Get the free Deferred payment plan - San Luis Coastal Unified School District - slcusd

Show details

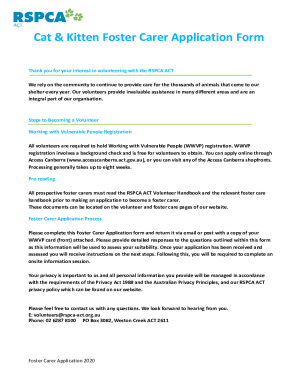

CREDIT CARD CHARGE PLAN San Luis Coastal Unified School District To take advantage of the Credit Card Charge Plan, you must: 1. Fill out the bus registration form for your child(men). Make sure you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred payment plan

Edit your deferred payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deferred payment plan online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deferred payment plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred payment plan

How to fill out a deferred payment plan:

01

Gather all necessary information and documents: To fill out a deferred payment plan, you will need to gather your personal information, such as your name, address, contact information, and Social Security number. Additionally, you may need to provide details about your financial situation, including your income, expenses, and any outstanding debts.

02

Contact the appropriate institution or organization: Reach out to the institution or organization offering the deferred payment plan. This could be a bank, credit card company, utility provider, or any other entity that allows for deferred payments. You can usually find their contact information on their website or through customer service.

03

Inquire about the deferred payment plan: Once you have contacted the institution, ask about their deferred payment plan and express your interest in filling out the necessary forms. They will provide you with the specific instructions and paperwork required to apply for the plan.

04

Fill out the application form: Carefully complete the application form provided by the institution. Make sure to provide accurate and up-to-date information to ensure a smooth processing of your deferred payment plan.

05

Provide supporting documents, if required: Some institutions may require additional documentation to support your application, such as proof of income or a letter explaining your financial situation. Ensure you have these documents ready and submit them along with your application.

06

Review and submit the application: Before submitting the application, take the time to review all the information you have provided. Double-check for any errors or missing details that could delay the approval process. Once you are satisfied with the application, submit it as per the institution's instructions.

07

Follow up on the application: If the institution does not provide an immediate decision on your deferred payment plan application, it is advisable to follow up with them after a reasonable amount of time has passed. This will allow you to check the status of your application and address any additional requirements or concerns they may have.

08

Complete any additional steps: Depending on the institution, there may be additional steps or agreements required to finalize the deferred payment plan. This could involve signing a contract, agreeing to specific terms and conditions, or setting up an automated payment schedule. Make sure to comply with any necessary steps to ensure the successful implementation of your deferred payment plan.

Who needs deferred payment plan?

01

Individuals facing temporary financial difficulties: A deferred payment plan can be beneficial for individuals who are experiencing temporary financial difficulties and need more time to pay their bills or debts. It provides them with an extended period to make payments, reducing the immediate financial burden.

02

Students managing education expenses: Students often find deferred payment plans helpful when managing their education expenses. It allows them to pay for tuition, textbooks, or other educational costs over time instead of paying the full amount upfront.

03

Small businesses or entrepreneurs: For small businesses or entrepreneurs, a deferred payment plan can provide financial flexibility and help manage cash flow. It allows them to make necessary purchases, invest in business growth, or manage operating expenses without immediate full payment.

04

Individuals making large purchases: Deferred payment plans can be useful for individuals planning to make large purchases, such as appliances, furniture, or electronics. It allows them to divide the total cost into smaller, more manageable payments over an agreed-upon period.

05

Consumers seeking budgeting flexibility: Some individuals may opt for deferred payment plans as a way to manage their budget more effectively. It allows them to spread out expenses and make regular payments aligned with their income schedule.

06

Customers in need of financial flexibility: In certain situations, customers may require financial flexibility, such as during times of unforeseen emergencies or unexpected expenses. A deferred payment plan can provide them with the necessary breathing room to overcome these financial challenges.

Overall, a deferred payment plan can be beneficial for a wide range of individuals who need temporary financial relief or greater flexibility in managing their expenses and payments.

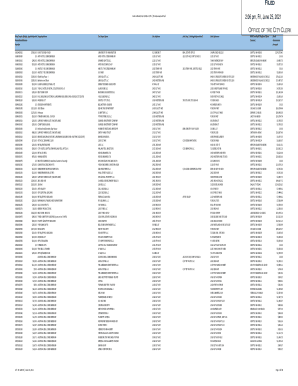

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute deferred payment plan online?

pdfFiller has made filling out and eSigning deferred payment plan easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit deferred payment plan on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign deferred payment plan right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit deferred payment plan on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute deferred payment plan from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is deferred payment plan?

Deferred payment plan is a payment arrangement that allows the payment of a debt in installments over a period of time, instead of paying the full amount upfront.

Who is required to file deferred payment plan?

Individuals or businesses who are unable to make immediate full payment of a debt or tax obligation may be required to file a deferred payment plan.

How to fill out deferred payment plan?

To fill out a deferred payment plan, you typically need to provide information about the debt or tax obligation, propose a payment schedule, and submit the plan to the relevant authority for approval.

What is the purpose of deferred payment plan?

The purpose of a deferred payment plan is to provide flexibility to debtors who are unable to pay a debt in full immediately, allowing them to make payments over time according to an agreed-upon schedule.

What information must be reported on deferred payment plan?

A deferred payment plan typically requires information such as the total amount owed, proposed payment schedule, reasons for inability to pay upfront, and any relevant supporting documentation.

Fill out your deferred payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.