MI 5081 Instruction 2023 free printable template

Show details

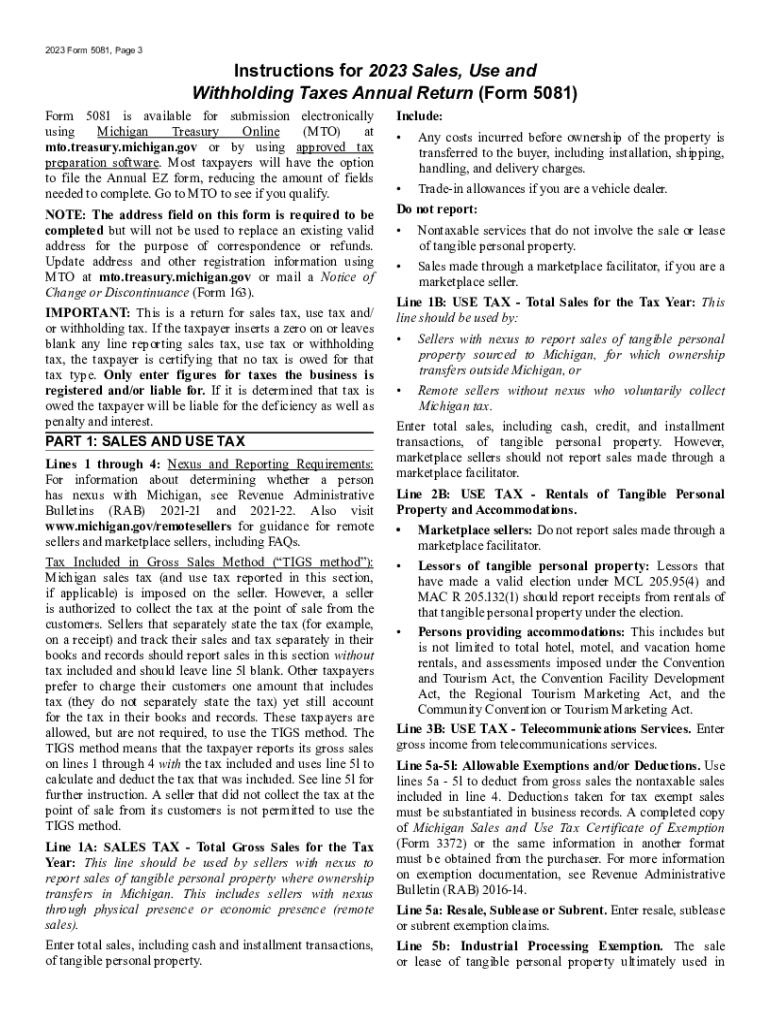

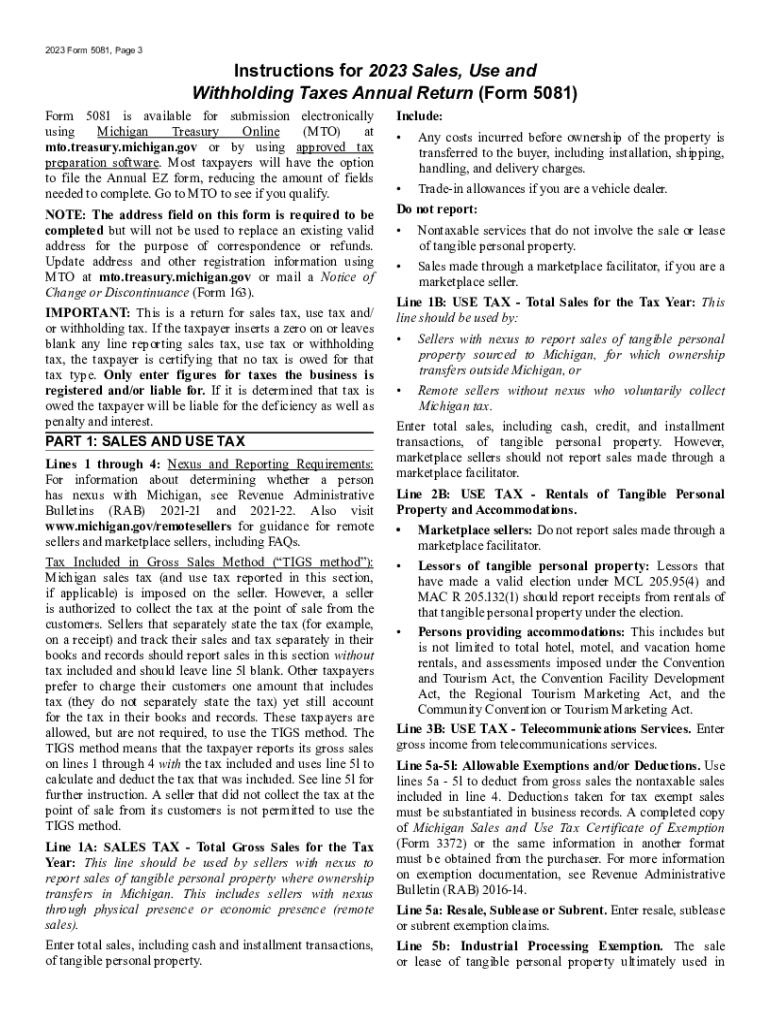

2 If the employer does not repay the employee as noted above the employee may claim a credit for the amount withheld on their individual income tax return Form MI-1040. 2023 Form 5081 Page 3 Instructions for 2023 Sales Use and Withholding Taxes Annual Return Form 5081 Form 5081 is available for submission electronically using Michigan Treasury Online MTO at mto. treasury. michigan*gov or by using approved tax preparation software. Most taxpayers will have the option to file the Annual EZ form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 5081 Instruction

Edit your MI 5081 Instruction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 5081 Instruction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI 5081 Instruction online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MI 5081 Instruction. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 5081 Instruction Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 5081 Instruction

How to fill out MI 5081 Instruction

01

Obtain the MI 5081 Instruction form from the appropriate source.

02

Read the instructions provided at the top of the form carefully.

03

Fill in your personal information in the designated fields, including your name, address, and contact information.

04

Specify the type of request or application you are making in the relevant section of the form.

05

Provide any additional information or documentation required as per the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form by the specified method (e.g., mail, email, or in-person) to the designated authority.

Who needs MI 5081 Instruction?

01

Individuals or entities seeking to obtain information or services related to MI 5081 requirements.

02

Applicants who need to file for specific permits, licenses, or benefits associated with MI regulations.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a sales tax license in Michigan?

