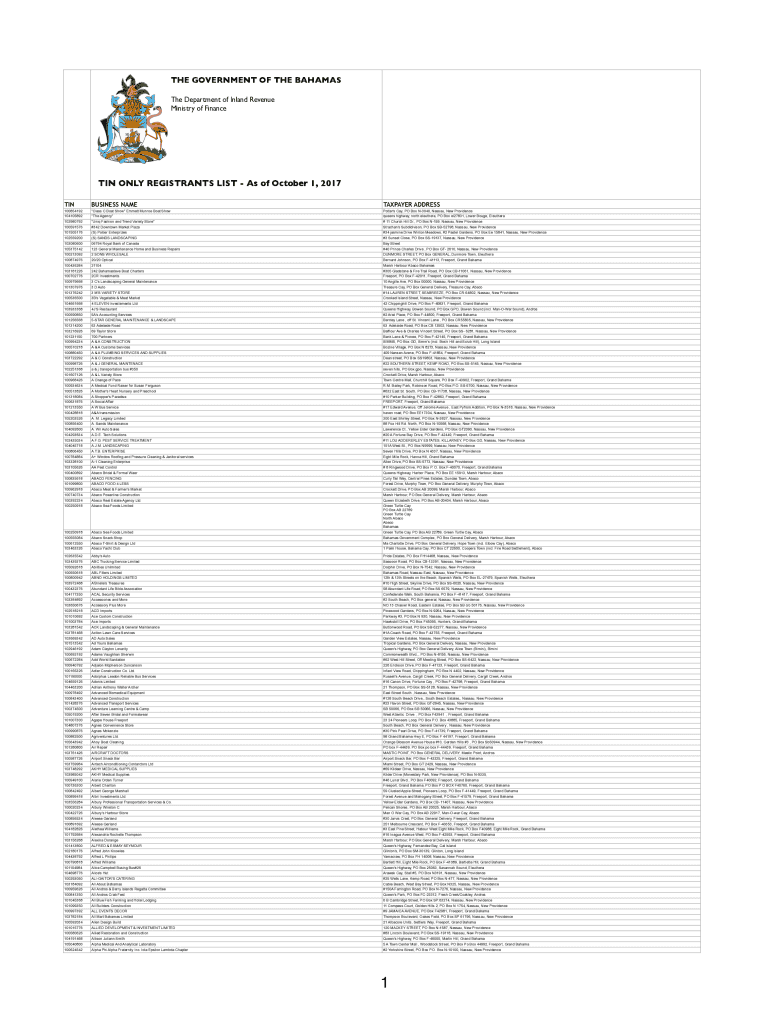

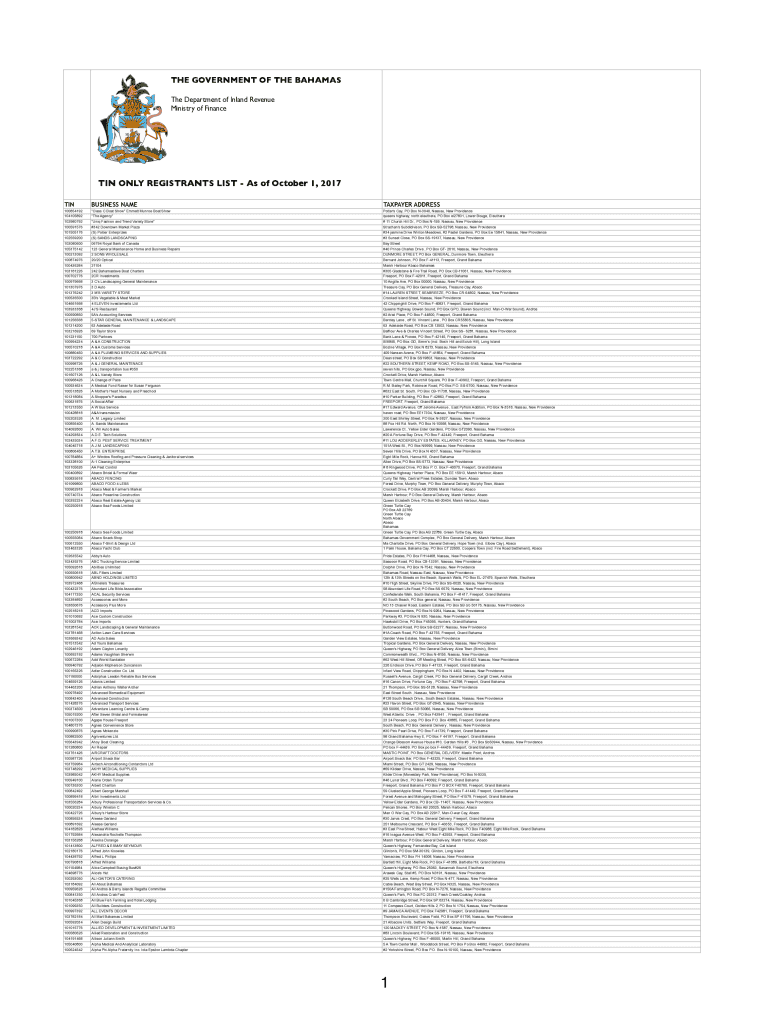

THE GOVERNMENT OF THE BAHAMAS

The Department of Inland Revenue

Ministry of Finance ONLY REGISTRANTS LIST As of October 1, 2017,

BUSINESS NAMETAXPAYER ADDRESS100854192

104105892

102980792

100591576

101505176

102559200

103080600

105375142

100213092

100874976

100436284

103181226

100702776

100979668

101307976

101376242

100536500

104661668

103933368

100590850

101256568

101314200

103216926

101231150

100994234

100510218

100880450

103722292

100998726

102251368

101607126

100968426

100934634

100513826...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign value added tax

Edit your value added tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your value added tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit value added tax online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit value added tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out value added tax

How to fill out value added tax

01

Register for a VAT number with the tax authorities.

02

Keep detailed records of all sales and purchases made by your business.

03

Calculate the VAT on your sales by adding the appropriate percentage to the selling price.

04

Submit regular VAT returns to the tax authorities, detailing the VAT you have charged on your sales and the VAT you have paid on your purchases.

05

Pay any VAT due to the tax authorities by the deadline specified.

Who needs value added tax?

01

Businesses that are registered for VAT and are making taxable supplies need to charge and collect VAT from their customers.

02

Consumers may also indirectly pay VAT when they purchase goods or services that have already had VAT charged on them.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit value added tax from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including value added tax, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send value added tax for eSignature?

When you're ready to share your value added tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit value added tax on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as value added tax. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is value added tax?

Value added tax is a consumption tax added to a product at every stage of its production and distribution.

Who is required to file value added tax?

Businesses that meet the threshold set by the government are required to file value added tax.

How to fill out value added tax?

Value added tax can be filled out by reporting the taxable sales and purchases made by the business.

What is the purpose of value added tax?

The purpose of value added tax is to generate revenue for the government and to tax consumption.

What information must be reported on value added tax?

Information such as taxable sales, purchases, and VAT amount must be reported on value added tax.

Fill out your value added tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Value Added Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.