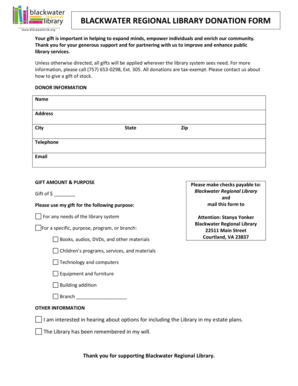

Get the free ALERT - Modifications to Form 8-K Rules Become Effective

Show details

This document discusses the changes to Form 8-K rules related to executive compensation, including the reporting process for executive compensation and related arrangements as mandated by the SEC.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alert - modifications to

Edit your alert - modifications to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alert - modifications to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alert - modifications to online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit alert - modifications to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alert - modifications to

How to fill out ALERT - Modifications to Form 8-K Rules Become Effective

01

Obtain the official ALERT document detailing the modifications to Form 8-K rules.

02

Review the changes outlined in the document to understand the implications for filing.

03

Gather all necessary information and data required to complete the Form 8-K.

04

Prepare the Form 8-K according to the new rules by including all relevant disclosures.

05

Ensure that all filings are compliant with the updated regulations outlined in the ALERT.

06

Submit the completed Form 8-K to the appropriate regulatory agency, making sure to follow any specific submission guidelines.

07

Keep a copy of the submitted Form 8-K for your records.

Who needs ALERT - Modifications to Form 8-K Rules Become Effective?

01

Public companies that are required to file Form 8-K disclosures.

02

Corporate executives and compliance officers responsible for regulatory filings.

03

Legal and financial professionals who assist companies in navigating SEC reporting obligations.

04

Investors and analysts who rely on accurate and timely disclosures for informed decision-making.

Fill

form

: Try Risk Free

People Also Ask about

What is the current report Form 8-K?

Form 8-K is known as a “current report” and it is the report that companies must file with the SEC to announce major events that shareholders should know about. Companies generally have four business days to file a Form 8-K for an event that triggers the filing requirement.

Who must file Form 8-K?

The U.S. Securities and Exchange Commission (SEC) requires companies to file a Form 8-K to announce significant events relevant to shareholders.

What is the SEC 8-K rule?

Form 8-K is a Securities and Exchange Commission (SEC) periodic report that public companies file to disclose material changes. Unlike Form 10-K and Form 10-Q , which are filed annually and quarterly, respectively, a public company files a Form 8-K whenever a material event occurs.

Is an 8-K filing good or bad?

Form 8-K is used to disclose any events or information that may affect investor decisions to the public, so it can contain both positive and negative events. An 8K filing may affect the company's stock price, but the direction of the price movement will depend on the nature of the trigger event.

What does 8-K mean filing?

The U.S. Securities and Exchange Commission (SEC) requires publicly traded companies (registrants) file an 8-K when there is a material corporate event impacting the registrant. A material event is considered a significant event that an investor would want to know.

What is keeping current Form 8-K?

Form 8-K requires public companies to make prompt disclosures about a large number of specified events. Although Form 8-K does not mandate current reporting of all material events, it goes a long way toward requiring public companies to keep the markets informed of material developments on a day-to-day basis.

Is an 8-K filing good or bad?

Form 8-K also provides substantial benefits to listed companies. By filing an 8-K promptly, the firm's management can meet specific disclosure requirements and avoid insider trading allegations. Companies may also use Form 8-K to tell investors of any events that they consider to be important.

What is Form 8-K used for ing to your textbook?

Form 8-K is a form required to be filed by registrants with the SEC when certain significant or “material” events occur, such as mergers and acquisitions, changes in management, and director resignations.

What is an 8-K filing example?

Common examples of events that necessitate the filing an 8-K include: Non-Public Plans for an Acquisition (i.e. In Process of Closing) Tender Offer Received. Resignation of Senior-Level Executive or Board of Directors Member.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ALERT - Modifications to Form 8-K Rules Become Effective?

ALERT - Modifications to Form 8-K Rules refers to changes implemented by the SEC that modify how companies disclose material events to ensure timely and accurate reporting.

Who is required to file ALERT - Modifications to Form 8-K Rules Become Effective?

Public companies, including those registered under the Securities Exchange Act of 1934, are required to file under the modified Form 8-K rules.

How to fill out ALERT - Modifications to Form 8-K Rules Become Effective?

To fill out the modified Form 8-K, companies must provide specific details about the material event, including the nature of the event, its impact, and any necessary disclosures as specified in the revised rules.

What is the purpose of ALERT - Modifications to Form 8-K Rules Become Effective?

The purpose is to enhance the transparency and timeliness of company disclosures regarding significant events that may affect investors' decisions.

What information must be reported on ALERT - Modifications to Form 8-K Rules Become Effective?

Information that must be reported includes details of the event, relevant dates, financial implications, and any actions taken or planned by the company in response to the event.

Fill out your alert - modifications to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alert - Modifications To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.