Get the free APPLICATION FOR MANDATORY CASHOUT EXCEPTION - web pensions

Show details

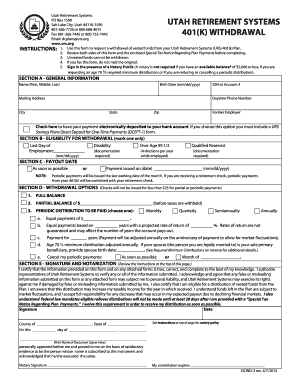

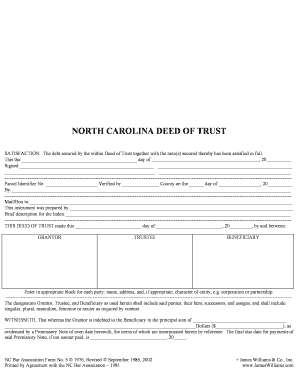

This document is an application form for members of the Benefits Plan of the Presbyterian Church (U.S.A.) to request an exception to the mandatory cashout provision upon termination of active participation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for mandatory cashout

Edit your application for mandatory cashout form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for mandatory cashout form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for mandatory cashout online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for mandatory cashout. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for mandatory cashout

How to fill out APPLICATION FOR MANDATORY CASHOUT EXCEPTION

01

Obtain the APPLICATION FOR MANDATORY CASHOUT EXCEPTION form from the relevant authority or website.

02

Carefully read the instructions provided on the form and any accompanying materials.

03

Fill in personal identification information, including your name, address, date of birth, and contact details.

04

Specify the reason for requesting the cashout exception, providing details and any necessary documentation.

05

Review the eligibility criteria to ensure you meet the requirements for the exception.

06

Sign and date the application form to certify that all information provided is accurate.

07

Submit the completed application form via the designated method (mail, online submission, etc.) as instructed.

Who needs APPLICATION FOR MANDATORY CASHOUT EXCEPTION?

01

Individuals who are required to take a mandatory cashout from retirement accounts but believe they qualify for an exception due to specific circumstances.

02

Retirement account holders who face financial hardship or other qualifying situations that warrant a cashout exception.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for force out distribution?

A force-out provision is a clause that requires dismissed participants with low balances of a set limit to remove their funds from the 401(k) plan. The minimum amount required can be from $1,000 to $5,000¹ (not including rolled over amounts), depending on the option chosen by the employer.

What are the exceptions for 401k withdrawal?

Other penalty-free exceptions You are terminally ill. You become or are disabled. You gave birth to a child or adopted a child during the year (up to $5,000 per account). You rolled the 401(k) over to another retirement plan (within 60 days).

Can a company force you to cash out your 401k?

If your account has a vested balance of less than $1,000, your employer may force you out and pay the amount left in your account with a check, or roll your funds into an IRA of their choosing.

What is the force out provision for 401k?

The IRS allows employers to add what's known as a force-out provision that would require former employees with low balances to remove their assets from the plan.

What is a mandatory cash out?

The term "mandatory distribution" generally refers to the process whereby separated participants with less than $7,000 can get forced out their plan, and the safe harbor IRA refers to the specialized individual retirement account (IRA) that's established when a participant of a qualified retirement savings plan is “

What is the mandatory cash out provision?

The mandatory cash-out rule allows employers to remove former employees with small-balance retirement accounts from their retirement plans. We help roll over your former employees' small-balance retirement accounts so that you can focus on nurturing your current employees' success.

What is the IRS rule for PTO cash out?

accrued PTO in the same year, the IRS rules say that you should be taxed on all your accrued PTO, even the PTO hours that you choose not to cash out. In order to NOT tax our teammates when they accrue PTO, cash out is paid at 90% of its value.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR MANDATORY CASHOUT EXCEPTION?

The APPLICATION FOR MANDATORY CASHOUT EXCEPTION is a formal request submitted to a governing body or institution to seek an exception to a mandatory cashout policy where individuals can opt to withdraw their funds or benefits under specific circumstances.

Who is required to file APPLICATION FOR MANDATORY CASHOUT EXCEPTION?

Individuals or entities who seek to qualify for an exception to the mandatory cashout provisions must file the APPLICATION FOR MANDATORY CASHOUT EXCEPTION. This typically includes participants in retirement plans or benefit programs that are undergoing mandatory cashout.

How to fill out APPLICATION FOR MANDATORY CASHOUT EXCEPTION?

To fill out the APPLICATION FOR MANDATORY CASHOUT EXCEPTION, applicants should carefully complete the required sections of the application form, providing all necessary personal information, details about the mandatory cashout, and the reason for the exception request. Supporting documentation may also be required.

What is the purpose of APPLICATION FOR MANDATORY CASHOUT EXCEPTION?

The purpose of the APPLICATION FOR MANDATORY CASHOUT EXCEPTION is to allow individuals to request a deviation from standard cashout rules, often due to unique circumstances that warrant consideration for maintaining their funds or benefits instead of being forced to cash them out.

What information must be reported on APPLICATION FOR MANDATORY CASHOUT EXCEPTION?

The information that must be reported includes personal identification details, account information, the reason for the cashout exception request, and any relevant supporting documents that validate the request or situation.

Fill out your application for mandatory cashout online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Mandatory Cashout is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.