Get the free How to Start a Washington State-Chartered Credit Union - dfi wa

Show details

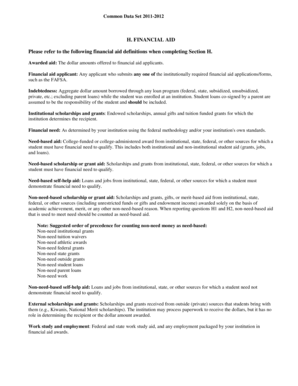

This document provides detailed guidance for individuals and groups interested in organizing a state-chartered credit union in Washington, covering definitions, application procedures, necessary documentation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to start a

Edit your how to start a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to start a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to start a online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how to start a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to start a

How to fill out How to Start a Washington State-Chartered Credit Union

01

Research the requirements for starting a credit union in Washington State.

02

Gather the necessary documents, including a business plan and a membership application.

03

Submit a charter application to the Washington State Department of Financial Institutions (DFI).

04

Select a board of directors who will oversee the operations of the credit union.

05

Secure adequate funding and capital to support the initial operations of the credit union.

06

Develop policies and procedures in compliance with state and federal regulations.

07

Obtain insurance coverage through the National Credit Union Administration (NCUA).

08

Launch the credit union and begin accepting members.

Who needs How to Start a Washington State-Chartered Credit Union?

01

Individuals interested in creating a community-focused financial institution.

02

Entrepreneurs seeking to provide alternative banking solutions.

03

Local organizations aiming to offer financial services to their members.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to start a credit union?

Historical data suggests that newly chartered credit unions typically require at least $500,000 in start-up capital to achieve economic viability. At this preliminary stage, the NCUA will review your general plan for obtaining donated funds to start operations and cover operating losses until you are profitable.

Is it difficult to start a credit union?

Establishing a new credit union requires much preparation and a time commitment. In addition, new credit unions are often not financially able to offer many of the products and services the membership needs due to difficulties and challenges in obtaining funding to cover such costs.

Can you start your own credit union?

How Do I Start A Credit Union? Credit unions need a charter — a license to operate — from either the National Credit Union Administration or a state credit union regulator. The federal government and state governments have different chartering rules and requirements.

Can a credit union be privately owned?

Unlike banks, which are publicly owned by stockholders, credit unions are cooperatives and member-owned.

How much does it cost to start a credit union?

Historical data suggests that newly chartered credit unions typically require at least $500,000 in start-up capital to achieve economic viability. At this preliminary stage, the NCUA will review your general plan for obtaining donated funds to start operations and cover operating losses until you are profitable.

Do credit union owners make money?

Credit unions are not-for-profit organizations. While a credit union may earn profits, those profits are funneled back into business operations, paid to members as dividends or used to offer additional benefits for members.

Can someone own a credit union?

Credit unions are cooperatives, meaning they are member-owned and operated.

How do I start my own credit union?

Choose the Name for Your Credit Union. Develop Your Credit Union Business Plan. Choose the Legal Structure for Your Credit Union. Secure Startup Funding for Your Credit Union (If Needed) Secure a Location for Your Business. Register Your Credit Union with the IRS. Open a Business Bank Account. Get a Business Credit Card.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is How to Start a Washington State-Chartered Credit Union?

How to Start a Washington State-Chartered Credit Union refers to the process and guidelines established for individuals or groups wishing to establish a credit union in the state of Washington, including necessary steps, legal requirements, and regulatory compliance.

Who is required to file How to Start a Washington State-Chartered Credit Union?

Individuals or groups intending to establish a Washington State-Chartered Credit Union are required to file, which may include potential members, organizers, and associated stakeholders.

How to fill out How to Start a Washington State-Chartered Credit Union?

Filling out the process involves completing the necessary application forms provided by the Washington State Department of Financial Institutions, including details about the proposed credit union, its organizational structure, and business plan.

What is the purpose of How to Start a Washington State-Chartered Credit Union?

The purpose is to provide a framework for individuals or communities to create a financial cooperative that serves its members by offering financial services like savings accounts, loans, and other banking services.

What information must be reported on How to Start a Washington State-Chartered Credit Union?

Key information that must be reported includes the proposed name of the credit union, the field of membership, governing board members, financial projections, business plan, and compliance with state and federal regulations.

Fill out your how to start a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Start A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.