OR Form 40N 2009-2026 free printable template

Show details

Clear Form 2009 Oregon resident: Form OREGON Amended Return Individual Income Tax Return FOR NONRESIDENTS mm dd YYY From mm dd YYY 40 N For office use only Fiscal year ending K To F Last name First

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 68552388 form

Edit your OR Form 40N form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR Form 40N form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR Form 40N online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OR Form 40N. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out OR Form 40N

How to fill out OR Form 40N

01

Download the OR Form 40N from the official website or obtain a physical copy.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal information such as name, address, and contact details in the designated fields.

04

Provide the necessary identification numbers, such as Social Security Number or Tax Identification Number, if applicable.

05

Fill out the sections related to your income, deductions, and credits accurately.

06

Review the filled-out form to ensure all information is correct and complete.

07

Sign and date the form at the bottom before submission.

08

Submit the form via mail or electronically as per the provided guidelines.

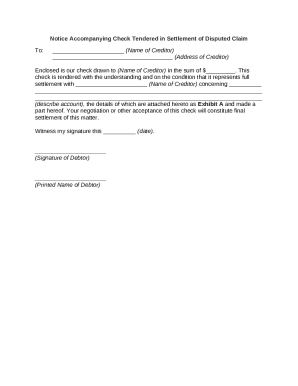

Who needs OR Form 40N?

01

Individuals or entities who are required to report certain tax information.

02

Taxpayers who have earned income and need to file an income tax return.

03

People who qualify for specific tax credits or deductions that need to be reported.

04

Those looking to claim refunds or reconcile tax payments with the state.

Fill

form

: Try Risk Free

People Also Ask about

How much income tax do I pay in Oregon?

Your average tax rate is 11.67% and your marginal tax rate is 22%. If your Oregon taxable income is over:But not over:Your tax is:$0$50,000A flat rate between $0 and $3,857, depending on how much you make$50,000$250,000$3,861 + 8.75% of the excess of $50,000$250,000$21,361 + 9.9% of the excess of $250,000

Why is there no tax in Oregon?

Because we have a state wage tax. Because we have property taxes. The State government tries with some frequency to pass a sales tax and its always been voted down by a large margin. The saying that goes around is “Don't Californucate Oregon”. California has some horrendous sales taxes as well as wage taxes.

Is Oregon an income tax free state?

Oregon has a graduated individual income tax, with rates ranging from 4.75 percent to 9.90 percent. There are also jurisdictions that collect local income taxes. Oregon has a 6.60 percent to 7.60 percent corporate income tax rate and levies a gross receipts tax.

Is Oregon considered a high tax state?

Oregon has a relatively high income tax at 9.90% (which is still not in the top 5 states for income tax). But the state has no sales tax.

Is there Oregon income tax?

The personal income tax is the largest source of state tax revenue, expected to account for 86% of the state's General Fund for the 2021–2023 biennium. Oregon's taxable income is closely connected to federal taxable income. The state personal income tax rates range from 4.75% to 9.9% of taxable income.

What state has the lowest taxes?

In 2020, the average American contributed 8.9% percent of their income in state taxes. Alaska had the lowest average overall tax burden – measured as total individual taxes paid divided by total personal income – at 5.4%, followed by Tennessee (6.3%), New Hampshire (6.4%), Wyoming (6.6%) and Florida (6.7%).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete OR Form 40N online?

Completing and signing OR Form 40N online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in OR Form 40N without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit OR Form 40N and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my OR Form 40N in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your OR Form 40N and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is OR Form 40N?

OR Form 40N is a tax form used in Oregon for reporting income tax for nonresidents and part-year residents.

Who is required to file OR Form 40N?

Nonresidents of Oregon who have income sourced from Oregon, as well as part-year residents who earned income during their residency, are required to file OR Form 40N.

How to fill out OR Form 40N?

To fill out OR Form 40N, you need to provide personal information, report your Oregon-sourced income, claim deductions and credits, and calculate your tax liability according to Oregon tax laws.

What is the purpose of OR Form 40N?

The purpose of OR Form 40N is to ensure that nonresidents and part-year residents report their income accrued from Oregon sources and pay any corresponding state income taxes.

What information must be reported on OR Form 40N?

The information that must be reported on OR Form 40N includes personal identification details, total income received from Oregon sources, adjusted gross income, applicable deductions, and any tax credits for which the taxpayer qualifies.

Fill out your OR Form 40N online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR Form 40n is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.