Get the free Dependent Student Verification of Parent 2011 Income Information 2012-2013 - ucc

Show details

This document is used for verifying the income information of a dependent student's parent as part of the financial aid application process for educational institutions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dependent student verification of

Edit your dependent student verification of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dependent student verification of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

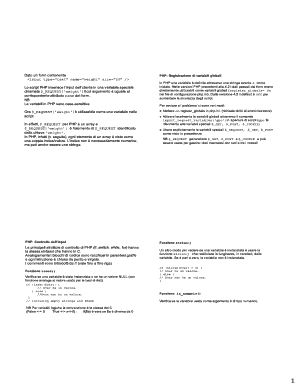

How to edit dependent student verification of online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dependent student verification of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dependent student verification of

How to fill out Dependent Student Verification of Parent 2011 Income Information 2012-2013

01

Obtain the Dependent Student Verification form from your financial aid office or website.

02

Fill in the student’s personal information, including name, student ID, and contact details.

03

Locate the section for Parent Income Information for the year 2011.

04

Gather required documents, such as the 2011 IRS tax return or W-2 forms for both parents.

05

Enter the gross income amount from the tax return or W-2 forms into the appropriate fields on the form.

06

Include any additional income that needs to be reported, such as unemployment or Social Security benefits.

07

Review the information for accuracy, ensuring all fields are complete.

08

Sign and date the form where indicated, and have a parent do the same if required.

09

Submit the completed form along with any necessary documentation to the financial aid office by the specified deadline.

Who needs Dependent Student Verification of Parent 2011 Income Information 2012-2013?

01

Students applying for federal financial aid who are considered dependents and need to verify their parents' income.

02

Students whose FAFSA application is selected for verification by the financial aid office.

03

Students who have reported income information that requires confirmation through additional documentation.

Fill

form

: Try Risk Free

People Also Ask about

How to avoid FAFSA verification?

A: The best way to avoid being selected for verification is to complete your FAFSA using the IRS Data retrieval tool, if possible. IRS data retrieval isn't an option for every applicant, but this one step will significantly reduce the likelihood of your application being selected.

Why is my school asking for FAFSA verification?

Verification is the process your school uses to confirm that the data reported on your FAFSA form is accurate. If you're selected for verification, your school will request additional documentation that supports the information you reported.

How does FAFSA verify parent income?

Some of the documentation you may need to provide in the verification process for you and your parents (if applicable) are: Tax transcripts or tax returns showing income information filed with the IRS. Tax transcripts can be ordered by mail for free at the IRS website.

What does it mean when your FAFSA has been selected for verification?

Verification is the process your school uses to confirm that the data reported on your FAFSA form is accurate. If you're selected for verification, your school will request additional documentation that supports the information you reported. Don't assume you're being accused of doing anything wrong.

What does "dependent student" mean when applying for FAFSA?

A dependent student is assumed to have the support of parents, so the parents' information must be assessed along with the student's information to get a full picture of the family's financial resources.

What happens if you fail to meet the deadline for FAFSA verification?

What happens if I miss a deadline? If you miss a deadline, always contact your school's financial aid office to see what options are still available for you. Some states and schools continue to award aid to FAFSA latecomers, but your chances get much slimmer, and the aid is often lower.

What happens if I don't do FAFSA verification?

If a student who is selected for verification does not complete the verification process, then any federal and/or need-based aid (Pell grant, SEOG, Work-Study, Federal Direct loans, certain Scholarships, and institutional aid) will NOT be awarded or disbursed.

What happens if you don't complete FAFSA verification?

What happens if I don't complete FAFSA verification process? Your college can withhold your financial aid until you've completed the verification process. To avoid any delays in your financial aid, submit the information requested by your college as soon as you can.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Dependent Student Verification of Parent 2011 Income Information 2012-2013?

It is a process used by educational institutions to confirm the income information reported by a dependent student's parents for the 2011 tax year in order to ensure the accuracy of financial aid applications for the 2012-2013 academic year.

Who is required to file Dependent Student Verification of Parent 2011 Income Information 2012-2013?

Dependent students who have submitted the Free Application for Federal Student Aid (FAFSA) and have been selected for verification are required to file this information.

How to fill out Dependent Student Verification of Parent 2011 Income Information 2012-2013?

To fill it out, obtain the required tax information from the parent's 2011 tax return or use the IRS Data Retrieval Tool to transfer the data directly into the FAFSA form.

What is the purpose of Dependent Student Verification of Parent 2011 Income Information 2012-2013?

The purpose is to ensure that the financial information provided in the FAFSA is accurate and to verify the financial need of the student for aid eligibility.

What information must be reported on Dependent Student Verification of Parent 2011 Income Information 2012-2013?

The report must include the parent's adjusted gross income (AGI), tax paid, and any other relevant income or tax information from the 2011 tax return.

Fill out your dependent student verification of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dependent Student Verification Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.