Get the free T-11ALayout 1 - tax ri

Show details

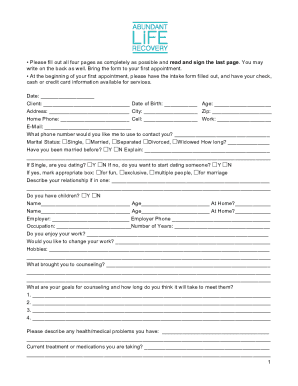

State of Rhode Island and Providence Plantations Form T-11A 13120899990101 Requisition for Cigarette Tax Stamps: Rolling Papers Name Federal employer identification number Address Requisition date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t-11alayout 1 - tax

Edit your t-11alayout 1 - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t-11alayout 1 - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t-11alayout 1 - tax online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit t-11alayout 1 - tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t-11alayout 1 - tax

To fill out t-11alayout 1 - tax, follow these steps:

01

Start by gathering all necessary information and documents related to your tax situation. This may include your W-2 forms, 1099 forms, receipts for deductible expenses, and any other relevant financial records.

02

Open the t-11alayout 1 - tax form on your computer or obtain a physical copy. You can usually find this form on the official website of the tax authority in your country.

03

Begin filling out the form by entering your personal information in the designated spaces. This may include your name, address, social security number or taxpayer identification number, and other identifiers as required.

04

Proceed to the income section of the form. Here, you will need to report all sources of income you received during the tax year. Make sure to accurately enter the amounts and provide the necessary details for each source of income.

05

Move on to the deductions and credits section of the form. This is where you can claim deductions for qualified expenses or credits that may reduce your overall tax liability. Consult the instructions provided with the form for guidance on which deductions and credits are applicable to your situation.

06

Check and review your entries to ensure accuracy and completeness. Double-check all calculations and ensure that all relevant sections of the form have been properly filled out.

07

If you are filing a paper form, sign and date the form in the designated area. If you are filing electronically, follow the instructions provided for electronic signatures.

Who needs t-11alayout 1 - tax?

The t-11alayout 1 - tax form is typically required by individuals or entities who are required to report and pay taxes in their respective jurisdictions. This may include:

01

Self-employed individuals who need to report their business income and expenses.

02

Employees who are not subject to automatic tax withholding by their employers.

03

Individuals with complex tax situations that require additional reporting beyond what is covered by simpler tax forms.

04

Certain types of businesses or organizations that have tax reporting obligations.

It is important to consult the specific tax laws and regulations in your country to determine if you need to fill out t-11alayout 1 - tax or any other applicable tax forms.

Fill

form

: Try Risk Free

People Also Ask about

What is the sales tax in Providence RI?

What is the sales tax rate in Providence, Rhode Island? The minimum combined 2023 sales tax rate for Providence, Rhode Island is 7%. This is the total of state, county and city sales tax rates. The Rhode Island sales tax rate is currently 7%.

What is a part time resident in Rhode Island?

Part-year resident: A part-year resident is a person who changed legal residence by moving into or out of Rhode Island at any time during the year. Part-year residents will file Form RI-1040NR. Nonresidents:Nonresidents are individuals who were not residents in Rhode Island at any time during the year.

What is the Rhode Island employer tax withholding?

Employers pay between 1.1% to 9.7% on the first $28,600 in wages paid to each employee in a calendar year. If you're a new employer (congratulations, by the way!), you pay 1.09% (which is a decrease from 1.19% from 2022).

Who must file a RI estate tax return?

Who must file and pay Estate Tax? If you're the Executor, Administrator or Personal Representative for the estate of someone who died, you will need to file an estate tax return.

How much is tax in Rhode Island?

Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes. Rhode Island's tax system ranks 42nd overall on our 2023 State Business Tax Climate Index.

How much taxes are taken away from a check?

When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, you'll also pay a 0.9% Medicare surtax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my t-11alayout 1 - tax directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your t-11alayout 1 - tax and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I execute t-11alayout 1 - tax online?

pdfFiller has made it simple to fill out and eSign t-11alayout 1 - tax. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the t-11alayout 1 - tax in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your t-11alayout 1 - tax and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is t-11alayout 1 - tax?

T-11alayout 1 - tax is a form used to report income and expenses related to business activities.

Who is required to file t-11alayout 1 - tax?

Any individual or entity engaged in business activities is required to file t-11alayout 1 - tax.

How to fill out t-11alayout 1 - tax?

T-11alayout 1 - tax can be filled out by providing information about income, expenses, and other relevant details pertaining to business activities.

What is the purpose of t-11alayout 1 - tax?

The purpose of t-11alayout 1 - tax is to report business income and expenses to the tax authorities.

What information must be reported on t-11alayout 1 - tax?

Information such as business income, expenses, deductions, and credits must be reported on t-11alayout 1 - tax.

Fill out your t-11alayout 1 - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T-11alayout 1 - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.