Get the free Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program

Show details

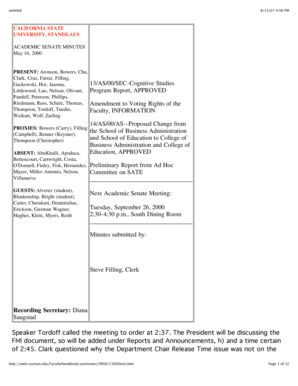

This document provides guidelines for plan administrators on filing Form 5500 under the Delinquent Filer Voluntary Compliance Program (DFVC) established by the Department of Labor, detailing penalties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidelines for filing form

Edit your guidelines for filing form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidelines for filing form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guidelines for filing form online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit guidelines for filing form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidelines for filing form

How to fill out Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program

01

Gather required information: Collect all relevant plan information including plan name, identification number, and the details of the plan administrator.

02

Review eligibility criteria: Confirm that your plan qualifies for the Delinquent Filer Voluntary Compliance Program based on the specific conditions outlined by the IRS.

03

Complete Form 5500: Fill out the Form 5500 carefully, ensuring all sections are accurately completed according to the instructions provided.

04

Prepare supporting documents: Compile any necessary documentation to support the information provided in Form 5500.

05

Submit Form 5500: File the completed Form 5500 electronically through the EBSA’s EFAST2 system.

06

Pay applicable fees: Ensure to pay any required fees associated with the submission of the Form 5500.

07

Monitor submission confirmation: After submission, check for confirmation to ensure that your filing has been processed successfully.

Who needs Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program?

01

Employers who sponsor employee benefit plans and have failed to timely file Form 5500.

02

Plan administrators looking to correct past non-filing errors to avoid penalties.

03

Trustees and fiduciaries responsible for maintaining compliance with ERISA requirements.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I need to file Form 5500?

In general, all employers who adopt and sponsor a retirement plan governed by ERISA, such as profit-sharing and 401(k) plans, must file a Form 5500 annually with the DOL. Which version of Form 5500 you complete will depend on the size of your business and the structure of your retirement plan.

Who is subject to 5500 filing?

The employer maintaining the plan or the plan administrator of a pension or welfare benefit plan covered by the (Employee Retirement Income Security Act) ERISA. File Form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

What is the penalty for filing a late Dfvcp?

Generally the DFVCP Penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501(c)(3) plans.

Who is required to file a 5500 form?

The employer maintaining the plan or the plan administrator of a pension or welfare benefit plan covered by the (Employee Retirement Income Security Act) ERISA. File Form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

What happens if you don't file form 5500?

It's normally a year after it was due and includes a substantial penalty. Late filed returns are subject to penalties from both IRS and DOL, so it's very important to identify this mistake before we do. The IRS penalty for late filing of a 5500-series return is $25 per day, up to a maximum of $15,000.

Who counts as a participant for 5500?

Active participants (i.e., any individuals who are currently in employment covered by the plan and who are earning or retaining credited service under the plan). This includes any individuals who are eligible to elect to have the employer make payments under a Code section 401(k) qualified cash or deferred arrangement.

Do all self funded plans have to file 5500?

Generally, group health plans covering private- sector employees must file a Form 5500 only if they cover 100 or more participants, hold assets in trust, or constitute a plan MEWA. Governmental and church plans, regardless of size, also are not required to file a Form 5500.

What is the delinquent filer voluntary compliance program?

The Delinquent Filer Voluntary Compliance Program (DFVCP) is designed to encourage voluntary compliance with the annual reporting requirements under Employee Retirement Income Security Act (ERISA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program?

The Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program (DFVCP) provide a framework for plan sponsors to comply with filing Form 5500 for their employee benefit plans that were not filed on time, allowing them to avoid potential penalties.

Who is required to file Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program?

All plan sponsors, including employers and plan administrators of pension and welfare benefit plans that must file Form 5500 but failed to do so by the due date, are required to participate in the DFVCP.

How to fill out Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program?

To fill out the Guidelines for filing Form 5500 under the DFVCP, plan sponsors need to complete the applicable Form 5500 and submit it along with the required filing fee to the Employee Benefits Security Administration (EBSA) while including a statement that the filing is made under the DFVCP for the delinquent years.

What is the purpose of Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program?

The purpose of the Guidelines for filing Form 5500 under the DFVCP is to encourage compliance among delinquent filers and to provide a streamlined process to address failures to file while reducing penalties.

What information must be reported on Guidelines for filing Form 5500 under the Delinquent Filer Voluntary Compliance Program?

Plan sponsors must report relevant information including the plan's identifying information, financial reports, operational data, and any applicable schedules that reflect the financial condition and operations of the employee benefit plan in accordance with the Form 5500 instructions.

Fill out your guidelines for filing form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidelines For Filing Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.