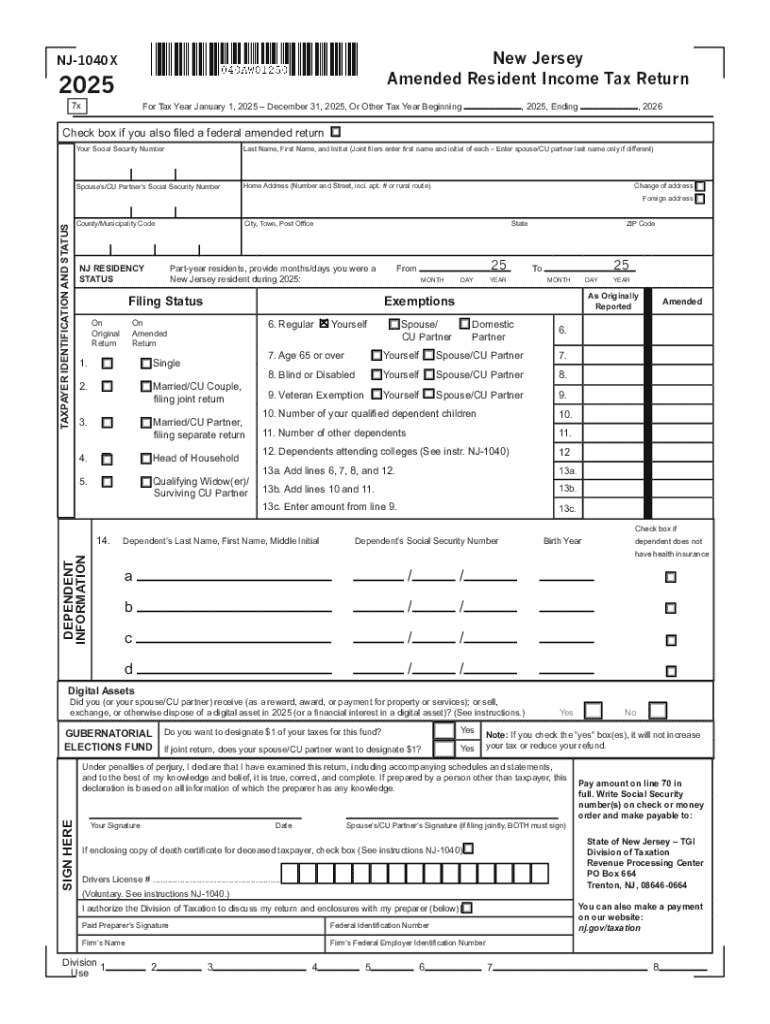

Get the free 2022 New Jersey Amended Resident Income Tax Return, form NJ-1040X. 2022 New Jersey A...

Get, Create, Make and Sign 2022 new jersey amended

How to edit 2022 new jersey amended online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 new jersey amended

How to fill out 2022 new jersey amended

Who needs 2022 new jersey amended?

2022 New Jersey Amended Form: A Comprehensive Guide

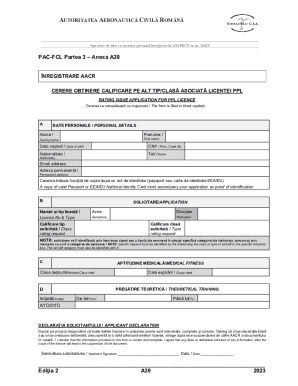

Understanding the 2022 New Jersey amended form

The 2022 New Jersey amended form is a crucial document that allows taxpayers to correct or adjust their previously filed tax returns. This form is designed to ensure that all financial discrepancies are properly addressed, allowing taxpayers to provide accurate information to the New Jersey Division of Taxation.

The primary purpose of filing an amended tax form is to correct errors or omissions that could impact tax liability. For instance, if taxpayers realize that they overlooked a specific deduction or mistakenly reported income, they can rectify these mistakes using the 2022 New Jersey amended form.

When to file an amended return

Filing an amended return is necessary under various circumstances. Taxpayers may need to make alterations if they discover mistakes in their original returns, such as inaccurately reported income or missed deductions. Additionally, new tax incentives or credits that became available after the initial filing might necessitate an update to the return.

Changes in filing status can also lead to the need for an amendment. For example, if a taxpayer's marital status changes or if they qualify for a different tax bracket after filing, they should consider amending their return to reflect this change.

Importantly, there are specific deadlines for filing amended returns in New Jersey, which is typically within three years from the original filing date or two years from when the tax was paid, whichever is later.

Gathering required documentation

Before filling out the 2022 New Jersey amended form, it is crucial to gather all necessary documentation. Key items include the original tax return, which acts as a baseline for any amendments, and supporting documents that validate the changes being made.

Supporting documents may comprise W-2 forms, 1099 forms, and receipts for deductible expenses. Having these documents organized not only eases the filling process but also ensures that all claims can be substantiated.

For an efficient filing experience, maintain a systematic storage method for your tax documents, whether in physical folders or a digital system, such as pdfFiller, which allows you to access necessary forms anytime, anywhere.