You can receive your new Sales Tax License in as little as 7 business days. Employers who are acquiring/purchasing a business may also register online.

How do I file sales and use tax in Michigan?

How to File and Pay Sales Tax in Michigan File online – File online at the Michigan Department of Treasury. File by mail – You can use Form 5080 and file and pay through the mail, though this form is only applicable for monthly or quarterly filers. AutoFile – Let TaxJar file your sales tax for you.

Who needs to file Michigan Form 5081?

What is the Michigan Form 5081? Taxpayers who withheld Michigan income tax on a 1099 form (1099- MISC, 1099-NEC, 1099-R, etc.) must report the income and the withholding on the Sales, Use, and Withholding Taxes Annual Return (Form 5081) and send a copy of the 1099 form directly to Treasury.

Do you have to file taxes every year in Michigan?

You are required to file a Federal Income Tax return. You must file a Michigan Individual Income Tax return, even if you do not owe Michigan tax.

How does Michigan sales tax work?

Sales Tax. Individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price (including shipping and handling charges) of their taxable retail sales to the State of Michigan.

How does a business pay sales tax in Michigan?

A seller must collect Michigan 6% use tax from Michigan purchaser/consumers calculated on the selling price of taxable services. A seller must remit Michigan 6% use tax collected to the State of Michigan. Blank forms are available on our Web site. Once you are registered you will receive pre-identified returns.

How do I file sales tax in Michigan?

How to File and Pay Sales Tax in Michigan File online – File online at the Michigan Department of Treasury. File by mail – You can use Form 5080 and file and pay through the mail, though this form is only applicable for monthly or quarterly filers. AutoFile – Let TaxJar file your sales tax for you.

