Get the free Homeowner Application for Financial Assistance - cityofchicago

Show details

This application allows homeowners in Chicago to apply for financial assistance related to lead hazard control and mitigation, aimed at ensuring homes are lead-safe, particularly for residents with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homeowner application for financial

Edit your homeowner application for financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homeowner application for financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

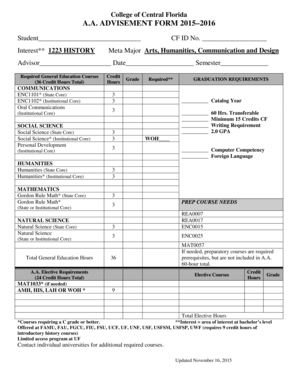

Editing homeowner application for financial online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit homeowner application for financial. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

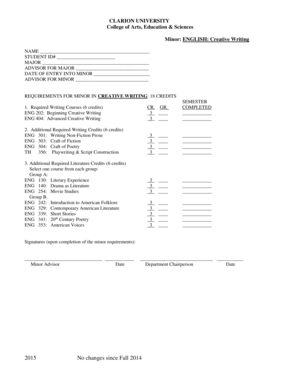

How to fill out homeowner application for financial

How to fill out Homeowner Application for Financial Assistance

01

Gather all required personal and financial documents, such as proof of income, mortgage statements, and property tax information.

02

Complete the Homeowner Application form with accurate and up-to-date information.

03

Provide documentation of financial hardship if applicable, such as job loss or medical expenses.

04

Review the application for completeness and accuracy before submission.

05

Submit the application through the designated submission method, such as online or by mail.

06

Keep a copy of the submitted application and any correspondence for your records.

Who needs Homeowner Application for Financial Assistance?

01

Homeowners experiencing financial hardship due to circumstances such as job loss, medical issues, or other unforeseen circumstances.

02

Individuals who are struggling to keep up with mortgage payments or property taxes.

03

Those who require assistance to avoid foreclosure or financial crisis regarding their home.

Fill

form

: Try Risk Free

People Also Ask about

What is the CARES Act relief program for mortgages?

This relief is available to anyone who has a federally-backed mortgage, regardless of delinquency status. Under the CARES Act, borrowers are entitled to request an initial forbearance of their monthly mortgage payments for up to 180 days, and may request up to an additional 180 days. be paid back over time.

How much income do you need to qualify for the Florida Homeowner Assistance Fund?

The Homeowner Assistance Fund (HAF) is a $9.961 billion federal program to help households who are behind on their mortgages and other housing-related expenses (utilities, property taxes, partial claims, etc.) due to the impacts of COVID-19.

How much income do you need to qualify for the Florida Homeowner Assistance Fund?

888.404.4674 Save the Dream Ohio is administered by the Ohio Housing Finance Agency (OHFA) and is being supported, in whole or in part, by federal award number HAF0086 awarded to the State of Ohio by the US Department of the Treasury.

What is the financial hardship program in Ohio?

Ohio Works First (OWF) is the financial assistance portion of the state's Temporary Assistance to Needy Families (TANF) program. It provides cash benefits to eligible families for up to 36 months.

What is the Ohio home relief grant?

Ohioans who are behind on rent, mortgage, and water and/or sewer utility bills may be able to receive assistance. Assistance can be applied to outstanding rent, mortgage, water, and/or sewer bills back to April 1, 2020.

How do I get help paying my mortgage in Ohio?

The Indiana Homeowner Assistance Fund (IHAF) is a federally funded housing assistance program for Hoosier homeowners impacted by COVID-19. It was created to provide funds to eligible homeowners for housing-related costs such as mortgages and property expenses.

What is the homeowner's assistance program?

The Homeowner Assistance Fund (HAF) is a federal program that was intended to help homeowners who were financially impacted by COVID-19. Each state has a program and might still have funds available. The money for the program is limited.

What is the mortgage relief program in Ohio?

Save the Dream Ohio – Mortgage Assistance program provides eligible Ohio homeowners with financial assistance to pay delinquent mortgage payments and/or future mortgage payments for up to six months.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Homeowner Application for Financial Assistance?

The Homeowner Application for Financial Assistance is a formal request submitted by homeowners to seek financial aid for home repairs, mortgage assistance, or other home-related expenses, often provided by government programs or non-profit organizations.

Who is required to file Homeowner Application for Financial Assistance?

Homeowners who are experiencing financial difficulties related to their housing costs, such as inability to pay mortgage, property taxes, or need for home repairs, are typically required to file this application.

How to fill out Homeowner Application for Financial Assistance?

To fill out the Homeowner Application for Financial Assistance, homeowners should gather necessary documents such as income statements, proof of homeownership, and details about financial hardship, and then complete the application form, ensuring all information is accurate and complete.

What is the purpose of Homeowner Application for Financial Assistance?

The purpose of the Homeowner Application for Financial Assistance is to provide a structured process for homeowners to apply for financial support to help maintain home stability and prevent foreclosure or homelessness.

What information must be reported on Homeowner Application for Financial Assistance?

The information that must be reported typically includes personal identification (name, address), financial information (income, debts), details about the property (ownership, value), and specifics regarding the type of assistance needed.

Fill out your homeowner application for financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homeowner Application For Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.