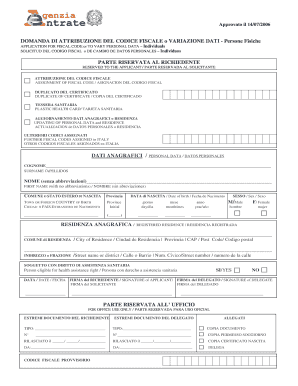

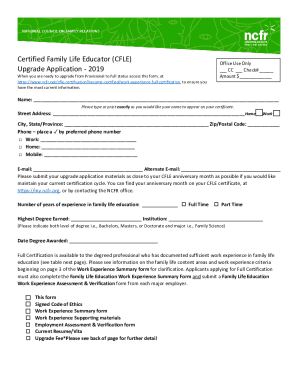

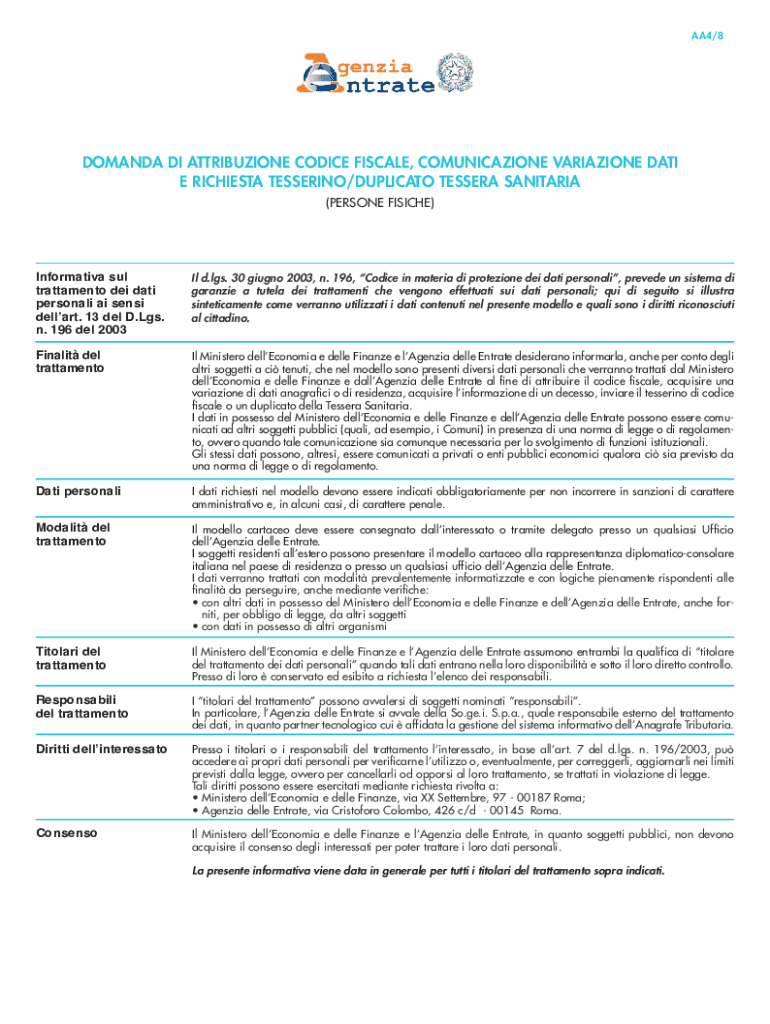

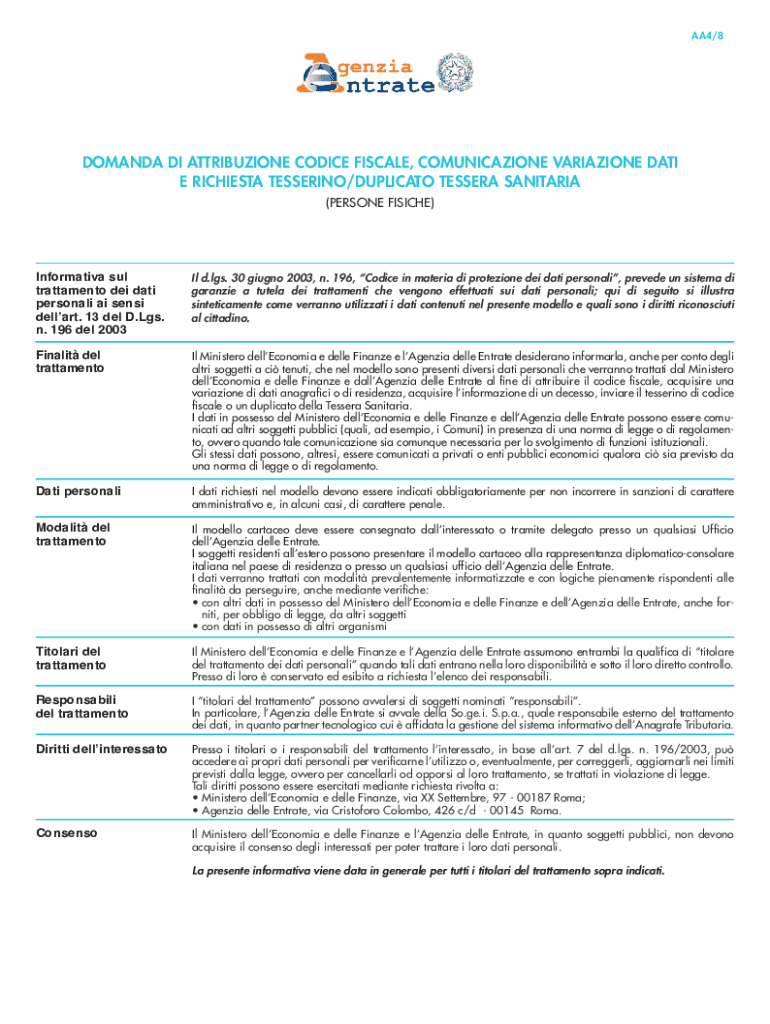

IT Agenzia Entrate Domanda di Attribuzione Codice Fiscale Comunicazione Variazione Dati - Persone Fisiche 2013-2025 free printable template

Show details

AA4/8DOMANDA DI ATTRIBUTION CODICES FISCAL, COMMUNICATION VARIATION DATA

E RICHEST LESSENING/DUPLICATE TESS ERA SANITARIAN

(PERSON FISCHER)Informative sub

trattamento DEI data

personal ai sense

dell

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tessera sanitariacodice fiscale modello

Edit your tessera sanitariacodice fiscale modello form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tessera sanitariacodice fiscale modello form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tessera sanitariacodice fiscale modello online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tessera sanitariacodice fiscale modello. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IT Agenzia Entrate Domanda di Attribuzione Codice Fiscale Comunicazione Variazione Dati - Persone Fisiche Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (96 Votes)

How to fill out tessera sanitariacodice fiscale modello

How to fill out IT Agenzia Entrate Domanda di Attribuzione Codice

01

Download the IT Agenzia Entrate Domanda di Attribuzione Codice form from the official website.

02

Fill in your personal information, including your name, address, and tax identification number.

03

Indicate the reason for requesting the Codice Fiscale (Tax Code) in the appropriate section.

04

Provide any necessary documentation to support your application, such as identification or residency proof.

05

Review your application for accuracy and completeness.

06

Sign the form where indicated.

07

Submit the completed form to the relevant local tax office (Agenzia delle Entrate) either in person or by mail.

Who needs IT Agenzia Entrate Domanda di Attribuzione Codice?

01

Individuals who are not registered as residents in Italy but require a tax code.

02

Foreign nationals conducting business or financial transactions in Italy.

03

Students or researchers coming to Italy for temporary stays.

04

Anyone planning to purchase property or open a bank account in Italy.

Fill

form

: Try Risk Free

People Also Ask about

Come richiedere l'attribuzione del codice fiscale online?

