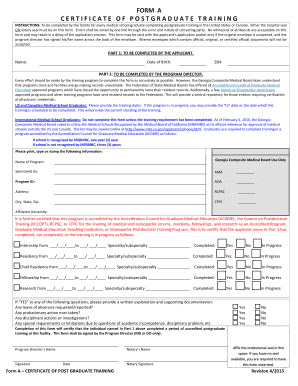

Get the free TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE)

Show details

This document is an application for a short-term insurance policy covering liability and physical damage for truck operators needing temporary coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign truck insurance application short-term

Edit your truck insurance application short-term form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your truck insurance application short-term form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit truck insurance application short-term online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit truck insurance application short-term. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out truck insurance application short-term

How to fill out TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE)

01

Gather necessary information about the truck, including its make, model, year, and Vehicle Identification Number (VIN).

02

Provide details about the truck's usage, such as the type of cargo it will carry and the average distance traveled.

03

Fill out the owner's personal information, including name, address, and contact details.

04

Indicate the type of coverage desired, including liability limits and physical damage options.

05

List any additional drivers who will operate the truck, including their driving history.

06

Disclose any previous insurance claims or accidents involving the truck.

07

Review the application for accuracy and completeness.

08

Submit the application to the insurance provider and await confirmation.

Who needs TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE)?

01

Truck owners who operate their vehicles for business purposes.

02

Drivers who require coverage for transporting goods short-term.

03

Businesses that rely on trucks for logistics and freight transportation.

04

Independent contractors renting or leasing trucks for delivery services.

Fill

form

: Try Risk Free

People Also Ask about

What are the two types of physical damage insurance?

Comprehensive and collision are separate coverage types, but they are often sold together. Investopedia says that combined physical damage insurance combines comprehensive and collision coverage into one policy.

What is the difference between unladen liability and non-trucking liability?

This term is often used interchangeably with "bobtail" or "non-trucking liability," but unladen liability has a broader scope since it includes both liability for deadheading or bobtailing regardless of dispatch status.

Does non-trucking liability cover physical damage?

Progressive Commercial's non-trucking liability insurance helps protect your truck when it's used for non-commercial activities. It helps pay for costs associated with bodily injury or property damage to third parties.

What is physical damage coverage in trucking?

For times when you need to use your truck for non-business purposes, non-trucking liability covers both your tractor and your trailer. Physical damage coverage offers even more protection. Standard trucking liability policies only provide coverage while you're on dispatch.

Is non trucking liability the same as physical damage?

Auto Physical Damage coverage is essential for moving and storage organizations that rely on commercial vehicles to transport and store goods. It offers financial protection against damage to insured vehicles, covering repair or replacement costs in the event of a loss.

What is liability and physical damage coverage?

This is coverage for almost any damages incurred by a truck, including fire, natural disasters, wind damage, animal-related damage, glass breakage, robbery, theft, and vandalism.

Is liability the same as physical damage?

Liability doesn't cover injuries to you or your passenger, nor does it cover physical damage to your vehicle, even when you're at fault in the accident.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE)?

TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE) is a document used by truck operators or businesses to apply for short-term insurance coverage that protects against liability and physical damage for their vehicles.

Who is required to file TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE)?

Any individual or business that operates trucks and requires temporary insurance coverage to protect against liability and physical damage is required to file the TRUCK INSURANCE APPLICATION.

How to fill out TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE)?

To fill out the TRUCK INSURANCE APPLICATION, gather necessary information about the truck, its owner, insurance requirements, and details about the intended use of the vehicle. Follow the form's instructions to provide all requested information accurately.

What is the purpose of TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE)?

The purpose of the TRUCK INSURANCE APPLICATION is to secure short-term insurance coverage that protects truck owners from financial losses due to accidents, damage, or liability claims arising from the use of their trucks.

What information must be reported on TRUCK INSURANCE APPLICATION (SHORT-TERM LIABILITY AND PHYSICAL DAMAGE)?

The information that must be reported includes the truck's make, model, year, identification number, driver details, coverage requirements, and any previous insurance history or claims.

Fill out your truck insurance application short-term online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Truck Insurance Application Short-Term is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.