Get the free C Federal Identification Number - revenue ky

Show details

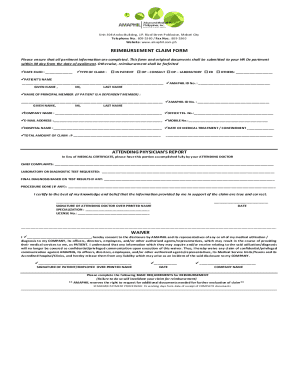

725 1400010270* 41A725 Department of Revenue ?? See instructions. Taxable period beginning, 201, and ending, 201? . B? Check applicable box(BS): C Federal Identification Number LET Receipts Method

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign c federal identification number

Edit your c federal identification number form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c federal identification number form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit c federal identification number online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit c federal identification number. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out c federal identification number

How to fill out a federal identification number?

01

Locate the application form: The first step in filling out a federal identification number (also known as an employer identification number or EIN) is to find the appropriate application form. The form needed to apply for an EIN is called Form SS-4, and it can be downloaded from the official website of the Internal Revenue Service (IRS).

02

Provide company information: The next part of the application requires you to provide accurate information about your company or organization. This includes details such as the legal name, mailing address, and the primary Contact Person or Responsible Party. Make sure to double-check the information provided to avoid any processing errors or delays.

03

Indicate the reason for applying: In the application form, you will be asked to select the reason for applying for a federal identification number. This could include starting a new business, hiring employees, establishing a trust or estate, or any other applicable reason. Select the option that best matches your situation.

04

Identify the type of organization: The next step is to indicate the type of organization you are applying for. This could be a sole proprietorship, partnership, corporation, LLC, or other types of entities. Choose the appropriate category that aligns with your organization's legal structure.

05

Determine the fiscal year: The application form will require you to provide information about your organization's fiscal year. Indicate the specific date range that represents your fiscal year. If you are unsure about this information, consult with your accountant or financial advisor.

06

Provide additional details, if necessary: Depending on the nature of your organization, you may be asked to provide additional details in the application form. This could include information about foreign-owned or controlled domestic corporations, affiliated companies, or any other relevant information. Fill out these sections accurately and provide any supporting documentation, if required.

Who needs a federal identification number?

01

Businesses: All types of businesses, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, typically require a federal identification number. This number is used by the IRS to identify your business for tax purposes and other legal obligations.

02

Non-profit organizations: Non-profit organizations, such as charities, religious institutions, and educational institutions, also need a federal identification number. This helps the IRS track their financial activities and ensure compliance with tax regulations for non-profit entities.

03

Trusts and estates: Trusts and estates are legal entities that manage assets and distribute them to beneficiaries. To fulfill their tax-related obligations, trusts and estates must obtain a federal identification number.

04

Employers: Any entity that hires employees, whether it's a business or a household employer, needs a federal identification number. This number is used to report and pay employment taxes to the IRS.

05

Entities involved in certain financial transactions: Certain financial transactions, such as opening a bank account for a business or applying for a loan, may require a federal identification number. Financial institutions and lenders often require this number to properly identify the entity involved.

It is important to note that not all individuals or organizations need a federal identification number. It is recommended to consult the official guidelines provided by the IRS or seek advice from a tax professional to determine if your specific situation requires an EIN.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is c federal identification number?

The c federal identification number, also known as EIN (Employer Identification Number), is a unique nine-digit number assigned by the IRS to identify a business entity.

Who is required to file c federal identification number?

Business entities such as corporations, partnerships, and LLCs are required to file for a c federal identification number.

How to fill out c federal identification number?

You can fill out the c federal identification number application online through the IRS website or by submitting Form SS-4 by mail or fax.

What is the purpose of c federal identification number?

The c federal identification number is used to identify businesses for tax purposes, opening bank accounts, hiring employees, and applying for business licenses.

What information must be reported on c federal identification number?

When applying for a c federal identification number, you will need to provide information such as the legal name of the business, address, type of entity, and responsible party's information.

How can I edit c federal identification number from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your c federal identification number into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send c federal identification number to be eSigned by others?

c federal identification number is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the c federal identification number electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your c federal identification number.

Fill out your c federal identification number online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

C Federal Identification Number is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.