Get the free Contractor’s Bond

Show details

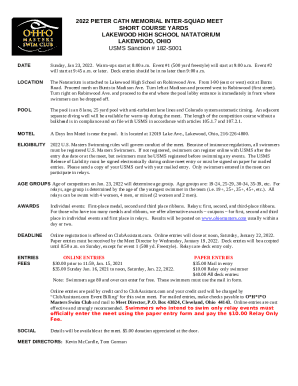

This document serves as a bond for contractors seeking to register with the City of Garfield Heights to engage in construction activities, ensuring compliance with the city's building codes and regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contractors bond

Edit your contractors bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contractors bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing contractors bond online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit contractors bond. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

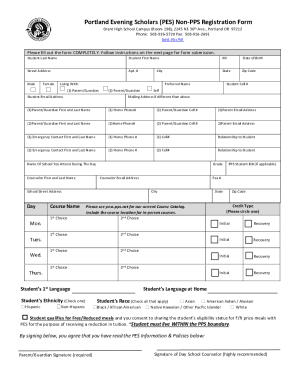

How to fill out contractors bond

How to fill out Contractor’s Bond

01

Obtain the Contractor’s Bond form from a relevant bonding company or regulatory authority.

02

Fill in the contractor's name and address in the designated fields.

03

Provide the license number and business details of the contractor.

04

Specify the bond amount required, in accordance with local regulations.

05

Include the project details for which the bond is being issued, such as project name and location.

06

Ensure all required signatures are provided, including those of the contractor and the surety company.

07

Review the form for completeness and accuracy before submission.

08

Submit the completed bond form to the appropriate agency or authority.

Who needs Contractor’s Bond?

01

Contractors who wish to bid on public projects.

02

Contractors required by law to obtain a bond for licensing purposes.

03

Businesses wanting to provide assurance to clients about project completion and compliance.

04

General contractors and subcontractors involved in construction projects.

Fill

form

: Try Risk Free

People Also Ask about

How much does a $25,000 contractor's bond cost?

$25,000 surety bonds typically cost 0.5–10% of the bond amount, or $125–$2,500. Highly qualified applicants with strong credit might pay just $125 to $250, while an individual with poor credit will receive a higher rate.

What is the definition of English bond in construction?

English bond brickwork combines alternate courses of stretchers and headers. This traditional pattern is considered to be one of the strongest bonds and is commonly used for bridges and engineering projects. It requires more facing bricks than other patterns.

How much is a $25,000 secured bond?

The cost of a $25,000 varies mostly based on the applicant's credit score. Usually, applicants with a FICO of 650 or more pay an annual premium of 0.75% to 3% or between $188 and $750. Applicants with credit issues can expect premiums in a range between 3% to 10%, i.e. annual payments between $750 and $2,500.

How much does a $20,000 surety bond cost?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Average Credit (600-675) $20,000 $200 - $600 $600 - $1,000 $25,000 $250 - $750 $750 - $1,250 $30,000 $300 - $900 $900 - $1,5007 more rows

What is a contractor's bond?

Unlike insurance, which protects the insured party, a contractor typically purchases a bond to protect the project owner from financial loss. If a problem occurs, the owner can file a claim with the surety company, which will step in to ensure the contract is completed.

What is a typical bond rate in construction?

Like most agreements in the construction industry, a bond cost is negotiable. However, the standard rate a surety will typically charge a general contractor is between 1-3% of a project's total value.

How much does a $25,000 contractor's bond cost?

$25,000 surety bonds typically cost 0.5–10% of the bond amount, or $125–$2,500. Highly qualified applicants with strong credit might pay just $125 to $250, while an individual with poor credit will receive a higher rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Contractor’s Bond?

A Contractor’s Bond is a type of surety bond that ensures a contractor will fulfill their contractual obligations and adhere to the regulations and laws applicable to their work.

Who is required to file Contractor’s Bond?

Contractors performing work that requires a license or permit, particularly in construction and related fields, are typically required to file a Contractor’s Bond.

How to fill out Contractor’s Bond?

To fill out a Contractor’s Bond, the contractor must complete specific forms provided by the bonding company, including information such as their business name, license information, and the amount of the bond, while ensuring that all required signatures are obtained.

What is the purpose of Contractor’s Bond?

The purpose of a Contractor’s Bond is to protect clients and the public from potential financial loss caused by a contractor's failure to complete a project, adhere to regulations, or meet other contractual obligations.

What information must be reported on Contractor’s Bond?

Information required on a Contractor’s Bond generally includes the name and address of the contractor, the amount of the bond, the surety company’s details, the project location, and any applicable license numbers.

Fill out your contractors bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contractors Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.