Get the free Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions ...

Show details

This document provides application instructions for the real property tax deferral program in Dauphin County under Act 50 of 1998, allowing eligible property owners to defer increases in real property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dauphin county real property

Edit your dauphin county real property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dauphin county real property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dauphin county real property online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dauphin county real property. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dauphin county real property

How to fill out Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions

01

Download the Dauphin County Real Property Tax Deferral Act 50, 1998 Application form from the official website.

02

Read the instructions carefully to understand the eligibility criteria.

03

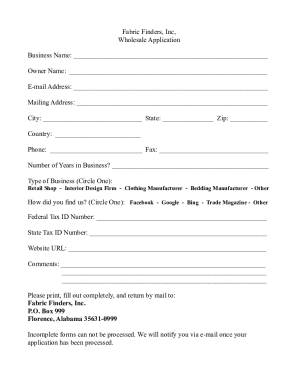

Fill out your personal information, including your name, address, and contact details.

04

Provide information about the property for which you are seeking tax deferral, including its address and tax identification number.

05

Indicate your reason for applying for the tax deferral and any supporting documentation required.

06

Review your application for accuracy and completeness before submission.

07

Submit the completed application form to the appropriate county office by the stated deadline.

Who needs Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions?

01

Homeowners in Dauphin County who are facing financial difficulties and seek temporary relief from property taxes.

02

Individuals who meet the eligibility criteria outlined in the Dauphin County Real Property Tax Deferral Act 50, 1998.

Fill

form

: Try Risk Free

People Also Ask about

At what age do seniors stop paying property taxes in PA?

Age requirements A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

What does deferral mean on local property tax?

A deferral is not an exemption. You are deferring the payment of the LPT. The deferred LPT becomes payable at a later date. The deferred LPT remains a charge on the property until it is paid. Interest accrues on the unpaid amount until it is paid.

What is the property tax deferral in California?

To qualify, a homeowner must apply and meet all of the following criteria for every year in which a postponement of property taxes is desired: Be at least 62 years of age, or blind, or disabled; Own and occupy the property as his or her principal place of residence (floating homes, and house boats are not eligible);

What does property tax in question have been legally deferred or abated?

Abatement, Deferral, Exemption, and Repayment Programs Each state has property tax abatement (reduction) or exemption programs that allow specific homeowners to reduce the amount of property tax they must pay based on age, disability, income, or personal status.

Which county in PA has the highest property taxes?

Monroe County (4.73%) had the highest property tax burden in the state, 0.92 percentage points higher than the second highest, Pike County (3.81%).

What is a deferral for local property tax?

The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes, including the education tax portion.

Is tax deferral a good thing?

In general it is always better to defer taxes. First, you get to hold on to your money longer, you may not know where your tax bracket will be in the future, it might be quite lower, you may not be able to put away money into an IRA but next tax year you can and thereby pay a lower rate.

What does it mean when your taxes are deferred?

Tax-deferred refers to income or investment earnings that are not taxed until they are withdrawn, which is typically done in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions?

The Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions is a document that provides guidelines for property owners in Dauphin County, Pennsylvania, who wish to apply for deferral of real property taxes based on certain financial criteria.

Who is required to file Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions?

Property owners in Dauphin County who meet specific criteria related to age, income, and property value are required to file the application to qualify for the tax deferral program.

How to fill out Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions?

To fill out the application, property owners must provide personal information, including details about their income, property, and any relevant financial documents as outlined in the instructions on the form.

What is the purpose of Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions?

The purpose of the Act is to allow eligible homeowners, especially seniors or those with financial hardships, to defer the payment of property taxes until a later time, alleviating immediate financial burdens.

What information must be reported on Dauphin County Real Property Tax Deferral Act 50, 1998 Application and Instructions?

Applicants must report their name, address, date of birth, income information, property details, and any other financial documents required by the application to assess eligibility for tax deferral.

Fill out your dauphin county real property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dauphin County Real Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.