Get the free Charitable Fund-raising Businesses Act

Show details

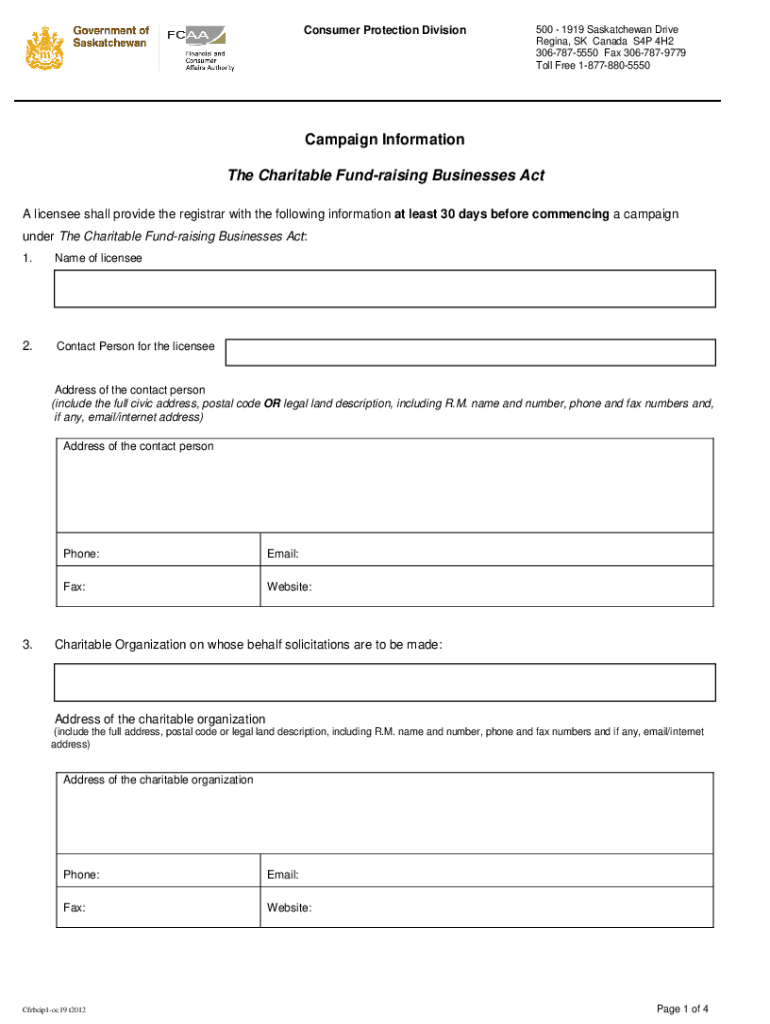

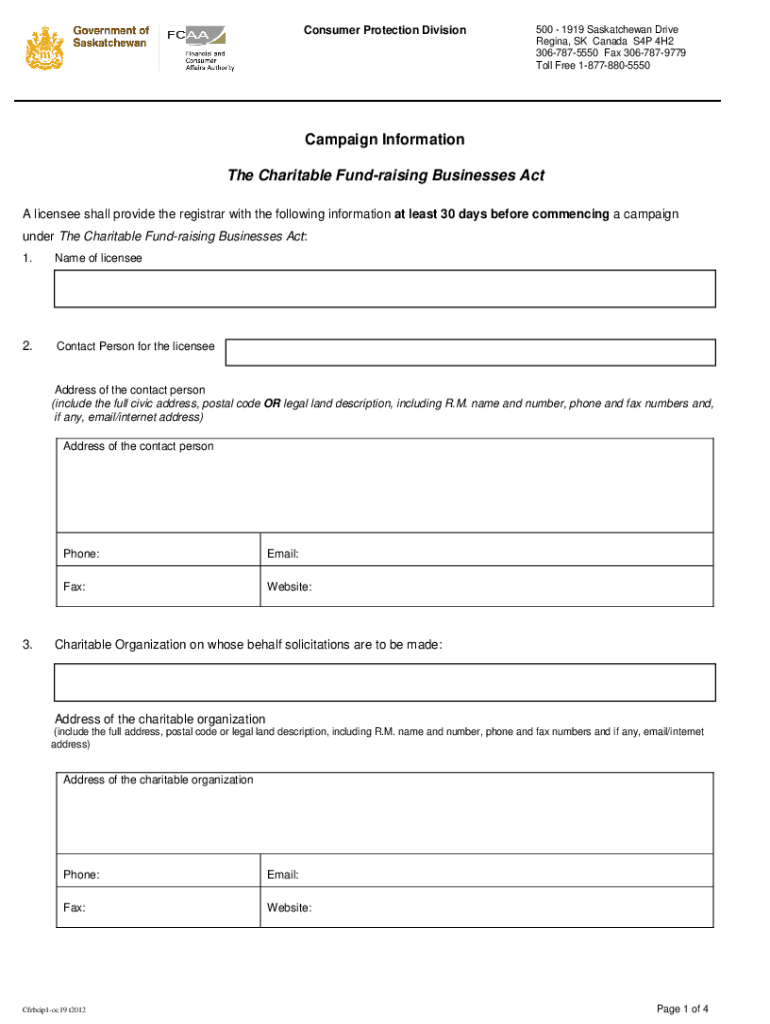

Reset Consumer Protection Division500 1919 Saskatchewan Drive Regina, SK Canada S4P 4H2 3067875550 Fax 3067879779 Toll Free 18778805550Campaign Information The Charitable Fundraising Businesses Act

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable fund-raising businesses act

Edit your charitable fund-raising businesses act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable fund-raising businesses act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable fund-raising businesses act online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit charitable fund-raising businesses act. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable fund-raising businesses act

How to fill out charitable fund-raising businesses act

01

Familiarize yourself with the charitable fund-raising businesses act and regulations in your jurisdiction.

02

Determine if your organization qualifies as a charitable fund-raising business.

03

Obtain any necessary permits or licenses required to operate as a charitable fund-raising business.

04

Develop a plan for how you will raise funds for charitable causes and ensure compliance with all regulations.

05

Keep detailed records of all donations received and how they are used to support charitable causes.

06

Submit any required reports or disclosures to regulatory authorities as needed.

Who needs charitable fund-raising businesses act?

01

Nonprofit organizations and other entities that engage in fundraising activities for charitable causes need to adhere to the charitable fund-raising businesses act.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify charitable fund-raising businesses act without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like charitable fund-raising businesses act, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find charitable fund-raising businesses act?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the charitable fund-raising businesses act in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the charitable fund-raising businesses act electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is charitable fund-raising businesses act?

The Charitable Fund-Raising Businesses Act is a law that regulates businesses that solicit donations for charitable purposes.

Who is required to file charitable fund-raising businesses act?

Nonprofit organizations and businesses that engage in fund-raising activities for charitable purposes are required to file the Charitable Fund-Raising Businesses Act.

How to fill out charitable fund-raising businesses act?

The form for the Charitable Fund-Raising Businesses Act can usually be filled out online or submitted through mail with the required information about the organization's fund-raising activities.

What is the purpose of charitable fund-raising businesses act?

The purpose of the Charitable Fund-Raising Businesses Act is to ensure transparency and accountability in fund-raising activities for charitable purposes.

What information must be reported on charitable fund-raising businesses act?

Information such as the organization's name, contact information, fund-raising activities, and financial statements must be reported on the Charitable Fund-Raising Businesses Act.

Fill out your charitable fund-raising businesses act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Fund-Raising Businesses Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.