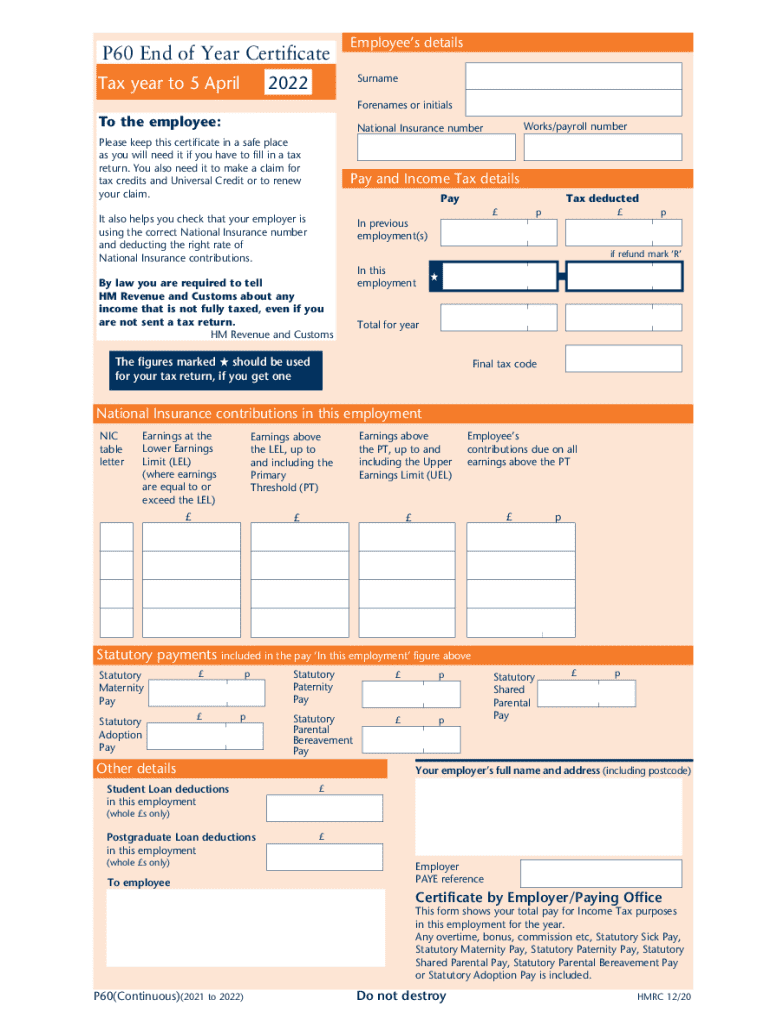

UK HMRC P14/P60 2022-2026 free printable template

Get, Create, Make and Sign UK HMRC P14P60

Editing UK HMRC P14P60 online

Uncompromising security for your PDF editing and eSignature needs

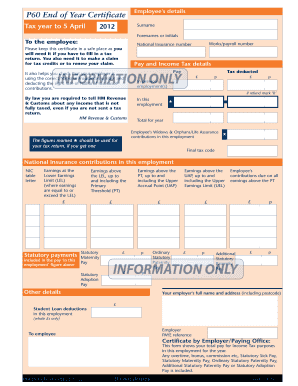

UK HMRC P14/P60 Form Versions

How to fill out UK HMRC P14P60

How to fill out p60 end of year

Who needs p60 end of year?

