Get the free Subdivision Bond Application & Indemnity Agreement

Show details

This document serves as an application and indemnity agreement for obtaining surety bonds for subdivision development projects, outlining necessary information about the developer and project details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign subdivision bond application indemnity

Edit your subdivision bond application indemnity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your subdivision bond application indemnity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing subdivision bond application indemnity online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit subdivision bond application indemnity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

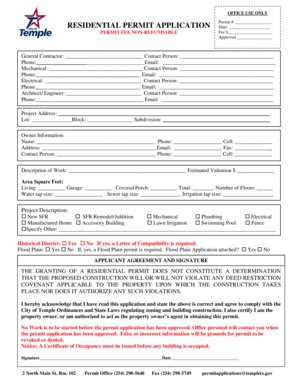

How to fill out subdivision bond application indemnity

How to fill out Subdivision Bond Application & Indemnity Agreement

01

Obtain the Subdivision Bond Application & Indemnity Agreement form from the relevant authority.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide details about the subdivision project, including the location and description of the work.

04

Specify the bond amount required for the project.

05

Include any relevant documentation, such as project plans or permits.

06

Review the application for accuracy and completeness.

07

Sign the application where indicated as the applicant.

08

Submit the application and any supporting documents to the appropriate authority or department.

Who needs Subdivision Bond Application & Indemnity Agreement?

01

Developers planning to create a subdivision.

02

Contractors involved in subdivision projects.

03

Property owners seeking to subdivide their land.

04

Municipalities requiring guarantees for public improvements in subdivisions.

Fill

form

: Try Risk Free

People Also Ask about

What is the point of an indemnity?

Indemnity insurance compensates the beneficiaries of the policies for their actual economic losses, up to the limiting amount of the insurance policy. It generally requires the insured to prove the amount of its loss before it can recover.

What is an indemnity bond agreement?

An indemnity bond assures the holder of the bond, that they will be duly compensated in case of a possible loss. This bond is an agreement that protects the lender from loss if the borrower defaults on a legally binding loan.

Why are subdivision bonds risky?

In other words, the principal or Surety must complete the obligation regardless of whether funds are ever received on the project. This makes these bonds a form of Completion Bonds and they are riskier for the principal and surety bond company.

Do you get the money back for an indemnity bond?

Do You Get the Money Back for an Indemnity Bond? No — the surety covers the cost of a claim upfront, but you must pay them back under the indemnity agreement terms. Indemnity bond premiums are also non-refundable once you file your official bond.

What is the indemnity agreement for a bail bond?

In the surety bond context, an indemnity agreement holds the bondholder liable for compensating the surety. Indemnitors agree to hold harmless and indemnify the surety from financial loss caused by failure to perform of the principal.

What is the difference between bond and indemnity bond?

An indemnity bond ensures the indemnifier compensates for losses, while a surety bond involves three parties: the obligee, the principal, and the surety, ensuring the principal fulfills obligations. A surety bond guarantees performance; an indemnity bond protects against losses.

What is the purpose of an indemnity bond?

An indemnity bond assures the holder of the bond, that they will be duly compensated in case of a possible loss. This bond is an agreement that protects the lender from loss if the borrower defaults on a legally binding loan.

What is the difference between a bond and an indemnity?

Financial Responsibility: In a surety bond, the surety provides a financial guarantee for the principal's obligations, whereas in bond indemnity, the principal assumes financial responsibility for any losses incurred by the surety.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Subdivision Bond Application & Indemnity Agreement?

A Subdivision Bond Application & Indemnity Agreement is a legal document that serves as a surety bond, ensuring that a developer will complete certain improvements in a subdivision, such as roads, utilities, and other infrastructure.

Who is required to file Subdivision Bond Application & Indemnity Agreement?

Typically, developers or property owners who are undertaking subdivision projects and are required by local government or planning authorities to provide a bond to secure completion of improvements are required to file this agreement.

How to fill out Subdivision Bond Application & Indemnity Agreement?

To fill out the Subdivision Bond Application & Indemnity Agreement, one must provide detailed information about the project, including the developer's information, project specifications, estimated costs, and the terms of the bond, ensuring all provided data is accurate and complete.

What is the purpose of Subdivision Bond Application & Indemnity Agreement?

The purpose of the Subdivision Bond Application & Indemnity Agreement is to protect the interests of the local government and the public by ensuring that necessary improvements in a subdivision are completed in a timely manner, thus avoiding potential liabilities.

What information must be reported on Subdivision Bond Application & Indemnity Agreement?

The information that must be reported includes the name and contact information of the bond applicant, a description of the subdivision project, estimates of costs for improvements, legal descriptions, and any other relevant details required by local authorities.

Fill out your subdivision bond application indemnity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Subdivision Bond Application Indemnity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.