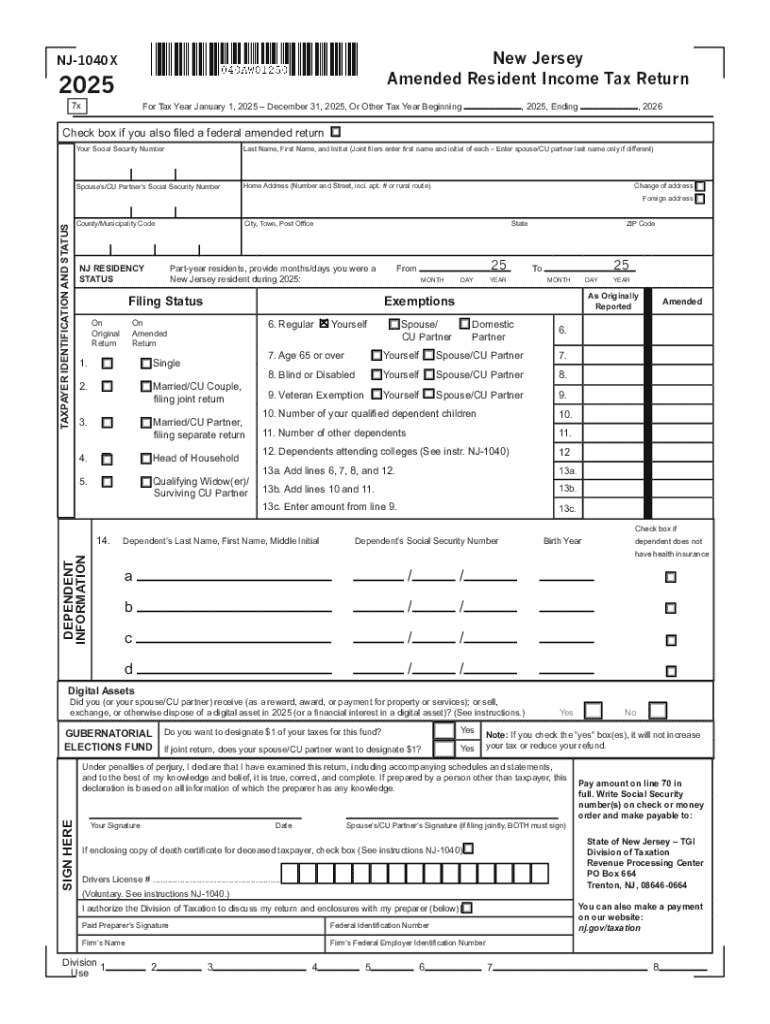

Completing the 2022 New Jersey amended form

Completing the 2022 New Jersey amended form requires careful attention. Start by reviewing the instructions provided with the form. Each line should be filled out accurately according to the changes being made. This includes indicating specific adjustments to income, deductions, or credits.

A line-by-line breakdown is essential, especially in ensuring that calculations are correct and that documentation corresponds to the changes made. Common mistakes include transposing numbers, overlooking required signatures, or failing to submit required supporting documents.

Interactive tools and resources available through pdfFiller can facilitate accurate filling, providing users with forms that can be edited easily and signed electronically, thereby enhancing the efficiency of the amendment process.

Options for submission

When it comes to submitting the 2022 New Jersey amended form, taxpayers have options: e-filing or paper filing. E-filing provides immediacy and allows for quicker processing, while paper filings may take longer but can suit those who prefer traditional methods.

To e-file your amended return in New Jersey, follow specific guidelines set by the state’s tax department, ensuring you utilize approved software to facilitate the process. For those opting to send their amended form by mail, ensure that it is sent to the address specified by the New Jersey Division of Taxation in the filing instructions.

Understanding the amended filing process

After submitting the 2022 New Jersey amended form, taxpayers may wonder what happens next. The submitted return goes through a processing stage by the New Jersey Division of Taxation, during which they may reach out for further information or clarification if necessary.

Typically, the timeline for processing an amended return can take several weeks, depending on the complexity of the changes and the volume of submissions the tax department is handling. Being proactive and checking on the status of an amendment can help ensure that there are no outstanding issues.

Impact of filing an amended return

Filing an amended return through the 2022 New Jersey amended form can have various outcomes. One of the most common scenarios is an increase in tax refunds. If an amendment is made to apply for missed deductions or credits, taxpayers might discover they are owed additional money from the state.

Alternatively, amendments can also increase tax liability. In instances where taxpayers realize they underreported income, owing additional tax may result in penalties or interest accumulating over time. Therefore, understanding the financial implications of amendments is vital for all taxpayers.

Frequently asked questions (FAQs)

It’s common for taxpayers to have questions when navigating the 2022 New Jersey amended form. Here are some frequently asked questions:

pdfFiller solutions for document management

pdfFiller is a robust solution for managing documents, perfect for facilitating the 2022 New Jersey amended form process. The platform offers options for editing, eSigning, and sharing documents seamlessly. By using pdfFiller, users can modify their PDF forms on any device, ensuring that access to necessary paperwork is never a concern.

The collaborative tools available on pdfFiller make it an ideal choice for teams working on amended returns, allowing for document management that is both efficient and secure. Users can track changes, add comments, and invite others to contribute to document preparation, making it a comprehensive solution for modern document needs.

Best practices for future tax returns

To minimize the need for filing amendments in future tax years, keeping thorough and accurate records is paramount. Implementing organizational strategies, such as maintaining updated expense reports and documenting all income sources, will simplify tax preparation.

Filing your taxes correctly the first time involves double-checking all calculations, reviewing eligibility for credits and deductions, and seeking professional advice if uncertainties arise. Furthermore, utilizing pdfFiller for ongoing document management can prevent common mishaps in tax submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2022 new jersey amended directly from Gmail?

Can I create an electronic signature for signing my 2022 new jersey amended in Gmail?

How do I edit 2022 new jersey amended straight from my smartphone?

What is 2022 new jersey amended?

Who is required to file 2022 new jersey amended?

How to fill out 2022 new jersey amended?

What is the purpose of 2022 new jersey amended?

What information must be reported on 2022 new jersey amended?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.