È possibile richiedere direttamente online il certificato di attribuzione del codice fiscale o della partita IVA: nell'area personale dell'Agenzia delle Entrate, accessibile tramite SPID, CIE, CNS, Fisconline/Entratel, debutta il nuovo servizio “Istanze e certificati” che permette di presentare e richiedere documenti

Come si compila il modello AA5 6?

Allegati. I documenti da allegare sono: copia atto costitutivo (in questa fase lo statuto non occorre), fotocopia documento del Presidente e del delegato se inserito.

A cosa serve il modello AA5 6?

Per richiedere il codice fiscale, i soggetti diversi dalle persone fisiche devono utilizzare il AA5/6 (“domanda di attribuzione codice fiscale, comunicazione variazione dati, avvenuta fusione, concentrazione, trasformazione ed estinzione”).

Cosa significa prima richiesta di attribuzione di codice fiscale?

La prima attribuzione del codice fiscale viene effettuata, generalmente, per i neonati al momento della prima iscrizione nei registri d'anagrafe della popolazione residente, attraverso un servizio a disposizione dei Comuni.

Come richiedere il codice fiscale per la prima volta?

Il cittadino sprovvisto del codice fiscale può richiederlo a un qualsiasi ufficio dell'Agenzia delle Entrate, utilizzando il modello AA4/8.

Come si compila la domanda di attribuzione del codice fiscale?

Come è fatto il codice fiscale 3 caratteri alfabetici per il cognome. 3 caratteri alfabetici per il nome. 2 numeri per l'anno di nascita. 1 carattere alfabetico per il mese di nascita. 2 numeri per il giorno di nascita e per il sesso.

Come richiedere il codice fiscale per italiani residenti all'estero?

Residenti all'estero Il cittadino sprovvisto del codice fiscale può richiederlo a un qualsiasi ufficio dell'Agenzia delle Entrate, utilizzando il modello AA4/8. Insieme alla richiesta, il cittadino italiano o appartenente a uno Stato dell'Unione europea deve esibire un documento di riconoscimento in corso di validità.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tessera sanitariacodice fiscale modello without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tessera sanitariacodice fiscale modello into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in tessera sanitariacodice fiscale modello?

The editing procedure is simple with pdfFiller. Open your tessera sanitariacodice fiscale modello in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I fill out tessera sanitariacodice fiscale modello on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your tessera sanitariacodice fiscale modello from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is IT Agenzia Entrate Domanda di Attribuzione Codice?

IT Agenzia Entrate Domanda di Attribuzione Codice is an official request form used in Italy for obtaining a tax identification code, also known as codice fiscale. This code is crucial for various administrative and financial transactions.

Who is required to file IT Agenzia Entrate Domanda di Attribuzione Codice?

Any individual or entity that needs to engage in activities requiring a tax identification code in Italy, such as residents, foreign nationals, companies, and other organizations, must file the IT Agenzia Entrate Domanda di Attribuzione Codice.

How to fill out IT Agenzia Entrate Domanda di Attribuzione Codice?

To fill out the IT Agenzia Entrate Domanda di Attribuzione Codice, applicants must provide personal details such as name, surname, date of birth, place of birth, and address. For non-Italian nationals, relevant identification numbers from their home countries may also be required.

What is the purpose of IT Agenzia Entrate Domanda di Attribuzione Codice?

The purpose of the IT Agenzia Entrate Domanda di Attribuzione Codice is to formally request the assignment of a tax identification code, which is essential for conducting legal and financial activities within Italy, such as opening bank accounts, signing contracts, and filing taxes.

What information must be reported on IT Agenzia Entrate Domanda di Attribuzione Codice?

The information that must be reported includes personal identification details such as full name, surname, date of birth, place of birth, nationality, residence address, and any tax identification numbers from other countries for non-Italian citizens.

Fill out your tessera sanitariacodice fiscale modello online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tessera Sanitariacodice Fiscale Modello is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.