IE Request for Irish Social Insurance Records Form U1 2021-2026 free printable template

Show details

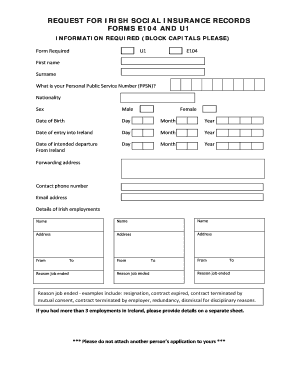

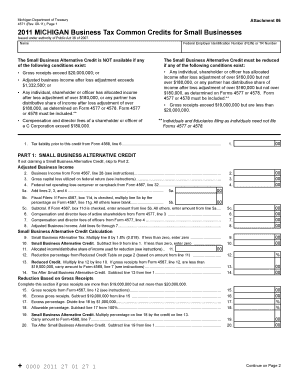

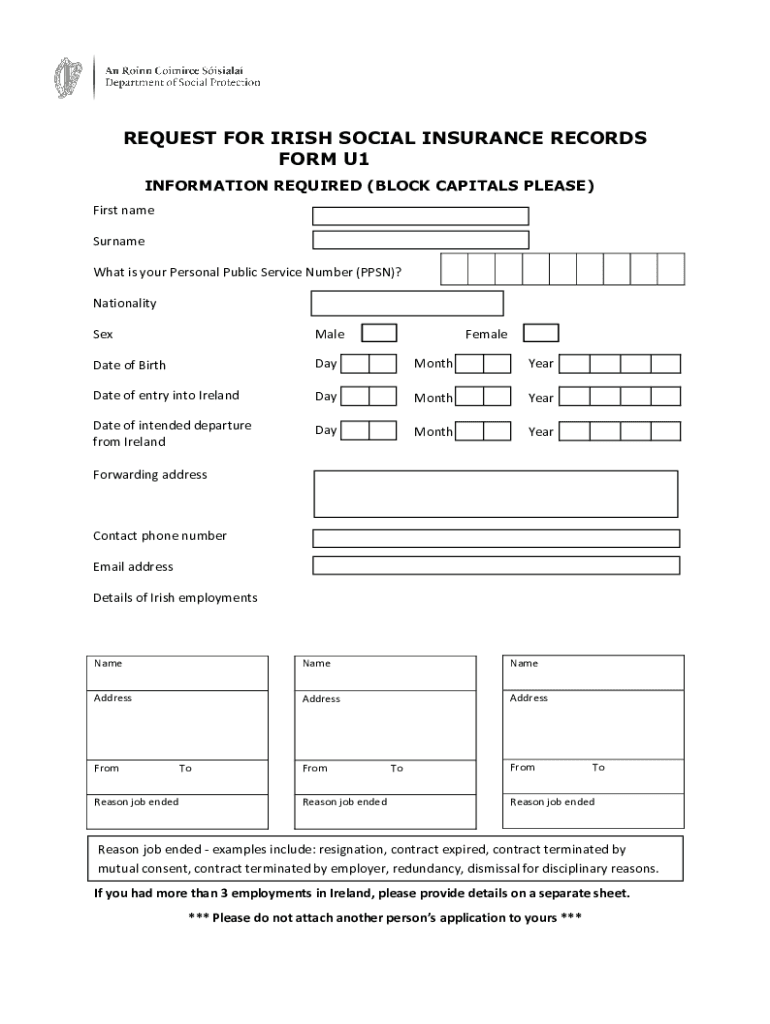

REQUEST FOR IRISH SOCIAL INSURANCE RECORDS

FORM U1

INFORMATION REQUIRED (BLOCK CAPITALS PLEASE)

First name

Surname

What is your Personal Public Service Number (PPLN)?

Nationality

SexMaleFemaleDate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign u1 form ireland online

Edit your u1 ireland form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your u1 form ireland download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit formulaire u1 irlande online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form u1 ireland. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IE Request for Irish Social Insurance Records Form U1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out e104 form ireland

How to fill out IE Request for Irish Social Insurance Records Form

01

Obtain the IE Request for Irish Social Insurance Records Form from the official website or relevant office.

02

Fill in your personal information accurately, including your full name, address, and date of birth.

03

Provide your Irish PPS number if you have one, as it helps in locating your records quickly.

04

Indicate the purpose for which you are requesting the records; this could be for employment, pension, etc.

05

Sign and date the form to confirm that the information provided is correct.

06

Submit the completed form via the designated submission method, such as by mail or online, as specified on the form.

Who needs IE Request for Irish Social Insurance Records Form?

01

Individuals who want to verify their contributions to the Irish social insurance system.

02

Those applying for social welfare benefits or pensions that require proof of insurance contributions.

03

Employers seeking records to confirm an employee's contributions for employment verification.

04

Anyone who needs their social insurance records for legal or administrative reasons.

Fill

u1 document ireland

: Try Risk Free

People Also Ask about irishsu1

How do I get my U1 form Ireland?

If you have been working in a country covered by EU Regulations and are returning to Ireland, you need to bring a record of your social insurance contributions using forms E104 and U1 (formerly E301) which you can get from your local social security office.

Can you leave Ireland on social welfare?

If you leave Ireland to live or work in another country, you may be able to use your Irish social insurance contributions to qualify for social security benefits in the country you are moving to. You can find more information about the social security arrangements that Ireland has with other countries.

How long can you leave the country on disability Ireland?

You can also go abroad on a respite break for a maximum of 3 weeks. Disability Allowance can be paid if you are studying an approved course outside the State under the Back to Education Allowance scheme or getting medical treatment not available in Ireland.

Can I transfer my Irish disability to another country?

You can get certain Irish social welfare payments and live in another country. You can also continue to get certain social welfare payments if you are on holiday abroad for a specific period of time or if you are getting medical treatment abroad.

Can I collect Social Security if I move to another country?

If you are a U.S. citizen, you may receive your Social Security payments outside the U.S. as long as you are eligible for them.

Can I move to Ireland and claim benefits?

When you come to Ireland, you will need a Personal Public Service Number (PPS number). This number is a unique personal identification number that you need to apply for State benefits and services in Ireland. You can find out about claiming a Irish social welfare payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my how to get u1 form ireland directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 682416689 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send if you have been working your local social security office for eSignature?

Once your u1 revenue ireland is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit u1 form online on an iOS device?

Create, modify, and share ireland u1 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is IE Request for Irish Social Insurance Records Form?

The IE Request for Irish Social Insurance Records Form is a document used to request an individual's social insurance records from the Irish Department of Social Protection.

Who is required to file IE Request for Irish Social Insurance Records Form?

Individuals seeking their own social insurance records or those making inquiries on behalf of another person, such as a legal representative, may be required to file the form.

How to fill out IE Request for Irish Social Insurance Records Form?

To fill out the form, complete all required fields with accurate personal information, including name, address, date of birth, and social insurance number, if applicable. Sign and date the form before submission.

What is the purpose of IE Request for Irish Social Insurance Records Form?

The purpose of the IE Request for Irish Social Insurance Records Form is to obtain a record of an individual's contributions to the Irish social insurance system, which may be necessary for pension or benefit claims.

What information must be reported on IE Request for Irish Social Insurance Records Form?

The form must report personal details such as full name, address, date of birth, social insurance number, and any relevant employment details if applicable.

Fill out your IE Request for Irish Social Insurance Records online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

s041 is not the form you're looking for?Search for another form here.

Keywords relevant to formulaire u1

Related to u1 form download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.