How does sales tax work in Michigan?

Sales Tax. Individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price (including shipping and handling charges) of their taxable retail sales to the State of Michigan.

Who must file Michigan Form 5081?

Form 5080/5081 are the monthly, quarterly, and annual forms filed by businesses operating in Michigan.

How often do I need to file sales tax in Michigan?

Sales, Use and Withholding taxes are filed on a monthly, quarterly or annual basis. A filing frequency will be assigned upon a taxpayer's estimated level of activity. After the first tax year of filing, the frequency is determined by a taxpayer's previous tax liability.

Does Michigan sales tax license expire?

What is the expiration date for my current Sales tax license? Sales tax licenses are issued yearly and are valid January - December of the tax year listed on the license.

What taxes do small businesses pay in Michigan?

MBT Details The Michigan Business Tax (MBT), which was signed into law by Governor Jennifer M. Granholm July 12, 2007, imposes a 4.95% business income tax and a modified gross receipts tax at the rate of 0.8%. Insurance companies and financial institutions pay alternate taxes (see below).

How do I register my business for Michigan taxes?

On the MTO homepage, click Start a New Business (E-Registration) to register the business with Treasury for Michigan taxes. The online application will open in a new tab or window on your web browser. Click here to watch a tutorial on the e-registration process.

Do I need to register for use tax in Michigan?

Out-of-state businesses - Businesses located outside of Michigan may register to collect Michigan taxes for sales to Michigan residents. This is a use tax registration. Michigan's use tax rate is six percent. This tax will be remitted to the state on monthly, quarterly or annual returns as required by the Department.

What is Michigan sales use and withholding taxes?

Michigan Sales and Use Tax Audits: What You Need to Know Sales and Use taxes are basically a 6 percent tax on the sale, use and consumption or storage of tangible personal property in the state of Michigan.

Do I have to renew my sales tax license in Michigan?

Michigan Sales Tax License expire on September 30 of each year, regardless of when your license was issued, and will be renewed automatically. You will be able to get a copy of your new license under the Correspondence tab of your account on the Michigan Treasury Online website.

Who has to pay the Michigan business tax?

The tax applies to C Corporations and any entity that elects to be taxed as a C corporation. Income is apportioned based 100% on the sales factor. Corporations with less than $350,000 of apportioned gross receipts or less than $100 in liability are not required to file or pay the CIT.

How do I register for sales and use tax in Michigan?

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Treasury via the sales tax permit hotline (517) 636-6925 or by checking the permit info website .

What taxes does an LLC pay in Michigan?

Michigan taxes LLC profits the same way as the IRS: the LLC's owners pay taxes to the state on their personal tax returns. The LLC itself does not pay a state tax, but Michigan does require LLCs to file an annual report, due February 15 each year, with a filing fee of $25.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MI 5081 Instruction for eSignature?

Once your MI 5081 Instruction is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find MI 5081 Instruction?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific MI 5081 Instruction and other forms. Find the template you need and change it using powerful tools.

How do I complete MI 5081 Instruction online?

pdfFiller has made it simple to fill out and eSign MI 5081 Instruction. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is MI 5081 Instruction?

MI 5081 Instruction refers to a specific tax form used in the state of Michigan for reporting certain types of income or tax credits.

Who is required to file MI 5081 Instruction?

Individuals or entities in Michigan that are subject to reporting requirements for specific income types or tax credits may be required to file MI 5081.

How to fill out MI 5081 Instruction?

To fill out MI 5081, taxpayers should follow the guidelines provided in the instruction booklet, ensuring that all required fields are completed accurately and any necessary supporting documentation is attached.

What is the purpose of MI 5081 Instruction?

The purpose of MI 5081 Instruction is to provide guidance for taxpayers on how to report specific types of income and claim eligible tax credits within Michigan.

What information must be reported on MI 5081 Instruction?

Information reported on MI 5081 typically includes details about income sources, applicable deductions, tax credits claimed, and personal identification information of the taxpayer.

Fill out your MI 5081 Instruction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 5081 Instruction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.