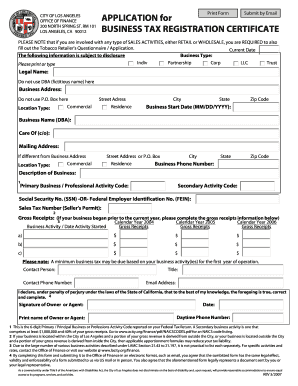

CA Application for Business Tax Registration Certificate - City of Los Angeles 2023-2025 free printable template

Show details

Email application to: finance.customerservice@lacity.orgBUSINESS TAX APPLICATIONDo you sell tobacco products? Y or NIf yes, you must fill out a Tobacco Retailer\'s Permit ApplicationSocial Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign california business tax registration form

Edit your tax registration certificate example form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax registration certificate example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax registration certificate example online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax registration certificate example. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Application for Business Tax Registration Certificate - City of Los Angeles Form Versions

Version

Form Popularity

Fillable & printabley

4.4 Satisfied (55 Votes)

4.8 Satisfied (150 Votes)

How to fill out tax registration certificate example

How to fill out CA Application for Business Tax Registration Certificate

01

Obtain the CA Application for Business Tax Registration Certificate form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Fill in your business information, including the name, address, and contact details of your business.

03

Indicate the type of business entity you are registering (e.g., sole proprietorship, partnership, corporation).

04

Provide details of the business owners, partners, or corporate officers, including their names, addresses, and social security numbers.

05

Specify the business activities your entity will be engaging in.

06

Indicate the beginning date of your business operations.

07

If applicable, include the information regarding any existing account numbers related to sales tax or other taxes.

08

Review your application for accuracy and completeness after filling it out.

09

Submit the application either online through the CDTFA website or by mail to the appropriate address provided in the instructions.

Who needs CA Application for Business Tax Registration Certificate?

01

Any business that intends to operate in California and engage in taxable activities is required to fill out the CA Application for Business Tax Registration Certificate.

02

This includes sole proprietors, partnerships, corporations, and organizations that plan to sell goods or services subject to sales tax.

03

Additionally, businesses that will hire employees or need to collect certain taxes such as use tax or employment tax must also apply.

Fill

form

: Try Risk Free

People Also Ask about

Does Ohio have a reseller certificate?

Ohio does not require registration with the state for a resale certificate. How can you get a resale certificate in Ohio? To get a resale certificate in Ohio, you will need to fill out the Sales and Use Blanket Exemption Certificate (Form STEC B).

How do I fill out a resale certificate in Ohio?

Common details listed on the Ohio resale certificate include the name (company or individual) and address of the buyer, a descriptive detail of the goods being purchased, a reference that this merchandise is intended to be resold and the accurate Ohio sales tax number.

What is a tax registration?

The tax registration certificate is often a part of or issued alongside a business license. The certificate serves the purpose of confirming the business has been registered for tax purposes and can file its own tax return.

How do I get an Ohio State tax registration number?

Your Ohio Taxpayer Identification Number (TIN) is located on the preprinted label of your Ohio tax booklet. If you do not have a TIN, you may still register to use Ohio I-File by entering your Social Security Number, Your Last Name, Your Last Year's Ohio Income Tax Refund OR Tax Due.

Is an Ohio vendors license the same as a resale certificate?

A seller's permit isn't the same as a resale certificate. A resale certificate allows a business to make tax-free purchases of taxable goods they plan to resell.

Do I need to register for sales tax in Ohio?

Registration — Ohio law requires any person or business making taxable retail sales to first obtain a license. File a Return Electronically — Ohio offers several options for electronically filing sales and use tax returns, which is now required.

How much is a reseller permit in Ohio?

For sellers located in Ohio an Ohio sales tax permit (form ST-1, called a vendor's permit) is $25 and you must pay via ACH debit. For “remote sellers” (sellers located outside of Ohio but required to collect sales tax in Ohio due to sales tax nexus) form UT-1000 is free. Other state registration fees may apply. 5.

How do I get a resale certificate in Ohio?

Ohio does not require registration with the state for a resale certificate. How can you get a resale certificate in Ohio? To get a resale certificate in Ohio, you will need to fill out the Sales and Use Blanket Exemption Certificate (Form STEC B).

How do I register with the Ohio Department of Taxation?

By internet: Register electronically through the Ohio Business Gateway; follow the instructions for ODT Business Tax Registrations. The Commercial Activity Tax is an annual tax imposed on an entity for the privilege of doing business in Ohio, measured by taxable gross receipts from most business activities.

Where can I get a state of Ohio tax form?

The Ohio Department of Taxation provides a searchable repository of individual tax forms for multiple purposes. Most forms are available for download and some can be filled or filed online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax registration certificate example?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your tax registration certificate example and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my tax registration certificate example in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your tax registration certificate example and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out tax registration certificate example on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your tax registration certificate example. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CA Application for Business Tax Registration Certificate?

The CA Application for Business Tax Registration Certificate is a document that businesses must file with the California Department of Tax and Fee Administration (CDTFA) to obtain a certificate that registers them for tax purposes.

Who is required to file CA Application for Business Tax Registration Certificate?

Any business operating in California that is selling tangible goods, providing taxable services, or who is otherwise required to collect sales tax must file this application.

How to fill out CA Application for Business Tax Registration Certificate?

To fill out the CA Application for Business Tax Registration Certificate, you need to provide information such as your business name, business address, owner information, type of business entity, and the nature of your business activities.

What is the purpose of CA Application for Business Tax Registration Certificate?

The purpose is to officially register a business with the state for tax purposes, allowing it to collect sales tax and fulfilling state tax obligations.

What information must be reported on CA Application for Business Tax Registration Certificate?

The information that must be reported includes the business name, address, owner's personal information, type of ownership (e.g., sole proprietorship, corporation), and a description of the business activities.

Fill out your tax registration certificate example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Registration Certificate Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.