Get the free Application for Conversion of Disaster Loan into a Grant - cgmahq

Show details

This document is an application form for converting a disaster loan into a grant for clients of the Coast Guard Mutual Assistance (CGMA), including information about the applicant's financial losses

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for conversion of

Edit your application for conversion of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for conversion of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for conversion of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for conversion of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for conversion of

How to fill out Application for Conversion of Disaster Loan into a Grant

01

Obtain the Application for Conversion of Disaster Loan into a Grant form from the relevant authority or website.

02

Carefully read all instructions provided with the application form.

03

Fill in your personal information, including name, address, and contact details.

04

Provide details about your disaster loan, including the loan number and amount.

05

Include any documentation that supports your request for conversion to a grant.

06

Review your application to ensure all sections are completed accurately.

07

Sign and date the application form.

08

Submit the completed application as instructed, either by mail, online, or in person.

Who needs Application for Conversion of Disaster Loan into a Grant?

01

Individuals or businesses that have received a disaster loan and are seeking to convert it into a grant due to financial hardship or other qualifying factors.

02

Applicants who experienced significant damage from a declared disaster and require additional financial assistance.

Fill

form

: Try Risk Free

People Also Ask about

Is it hard to get approved for an SBA disaster loan?

You have a low credit score However, the required value typically depends on which lender you choose and may not need to be as high when applying for a Disaster Loan. Unfortunately even under these circumstances, if you don't have great credit, you will most likely not receive an SBA loan.

Do you have to pay back the SBA disaster relief loan?

You are responsible for your COVID-19 EIDL monthly payment obligation beginning 30 months from the disbursement date shown on the top of the front page of your Original Note. During this deferment: You may make voluntary payments without prepayment penalties.

Can I get my SBA disaster loan forgiven?

Applicants may be eligible for a loan amount increase of up to 20% of their physical damages, as verified by the SBA for mitigation purposes. Eligible mitigation improvements may include a safe room or storm shelter, sump pump, French drain or retaining wall to help protect property and occupants from future disasters.

What is the SBA grant for disaster relief?

Eligibility includes: In "Low-income community" (more on this below), less than 10 employees, and suffered economic loss of 50% between 2019 and 2020 over an 8 week period. Once you click the green button, Targeted Advance Application, you'll get to a screen to enter your EIN or SSN, if self-employed.

How to increase SBA disaster loan amount?

Program Description The U.S. Small Business Administration (SBA) offers financial help to homeowners and renters in declared disaster areas. You don't need to own a business to get our help. We provide long-term, low-interest loans for losses that insurance and other sources don't fully cover.

How much will I get from an SBA disaster loan?

Homeowners may be eligible for a disaster loan up to $500,000 to repair or replace damaged or destroyed real estate. SBA may also be able to help homeowners and renters with up to $100,000 to repair or replace damaged or destroyed personal property, including personal vehicles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Conversion of Disaster Loan into a Grant?

The Application for Conversion of Disaster Loan into a Grant is a formal request submitted by borrowers of disaster loans to convert their existing loans into grants, typically following a natural disaster.

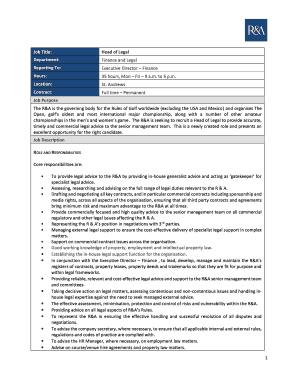

Who is required to file Application for Conversion of Disaster Loan into a Grant?

Borrowers who have received a disaster loan and are eligible for the conversion to grant status must file this application.

How to fill out Application for Conversion of Disaster Loan into a Grant?

To fill out the application, borrowers need to provide necessary details such as loan information, financial statements, and documentation proving the impact of the disaster on their business.

What is the purpose of Application for Conversion of Disaster Loan into a Grant?

The purpose is to allow borrowers to receive financial relief in the form of a grant, alleviating the burden of repaying the disaster loan due to qualifying circumstances.

What information must be reported on Application for Conversion of Disaster Loan into a Grant?

The application must report information such as the loan number, borrower’s financials, details about the disaster impact, and any other relevant financial data required by the lending agency.

Fill out your application for conversion of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Conversion Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.