Get the free Form 1120-PC - irs

Show details

This document provides instructions for filing tax returns for U.S. property and casualty insurance companies. It outlines income reporting, deductibles, tax liabilities, and compliance requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1120-pc - irs

Edit your form 1120-pc - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1120-pc - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1120-pc - irs online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1120-pc - irs. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1120-pc - irs

How to fill out Form 1120-PC

01

Obtain Form 1120-PC from the IRS website or your tax professional.

02

Fill in the identification section with your company's name, address, and Employer Identification Number (EIN).

03

Indicate the tax year for which you are filing the form.

04

Complete the income section by listing all taxable income earned during the year.

05

Fill out the deductions section to report any deductible expenses related to your business.

06

Calculate your taxable income by subtracting total deductions from total income.

07

Complete the tax computation section to determine your overall tax liability.

08

Ensure all lines are filled out accurately, and double-check your math.

09

Sign and date the form, and provide any necessary attachments.

10

File the completed Form 1120-PC by the deadline, either electronically or by mail.

Who needs Form 1120-PC?

01

Form 1120-PC is required for property and casualty insurance companies to report their income, deductions, and tax liability.

02

It is needed by companies that are taxed under subchapter L of the Internal Revenue Code.

03

Companies that provide any type of property and casualty insurance, including health insurance, may also need it.

Fill

form

: Try Risk Free

People Also Ask about

Can form 1120-PC be filed electronically?

You can't e-file Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return, in UltraTax CS. The IRS doesn't allow e-filing of Form 1120-PC unless it's a subsidiary of a parent corporation that files Form 1120.

What is the maximum late filing penalty?

If you owe tax and don't file on time (with extensions), there's also a penalty for not filing on time. The failure-to-file penalty is usually five percent of the tax owed for each month, or part of a month that your return is late, up to a maximum of 25%.

What is the penalty for filing as corp late?

S corporations that fail to file Form 1120S by the due date or by the extended due date face a $220 (for 2024) penalty for each month or part of a month the return is late. The penalty is multiplied by the number of shareholders.

Can I file 1120 myself?

You can fill out Form 1120 online for free with IRS Free File, or with a tax software if you feel comfortable filling out and filing this form yourself. Otherwise, you can hire a professional tax preparer to file Form 1120 online.

Can you e-file 1120 PC?

Only 1120 parent mixed returns that meet the asset (>= $10 million) and return filing (>= 250 returns) requirements are required to be filed electronically. Form 1120-PC and/or Form 1120-L returns filed as stand-alone returns or as the parent of a consolidated return must be filed in paper.

What is the penalty for filing 1120-PC late?

Late filing of return. A corporation that does not file its tax return by the due date, including extensions, may be penalized 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax.

What is the penalty for filing 1120 Pol late?

What if a political organization fails to pay the tax shown on Form 1120-POL? A political organization that does not pay the tax due generally may have to pay a penalty of ½ of 1% (0.005) of the unpaid tax for each month or part of a month the tax is not paid, up to a maximum of 25% of the unpaid tax.

Can you file 1120 electronically?

Tax Professionals who plan to e-file Forms 1120/1120-F/1120-H/1120-S for their clients must submit a new electronic IRS e-file application to become an authorized IRS e-file provider/electronic return originator.

Can 1120 PC be filed?

You can't e-file Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return, in UltraTax CS. The IRS doesn't allow e-filing of Form 1120-PC unless it's a subsidiary of a parent corporation that files Form 1120.

What is form 1120-PC?

Purpose of Form Use Form 1120-PC to report the income, gains, losses, deductions, and credits, and to figure the income tax liability of insurance companies, other than life insurance companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1120-PC?

Form 1120-PC is a U.S. tax form used by certain property and casualty insurance companies to report their income, gains, losses, deductions, and credits as well as to calculate their tax liability.

Who is required to file Form 1120-PC?

Property and casualty insurance companies that elect to be taxed under the special rules applicable to insurance companies must file Form 1120-PC.

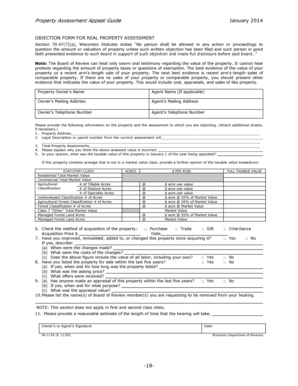

How to fill out Form 1120-PC?

To fill out Form 1120-PC, a taxpayer must provide financial information such as premium income, losses incurred, and other relevant deductions. The form consists of various sections that require precise financial data specific to the company's operations.

What is the purpose of Form 1120-PC?

The purpose of Form 1120-PC is to ensure that property and casualty insurance companies report their taxable income accurately and pay the correct amount of taxes based on their income and losses.

What information must be reported on Form 1120-PC?

Form 1120-PC requires reporting of income from premiums, losses, investment income, operating expenses, tax credits, and other relevant financial data.

Fill out your form 1120-pc - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1120-Pc - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.