Get the free SIMPLE IRA Employee Application & Brochure - AllianceBernstein

Show details

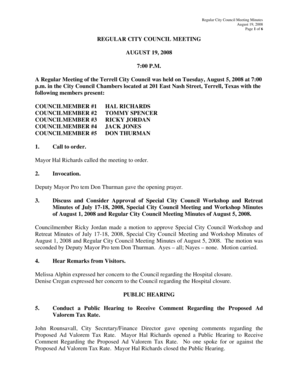

Alliance Bernstein SIMPLE IRA Employee Brochure ?? SIMPLE IRA Overview ?? SIMPLE S IRA Salary Reduction Agreement ?? SIMPLE IRA Application ?? SIMPLE IRA Transfer Form ?? Special S Employer Agreement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simple ira employee application

Edit your simple ira employee application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simple ira employee application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing simple ira employee application online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit simple ira employee application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simple ira employee application

How to fill out simple IRA employee application?

01

Begin by obtaining a copy of the Simple IRA employee application form from your employer or the financial institution offering the plan.

02

Carefully read the instructions provided on the application form to familiarize yourself with the required information and documentation.

03

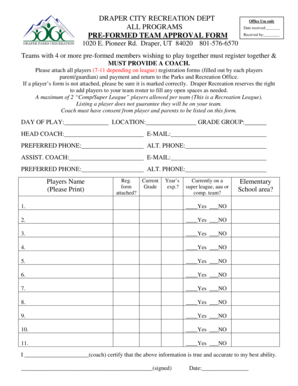

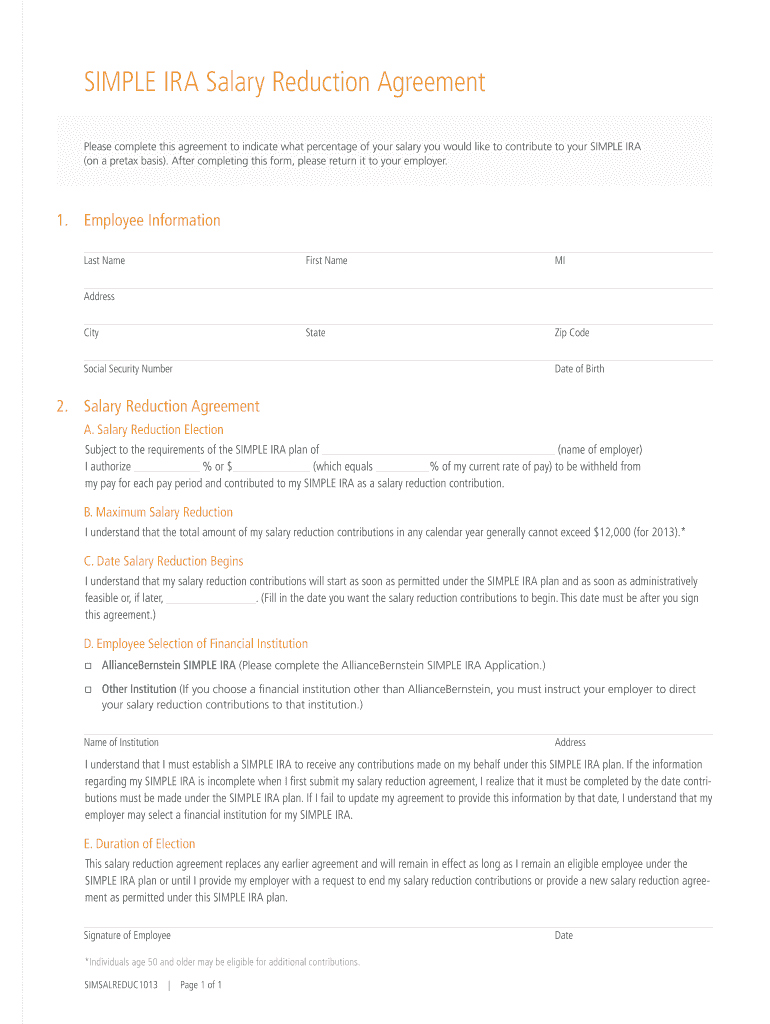

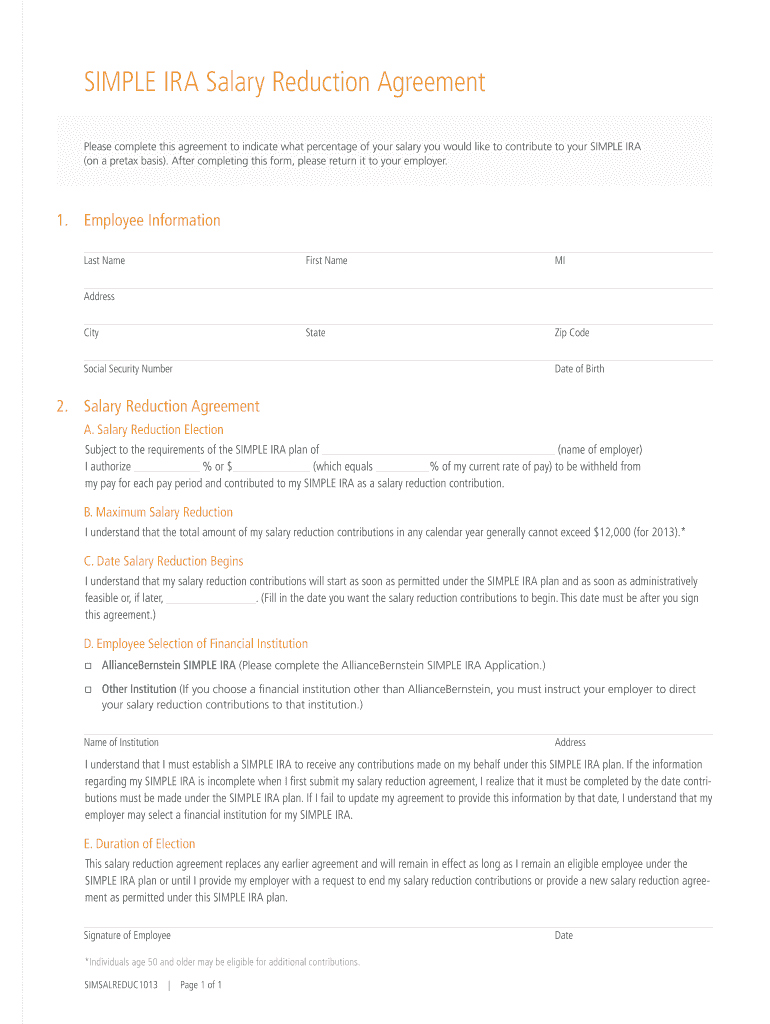

Start by providing your personal details, including your full name, address, social security number, and date of birth.

04

Indicate your employment status and provide information about your employer, such as the company name, address, and contact information.

05

Specify your desired contribution amount or percentage, keeping in mind any limitations set by the plan or IRS guidelines.

06

If applicable, indicate your spousal consent to participate in the Simple IRA plan.

07

Review your completed application form for accuracy and ensure all necessary sections are filled out.

08

Sign and date the application form, as well as any additional documents that may be required.

09

Submit the completed application form to your employer or the designated financial institution as per their instructions.

Who needs simple IRA employee application?

01

Employees who work for companies or organizations that offer a Simple IRA plan as part of their retirement benefits.

02

Individuals who are eligible to contribute to a Simple IRA, which typically includes employees who have received at least $5,000 in compensation from the employer in the previous two years and expect to receive at least $5,000 in the current year.

03

Individuals who want to save for retirement in a tax-advantaged account and have chosen the Simple IRA as their preferred retirement plan option.

Fill

form

: Try Risk Free

People Also Ask about

Do employers have to offer SIMPLE IRA to all employees?

Generally, any employee who has earned at least $5,000 during any two prior years and who is expected to earn $5,000 in the current year must be eligible to participate in a SIMPLE IRA plan. However, your employer may choose to exclude certain union employees and nonresident aliens.

What are the pros and cons of a SIMPLE IRA?

What Are the Pros and Cons of a SIMPLE IRA? More flexibility and more options. Easier and less expensive to set up and operate. Plenty of tax advantages. There's no Roth option for SIMPLE IRAs. Lower contribution limits. Beware of steep withdrawal penalties.

