Get the free Form 5.2 - Application to withdraw or transfer up to 50% of the money transferred in...

Show details

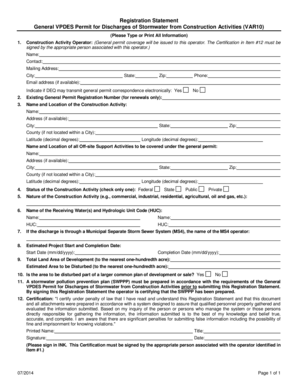

This application form is used to request the withdrawal or transfer of up to 50% of funds from an Ontario life income fund (LIF), specifically under the requirements of the applicable regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 52 - application

Edit your form 52 - application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 52 - application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 52 - application online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 52 - application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 52 - application

How to fill out Form 5.2 - Application to withdraw or transfer up to 50% of the money transferred into a Schedule 1.1 LIF

01

Obtain Form 5.2 from the relevant authority or their website.

02

Fill in your personal information in the designated fields, such as your name, address, and identification number.

03

Specify the amount you wish to withdraw or transfer, ensuring it does not exceed 50% of the transferred amount.

04

Indicate the reason for the withdrawal or transfer in the provided section.

05

Attach any required supporting documents that may be necessary for your application.

06

Review the form for any errors or missing information.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form along with any attachments to the appropriate authority via mail or through their online submission portal.

Who needs Form 5.2 - Application to withdraw or transfer up to 50% of the money transferred into a Schedule 1.1 LIF?

01

Individuals who have transferred funds into a Schedule 1.1 LIF and wish to withdraw or transfer up to 50% of those funds.

Fill

form

: Try Risk Free

People Also Ask about

What is 50% LIF unlocking in Ontario?

One-Time 50% Unlocking Individuals 55 or older will be entitled to a one-time conversion of up to 50% of holdings value into a tax-deferred savings vehicle with no maximum withdrawal limits.

Can you convert a lif back to a lira in Ontario?

Generally, there is not a way to transfer a LIF back to a LIRA. However, in some instances, funds can be withdrawn in cases of financial hardship, or other circumstances. In Ontario, the Financial Services Regulatory Authority of Ontario (FSRA) regulates pensions, LIRAs, and LIFs.

Can you unlock a lif in Ontario?

The Pension Benefits Act sets out four categories of financial hardship under which you can unlock your pension funds held in a locked-in retirement account (LIRA) or life income fund (LIF). You can unlock for any of these reasons and you can unlock for a combination of reasons.

What is 50% LIF unlocking in Ontario?

One-Time 50% Unlocking Individuals 55 or older will be entitled to a one-time conversion of up to 50% of holdings value into a tax-deferred savings vehicle with no maximum withdrawal limits.

Can you transfer LIF back to LIRA?

You cannot transfer the money back to a LIRA after funds have been transferred to a LIF.

Can you withdraw money from a LIF?

Yes. The maximum annual amount that may be withdrawn from a LIF or an RLIF is separate from, and in addition to, any unlocking that is done under the one-time 50%, small account balance or financial hardship options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 5.2 - Application to withdraw or transfer up to 50% of the money transferred into a Schedule 1.1 LIF?

Form 5.2 is an official application allowing individuals to withdraw or transfer up to 50% of the funds that have been transferred into a Schedule 1.1 Life Income Fund (LIF).

Who is required to file Form 5.2 - Application to withdraw or transfer up to 50% of the money transferred into a Schedule 1.1 LIF?

Individuals who have funds in a Schedule 1.1 LIF and wish to withdraw or transfer up to 50% of those funds are required to file Form 5.2.

How to fill out Form 5.2 - Application to withdraw or transfer up to 50% of the money transferred into a Schedule 1.1 LIF?

To fill out Form 5.2, individuals must provide personal information, details about the LIF, the specific amount they wish to withdraw or transfer, and their reason for the request, along with any required signatures.

What is the purpose of Form 5.2 - Application to withdraw or transfer up to 50% of the money transferred into a Schedule 1.1 LIF?

The purpose of Form 5.2 is to facilitate the withdrawal or transfer of funds from a Schedule 1.1 LIF, enabling individuals to access a portion of their retirement savings under specified conditions.

What information must be reported on Form 5.2 - Application to withdraw or transfer up to 50% of the money transferred into a Schedule 1.1 LIF?

Form 5.2 must include information such as the applicant's name, identification, details of the LIF account, the amount requested for withdrawal or transfer, and any applicable supporting documentation.

Fill out your form 52 - application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 52 - Application is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.