Get the free Severance & Surcharge Taxes Direct Deposit Setup - wvsao

Show details

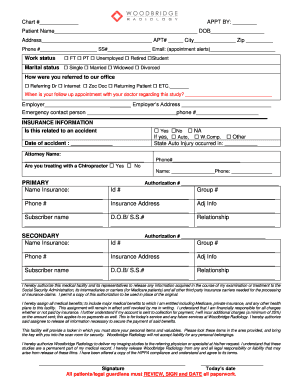

This document establishes the direct deposit instructions for various taxes collected by the State of West Virginia, including oil, gas, and coal severance taxes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign severance surcharge taxes direct

Edit your severance surcharge taxes direct form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your severance surcharge taxes direct form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing severance surcharge taxes direct online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit severance surcharge taxes direct. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out severance surcharge taxes direct

How to fill out Severance & Surcharge Taxes Direct Deposit Setup

01

Gather necessary personal information, including bank account details.

02

Locate the Severance & Surcharge Taxes Direct Deposit Setup form.

03

Fill in your full name, Social Security number, and contact information in the designated fields.

04

Provide your bank's name and routing number.

05

Enter your account number and select whether it's a checking or savings account.

06

Review the information for accuracy to avoid any errors.

07

Sign and date the form to authorize direct deposit.

08

Submit the completed form to the appropriate payroll or HR department.

Who needs Severance & Surcharge Taxes Direct Deposit Setup?

01

Employees receiving severance pay or surcharge taxes.

02

Individuals whose employers offer direct deposit as a payment method.

03

Anyone seeking to streamline their payment processes and receive funds electronically.

Fill

form

: Try Risk Free

People Also Ask about

How do I add a bank account to my IRS?

To add an account, enter the bank account information and click “Submit.” Your changes will be reflected in the Account List. To add an account, enter the credit/debit account information and click “Submit.” Your changes will be reflected in the Account List.

How do I set up a direct deposit account?

There's no way to change your bank information once the IRS has accepted your e-filed tax return. You can check the status of your refund by using the IRS's Where's My Refund? tool.

How do I change my direct deposit information with the IRS online?

EFTPS may save you time if you are making quarterly estimated tax payments or making frequent payments. Direct Pay may be faster if you have an immediate payment deadline and have never used EFTPS. If you save your confirmation number, you can look up one Direct Pay payment at a time.

What is the IRS $100000 next day deposit rule?

$100,000 next-day deposit rule - Regardless of whether you're a monthly schedule depositor or a semiweekly schedule depositor, if you accumulate taxes of $100,000 or more on any day during a deposit period, you must deposit the taxes by the next business day after you accumulate the $100,000.

What information is needed to set up a direct deposit for your refund?

To get your refund deposited directly into your bank account, select the direct deposit option when prompted by the tax software you are using. Then, enter your account and routing numbers of the bank account you want your refund deposited into.

How do I set up an IRS direct deposit?

It's easy. Taxpayers can simply follow the instructions when selecting direct deposit as a refund method and enter their account information as directed. Taxpayers can find their routing and account numbers on their online banking page, banking statements or a personal check. It provides options.

How do I set up my direct deposit?

Get a direct deposit form from your employer. Ask for a written or online direct deposit form. Fill in account information. You typically need to provide the following personal and bank details: Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Severance & Surcharge Taxes Direct Deposit Setup?

Severance & Surcharge Taxes Direct Deposit Setup is the process of arranging for the electronic deposit of severance and surcharge tax payments directly into the designated bank account.

Who is required to file Severance & Surcharge Taxes Direct Deposit Setup?

Businesses and individuals who are subject to severance and surcharge taxes are required to file for the direct deposit setup to ensure timely and efficient payment processing.

How to fill out Severance & Surcharge Taxes Direct Deposit Setup?

To fill out the Severance & Surcharge Taxes Direct Deposit Setup, you typically need to provide your tax identification number, banking information (account number and routing number), and authorize the direct deposit.

What is the purpose of Severance & Surcharge Taxes Direct Deposit Setup?

The purpose of the Severance & Surcharge Taxes Direct Deposit Setup is to facilitate faster and more secure payment of tax obligations, reducing the risk of late payments and enhancing cash flow management.

What information must be reported on Severance & Surcharge Taxes Direct Deposit Setup?

The information that must be reported includes the taxpayer's identification details, the type of taxes being paid, the amount to be deposited, and the relevant banking information for the direct deposit.

Fill out your severance surcharge taxes direct online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Severance Surcharge Taxes Direct is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.