Get the free MO-CIC CHILDREN IN CRISIS TAX CREDIT - dor mo

Show details

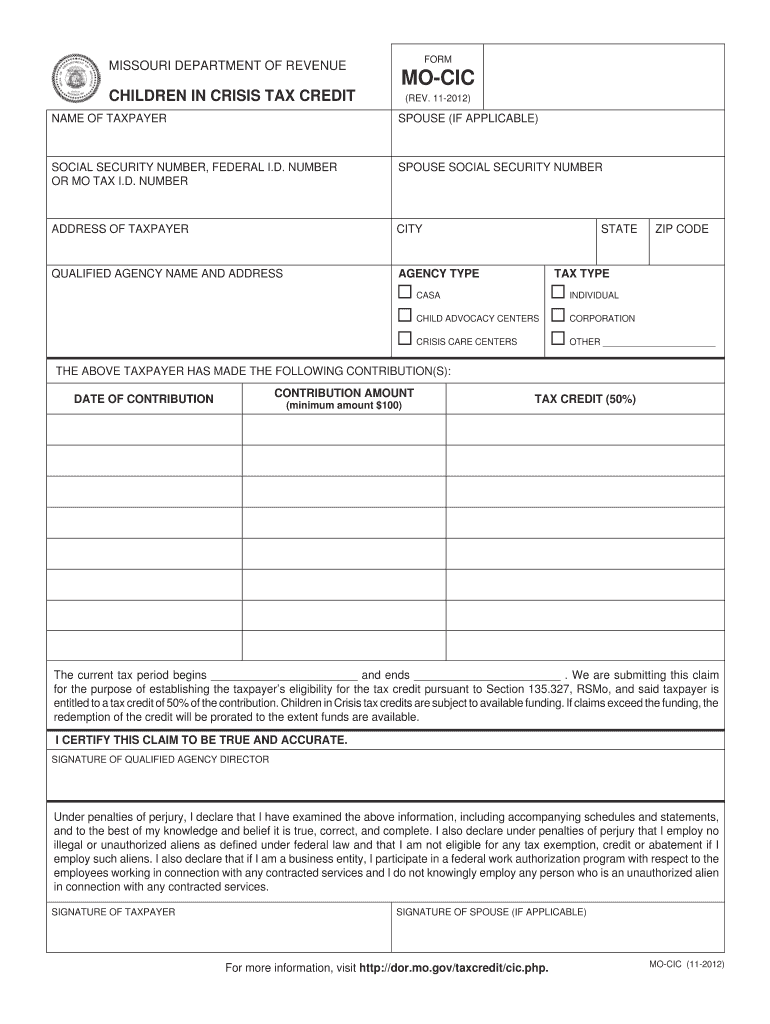

Form used to claim a tax credit for contributions made to qualified agencies supporting children in crisis, in accordance with Missouri law.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mo-cic children in crisis

Edit your mo-cic children in crisis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mo-cic children in crisis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mo-cic children in crisis online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mo-cic children in crisis. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mo-cic children in crisis

How to fill out MO-CIC CHILDREN IN CRISIS TAX CREDIT

01

Gather necessary documents: Collect all relevant documents needed to prove your eligibility for the tax credit.

02

Obtain the MO-CIC form: Download or request the MO-CIC form from the Missouri Department of Revenue website.

03

Fill in personal information: Provide your name, address, social security number, and other identifying information on the form.

04

Document your children: List all qualifying children that meet the criteria for the Children in Crisis Tax Credit.

05

Provide income information: Fill out the income section, including earnings and any additional sources of income.

06

Calculate the credit: Use the instructions on the form to calculate your preliminary tax credit based on your submissions.

07

Attach supporting documents: Include any required supporting documentation such as proof of residency or other eligibility documents.

08

Review and double-check: Make sure all information is accurate and complete to avoid any issues with your application.

09

Submit the form: Send the completed MO-CIC form and all supporting documents to the appropriate address as indicated on the form.

Who needs MO-CIC CHILDREN IN CRISIS TAX CREDIT?

01

Families with children who are facing financial hardship due to a crisis.

02

Parents or legal guardians of children who qualify for the credit based on the specific eligibility criteria set forth by Missouri laws.

03

Individuals seeking financial assistance to support the welfare of their children during difficult times.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for the Missouri working family credit?

You must be a resident individual with a filing status of single, head of household, qualifying widow(er), or married filing combined, who is allowed a Federal Earned Income Credit (EIC) on your Federal Form 1040 or Form 1040SR. Your investment income cannot exceed $4,050.

What is the ERC credit in Missouri?

WHAT IS THE ERC CREDIT IN MISSOURI? The ERC credit in Missouri is a tax credit aimed at helping businesses that retained their employees during the COVID-19 pandemic, up to $7,000 per employee per quarter for qualifying wages paid to employees from March 13, 2020, through December 31, 2021.

Who is eligible for the income tax credit?

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual earning up to $31,950 per year. You must claim the credit on the 2024 FTB 3514 form, California Earned Income Tax Credit, or if you e-file follow your software's instructions.

Who qualifies for minimum family tax credit?

You may qualify for a minimum family tax credit if you get Working for Families, your family income is under the income limit, and you work a minimum number of hours every week.

Who is eligible for the Missouri property tax credit?

You may be eligible for this tax credit if one or more of the following applies: You or your spouse were age 65 or older as of December 31, 2024, and you or your spouse were residents of Missouri for the entire year. You or your spouse became 100% disabled as a result of military service.

What is the $4000 Child Tax Credit?

For example, a taxpayer with two qualifying children may be eligible for a $4,000 credit. Taxpayers may receive the child tax credit as a reduction in tax liability (the nonrefundable portion of the credit), a refundable credit (the amount of the credit in excess of income tax liability), or a combination of both.

Did Missouri pass the Child Tax Credit?

Missouri House approves child care tax credit bill.

Did they pass the $3600 Child Tax Credit?

For 2021, the CTC was temporarily increased to $3,600 per child under six and $3,000 per child aged six to 17. It also was provided via monthly payments and made fully refundable.

Who is eligible for the Missouri working family tax credit?

To claim this credit, you must be a resident individual with a filing status of single, head of household, qualifying widow(er), or married filing combined, and who is allowed a Federal Earned Income Credit (EIC) on their federal return. Yes - Continue to calculate your Missouri Working Family Tax Credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MO-CIC CHILDREN IN CRISIS TAX CREDIT?

The MO-CIC Children in Crisis Tax Credit is a tax benefit designed to provide financial relief to taxpayers who support children in crisis situations, such as those in foster care or other at-risk environments.

Who is required to file MO-CIC CHILDREN IN CRISIS TAX CREDIT?

Taxpayers who have made qualified donations to organizations that benefit children in crisis and wish to claim the tax credit are required to file the MO-CIC Children in Crisis Tax Credit.

How to fill out MO-CIC CHILDREN IN CRISIS TAX CREDIT?

To fill out the MO-CIC Children in Crisis Tax Credit, taxpayers need to complete the specific state form, provide details of their qualifying donations, and ensure all supporting documents are attached.

What is the purpose of MO-CIC CHILDREN IN CRISIS TAX CREDIT?

The purpose of the MO-CIC Children in Crisis Tax Credit is to incentivize charitable donations to programs that assist children facing significant challenges and to promote the welfare of vulnerable youth.

What information must be reported on MO-CIC CHILDREN IN CRISIS TAX CREDIT?

Taxpayers must report the total amount of their qualified donations, the names of the organizations receiving the donations, and any other required supporting references as specified on the tax credit form.

Fill out your mo-cic children in crisis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mo-Cic Children In Crisis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.