P60 End of Year Form: A Comprehensive Guide

Understanding the P60 end of year form

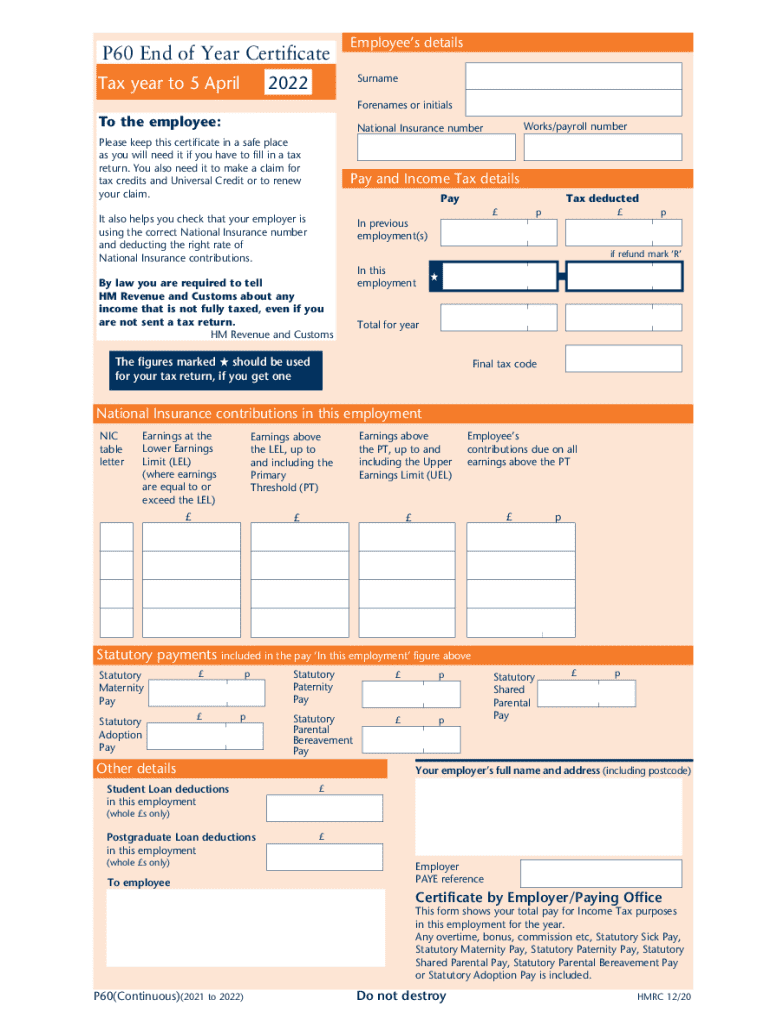

The P60 end of year form is a crucial document in the UK tax system that summarizes an employee's total pay and the taxes deducted from their salary over the fiscal year. This form is issued by employers and is vital for individuals as it helps them keep track of their earnings and tax contributions. Understanding its definition and purpose is essential for every employee.

Key components of the P60 include personal details like the employee's name, National Insurance number, and unique tax code, as well as the total gross pay, tax deductions, and employee National Insurance contributions. This data is necessary for individuals to accurately report their income when they file their tax return.

Who needs a P60?

Primarily, all employees in the UK who pay tax through the Pay As You Earn (PAYE) scheme are entitled to receive a P60 from their employers. For self-employed individuals, a P60 is not applicable; instead, they will need to rely on their financial records and other tax documents to assess their income tax obligations. The P60 plays an essential role in tax reporting, ensuring that employees can accurately account for their earnings and tax deductions.

Why the P60 matters for your tax reporting

The P60 end of year form is integral to your personal tax return for multiple reasons. It provides a comprehensive summary of your annual earnings and the taxes you've paid. This information is necessary for accurately completing your tax returns. Failing to report or misreporting data from your P60 can lead to incorrect tax assessments, possibly resulting in penalties or a tax bill.

Moreover, the P60 serves as evidence in case of a tax investigation by HM Revenue & Customs (HMRC). The consequences of inaccuracies, whether they stem from clerical errors or misunderstanding the information presented, can impact your financial standing, hence the importance of thoroughly reviewing this document upon receipt.

Filling out your P60: step-by-step instructions

Before you begin filling out your P60, gather relevant information. You will need personal details like your name, address, and National Insurance number, as well as financial details, including your total gross pay and the amount of tax you have paid over the year. This ensures that the form is completed accurately.

When you start filling out the P60, pay close attention to the sections listed. The first section usually contains personal identification details. The second section requires your total income, including any additional earnings, while the third details the tax deducted and National Insurance contributions. Avoid common errors, like transposing numbers or miscalculating totals, which could lead to complications when it comes time to file your tax return.

