Get the free No Automatic Form 5500 Filing Extension Granted

Show details

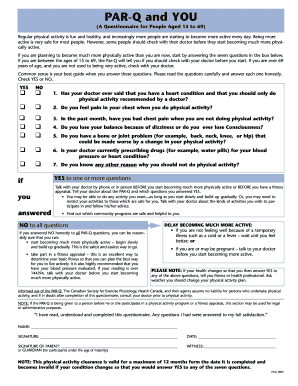

This document informs plan sponsors about the denial of an automatic extension for Form 5500 filing for the 2009 plan year and outlines procedures for filing extensions using Form 5558.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no automatic form 5500

Edit your no automatic form 5500 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no automatic form 5500 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit no automatic form 5500 online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit no automatic form 5500. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no automatic form 5500

How to fill out No Automatic Form 5500 Filing Extension Granted

01

Begin by reviewing the Form 5500 instructions provided by the Department of Labor.

02

Obtain the No Automatic Filing Extension form from the appropriate regulatory website.

03

Complete the required information, including your organization’s name, EIN, and plan number.

04

Specify the reason for the extension request in the designated section of the form.

05

Sign and date the form to confirm the accuracy of the information provided.

06

Submit the completed form to the appropriate agency, either electronically or by mail, prior to the original filing deadline.

07

Retain a copy of the submitted form for your records.

Who needs No Automatic Form 5500 Filing Extension Granted?

01

Organizations that operate employee benefit plans and require additional time to gather necessary information for Form 5500.

02

Plan administrators and sponsors who encounter unforeseen circumstances that prevent timely filing.

03

Employers who want to avoid penalties or late fees associated with non-compliance for Form 5500 submissions.

Fill

form

: Try Risk Free

People Also Ask about

Can you extend a final form 5500?

Use a separate Form 5558 for an extension to file Form 5500 series. Signatures are not needed for extension of time to file Form 5500 series or Form 8955-SSA. May use a single Form 5558 to extend the Form 5500 and Form 8955-SSA filed for the same plan. Avoid errors when requesting an extension.

Is form 5500 automatic extension?

Exception: Form 5500, Form 5500-SF, Form 5500-EZ, and Form 8955-SSA filers are automatically granted extensions of time to file until the extended due date of the federal income tax return of the employer (and are not required to file Form 5558) if both of the following conditions are met: (1) the plan year and the

Can form 5500 be paper filed?

One-participant plans or foreign plans must file the Form 5500-EZ. If you are not subject to the IRS e-filing requirements, however, you may file a Form 5500-EZ on paper with the IRS.

What are 5500 filing requirements?

Employers are required to file Form 5500 with the Department of Labor (DOL) when their plan has 100 or more employee participants at the beginning of a plan year and when their plan is funded through a trust, regardless of the number of participants.

Can I file my own form 5500?

You can easily do this very simple tax filing yourself and save the money. There are two ways to file: by postal mail using IRS Form 5500-EZ, Annual Return of One-Participant (Owners and Their Spouses) Retirement Plan to the IRS, or. electronically, by filing IRS Form 5500-SF.

Can form 5500 be signed electronically?

Your signature as Plan Sponsor and/or Plan Administrator is still required, but signing of the forms must be done electronically. Each authorized person responsible for signing your Form 5500 must apply for Electronic Signature Credentials on the DOL's EFAST2 website.

What happens if you miss the 5500 filing deadline?

It's normally a year after it was due and includes a substantial penalty. Late filed returns are subject to penalties from both IRS and DOL, so it's very important to identify this mistake before we do. The IRS penalty for late filing of a 5500-series return is $25 per day, up to a maximum of $15,000.

Does Form 5500 have to be filed electronically?

For the Form 5500, the Form 5500-SF, and the Form PR: You must electronically file the Form 5500, the Form 5500-SF, and the Form PR (Pooled Plan Provider Registration).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is No Automatic Form 5500 Filing Extension Granted?

No Automatic Form 5500 Filing Extension Granted refers to the stipulation that certain filers of the Form 5500 do not receive an automatic extension for submitting their annual report regarding employee benefit plans. This means that they are expected to file the form by the original due date without the benefit of an extended deadline.

Who is required to file No Automatic Form 5500 Filing Extension Granted?

Entities that administer employee benefit plans, such as pension plans, health plans, and other welfare benefit plans, who are filing Form 5500 but do not qualify for an automatic extension are required to comply with the No Automatic Filing Extension mandate.

How to fill out No Automatic Form 5500 Filing Extension Granted?

To fill out the No Automatic Form 5500 Filing Extension, filers should complete the standard Form 5500 with all required information accurately and ensure submission by the due date. This includes specifying the plan year, providing financial statements, and disclosing other pertinent information. Care should be taken to adhere strictly to the guidelines provided by the Department of Labor.

What is the purpose of No Automatic Form 5500 Filing Extension Granted?

The purpose of No Automatic Form 5500 Filing Extension Granted is to ensure timely reporting of employee benefit plan information to the Department of Labor, allowing for increased transparency and regulatory oversight regarding the management of such plans.

What information must be reported on No Automatic Form 5500 Filing Extension Granted?

Information that must be reported on the No Automatic Form 5500 Filing Extension includes details about the plan's financial condition, including assets, liabilities, income, and expenses, along with information about plan operations, funding, and relevant compliance issues.

Fill out your no automatic form 5500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Automatic Form 5500 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.