Get the free Metropolitan Life Insurance Tower - pdfhost focus nps

Show details

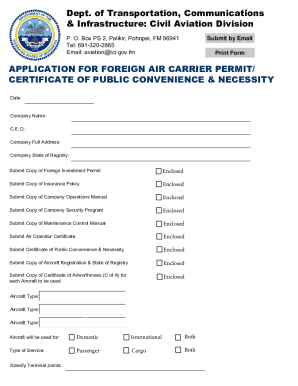

Form No. 10-300JRev. 10-74) UNITED STATES DEPARTMENT OF THE INTERIOR NATIONAL PARK SERVICE NATIONAL REGISTER OF HISTORIC PLACES INVENTORY -- NOMINATION FORM SEE INSTRUCTIONS IN HOW TO COMPLETE NATIONAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign metropolitan life insurance tower

Edit your metropolitan life insurance tower form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your metropolitan life insurance tower form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing metropolitan life insurance tower online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit metropolitan life insurance tower. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out metropolitan life insurance tower

How to fill out metropolitan life insurance tower:

01

Contact a licensed insurance agent or broker who offers policies from Metropolitan Life Insurance Company, also known as MetLife. They will guide you through the application process and help you choose the right coverage options for your needs.

02

Gather all necessary information, such as your personal details, including your name, address, date of birth, and contact information. You may also need to provide information about your occupation, income, and any existing insurance policies you have.

03

Determine the type and amount of coverage you need. Metropolitan Life Insurance Tower offers various types of insurance policies, including life insurance, disability insurance, long-term care insurance, and annuities. Consider your financial goals and needs to select the appropriate coverage.

04

Fill out the application form accurately and completely. Make sure to double-check all the information before submitting the application. Incomplete or incorrect information may delay the processing of your application.

05

Review the terms and conditions of the policy before signing it. Make sure you understand the coverage, premiums, exclusions, and any other important details. If you have any questions or concerns, don't hesitate to ask your insurance agent.

06

Pay any required premiums or fees to activate your policy. Metropolitan Life Insurance Tower offers various payment options, such as monthly, quarterly, or annual payments. Choose the payment frequency that fits your budget and preferences.

07

Keep a copy of the filled-out application and all related documents for your records. It's essential to have easy access to these documents in case you need to review or update your policy in the future.

Who needs metropolitan life insurance tower?

01

Individuals who want to protect their loved ones financially in the event of their death may consider obtaining life insurance from Metropolitan Life Insurance Tower. This coverage provides a death benefit payout to the beneficiaries, helping them cover funeral expenses, mortgage payments, educational costs, and other financial obligations.

02

Professionals who rely on their income to support themselves and their families could benefit from disability insurance offered by Metropolitan Life Insurance Tower. This coverage provides income replacement if the policyholder becomes disabled and unable to work due to illness or injury.

03

Individuals who wish to safeguard their savings and assets against the high costs of long-term care may opt for long-term care insurance from Metropolitan Life Insurance Tower. This coverage helps cover the expenses associated with home care, assisted living facilities, or nursing homes.

04

Those looking for retirement planning options can explore annuities offered by Metropolitan Life Insurance Tower. Annuities provide a steady income stream during retirement and help individuals accumulate funds over time.

Overall, anyone concerned about financial security, protecting their loved ones, or planning for retirement should consider Metropolitan Life Insurance Tower's insurance products. It's recommended to consult with a licensed insurance professional to assess your needs and find the most suitable coverage options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in metropolitan life insurance tower?

The editing procedure is simple with pdfFiller. Open your metropolitan life insurance tower in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the metropolitan life insurance tower in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your metropolitan life insurance tower and you'll be done in minutes.

How do I complete metropolitan life insurance tower on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your metropolitan life insurance tower. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is metropolitan life insurance tower?

The Metropolitan Life Insurance Tower is a landmark skyscraper located in New York City.

Who is required to file metropolitan life insurance tower?

Insurance companies and related entities are required to file the Metropolitan Life Insurance Tower.

How to fill out metropolitan life insurance tower?

The Metropolitan Life Insurance Tower form can be filled out online or submitted via mail with the required information.

What is the purpose of metropolitan life insurance tower?

The purpose of the Metropolitan Life Insurance Tower is to report financial and operational information of insurance companies.

What information must be reported on metropolitan life insurance tower?

The Metropolitan Life Insurance Tower requires information on financial performance, policies, and claims of insurance companies.

Fill out your metropolitan life insurance tower online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Metropolitan Life Insurance Tower is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.