Editing and managing your P60 with pdfFiller

Managing your P60 digitally is made easy with pdfFiller. Uploading your document to pdfFiller allows you to edit any errors directly on the form. The platform offers user-friendly tools that facilitate the editing process, so users can ensure their P60 accurately reflects their financial details.

In addition, managing your P60 online ensures easy access to your document anytime, anywhere. However, it's important to consider the dangers of misplacing your P60; using digital solutions is a secure way to prevent that. Utilize pdfFiller's options for organizing and storing tax documents securely, protecting sensitive information from potential loss or theft.

eSigning your P60: simplifying the approval process

While a physical signature might have sufficed in the past, eSigning your P60 streamlines the approval process significantly. This electronic method allows users to confirm their tax documents without printing, scanning, or faxing, making it more convenient.

Using pdfFiller, you can easily eSign your P60 in a few clicks. This method holds the same legal validity as a traditional signature, as eSigned documents are recognized in court, adhering to the legal standards set by regulatory bodies. This not only simplifies your task but also guarantees compliance with legal considerations.

Collaborating on your P60: working with tax professionals

Often, while filling out your P60, you may find yourself needing assistance from a tax professional. Sharing your P60 for review is straightforward with pdfFiller's collaboration features. You can easily share the document with your accountant for direct feedback.

Features such as commenting and feedback tools enhance the collaboration experience, allowing for clear communication and queries to be addressed without confusion. Security features also ensure sensitive information, such as your financial data, is safely exchanged, protecting your privacy.

Navigating P60 income alongside other earnings

When reporting your P60 income, it's essential to understand how it fits in with additional earnings like rental income or income from side jobs. Accurately reporting all sources of income ensures compliance with the tax system and helps prevent issues with HMRC.

Balancing multiple income sources can be challenging; common pitfalls include failing to report additional earnings and not maintaining accurate records. To avoid these errors, keep thorough documentation and consult with tax professionals as needed, ensuring that all income is reported correctly on your tax return.

Common questions about the P60 end of year form

If your P60 is incorrect, it’s crucial to address the issue promptly. You should contact your employer to rectify any mistakes, as these inaccuracies can lead to complications during the tax return process. It's advisable to keep a record of all correspondence regarding discrepancies.

Moreover, if you haven’t received your P60, you can still submit your tax return. It's best practice to estimate your earnings based on payslips or past records, but you must request the P60 from your employer as soon as possible to prevent future reporting issues.

Maximizing your tax benefits: P60 considerations for future returns

The P60 end of year form not only aids in current tax returns but is also a strategic asset for future filings. By thoroughly tracking benefits and deductions outlined in your P60, you position yourself to optimize tax benefits in upcoming years.

Maintaining accurate records of your P60 and other tax documents ensures you're prepared for future tax obligations. This proactive approach enables better planning, especially in navigating changes in the tax system over the years.

Final thoughts on managing your P60 with pdfFiller

In closing, utilizing a cloud-based solution such as pdfFiller empowers efficient document management for your P60. With the ability to access, edit, and share your P60 securely, you can ensure compliance with regulations while maximizing your tax benefits.

The unique features of pdfFiller allow you to seamlessly navigate tax obligations with ease. Whether you're an employee managing individual earnings or part of a team handling multiple documents, pdfFiller is equipped to enhance your document handling processes, ensuring peace of mind throughout your tax-related duties.

People Also Ask about

What is a P60 Ireland?

How to download P60 UK?

Can I download my P60?

What is P45 in Ireland?

How to open P60?

How do I get my P60 in Ireland?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UK HMRC P14P60 to be eSigned by others?

How do I make edits in UK HMRC P14P60 without leaving Chrome?

How do I edit UK HMRC P14P60 on an Android device?

What is p60 end of year?

Who is required to file p60 end of year?

How to fill out p60 end of year?

What is the purpose of p60 end of year?

What information must be reported on p60 end of year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.