When can an employee enroll in a SIMPLE IRA?

1) The Plan Timeline Employers can set up a plan at any time between January 1 and October 1, and that plan will be eligible for the current year—as long as that employer did not previously maintain a SIMPLE IRA plan or any other qualified retirement plan (e.g., 401(k) plan).

How do I set up a SIMPLE IRA as an employee?

There are three steps to establishing a SIMPLE IRA plan. Execute a written agreement to provide benefits to all eligible employees. Give employees certain information about the agreement. Set up an IRA account for each employee.

What are the downsides of a SIMPLE IRA for employees?

Are There Downsides to SIMPLE IRAs and SEPs? Employee limitations. SIMPLE IRAs can only be implemented at companies with 100 or fewer employees. Total annual contribution limits. Lower contribution limits than a 401(k). Mandatory employer contributions. No loans or Roth contributions.

Is SIMPLE IRA good for employees?

SIMPLE IRA plans can provide a significant source of income at retirement by allowing employers and employees to set aside money in retirement accounts. SIMPLE IRA plans do not have the start-up and operating costs of a conventional retirement plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in simple ira employee application without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing simple ira employee application and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit simple ira employee application on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share simple ira employee application from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out simple ira employee application on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your simple ira employee application. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is simple ira employee application?

The Simple IRA employee application is a form used by employees to apply for participation in a Simple IRA retirement plan offered by their employer.

Who is required to file simple ira employee application?

Any employee who wishes to enroll in a Simple IRA retirement plan provided by their employer is required to file a Simple IRA employee application.

How to fill out simple ira employee application?

To fill out a Simple IRA employee application, the employee needs to provide their personal information, such as name, address, and Social Security number. They also need to specify their contribution amount and investment options.

What is the purpose of simple ira employee application?

The purpose of the Simple IRA employee application is to allow employees to apply for participation in the Simple IRA retirement plan offered by their employer. This application helps the employer keep track of employee enrollment and contributions.

What information must be reported on simple ira employee application?

On a Simple IRA employee application, the employee must report their personal information including name, address, and Social Security number. They also need to indicate their desired contribution amount and investment options.

Fill out your simple ira employee application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simple Ira Employee Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.