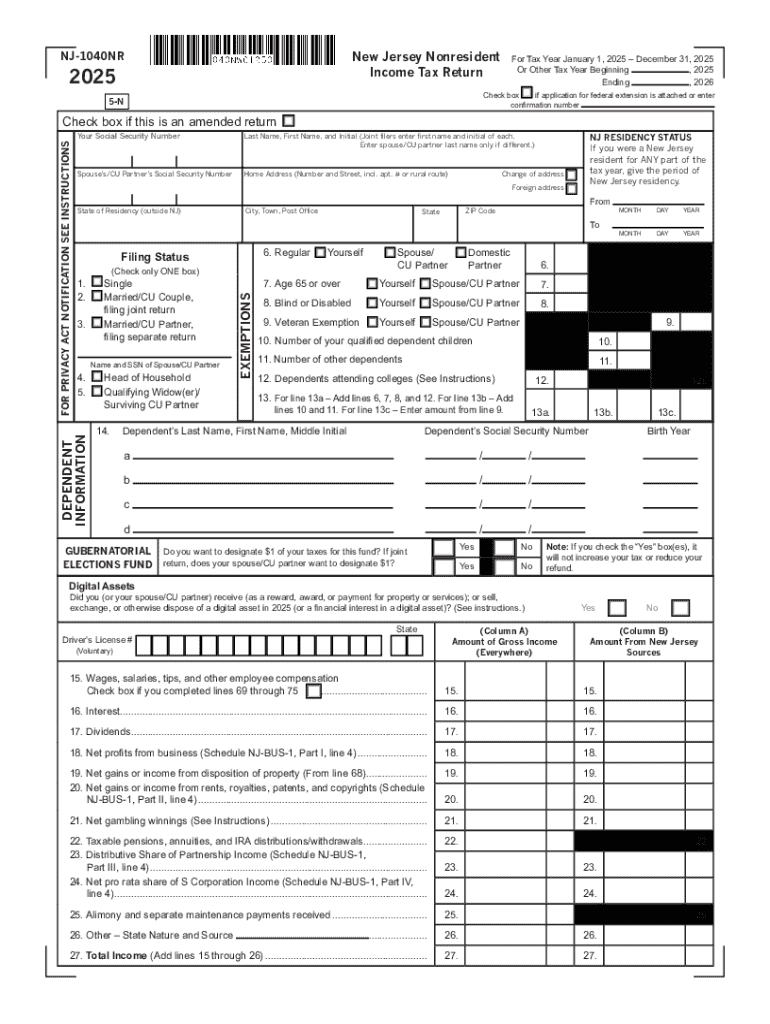

Get the free 2022 New Jersey Nonresident Return, Form NJ-1040NR. 2022 New Jersey Nonresident Retu...

Get, Create, Make and Sign 2022 new jersey nonresident

How to edit 2022 new jersey nonresident online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 new jersey nonresident

How to fill out 2022 new jersey nonresident

Who needs 2022 new jersey nonresident?

Your Complete Guide to the 2022 New Jersey Nonresident Form

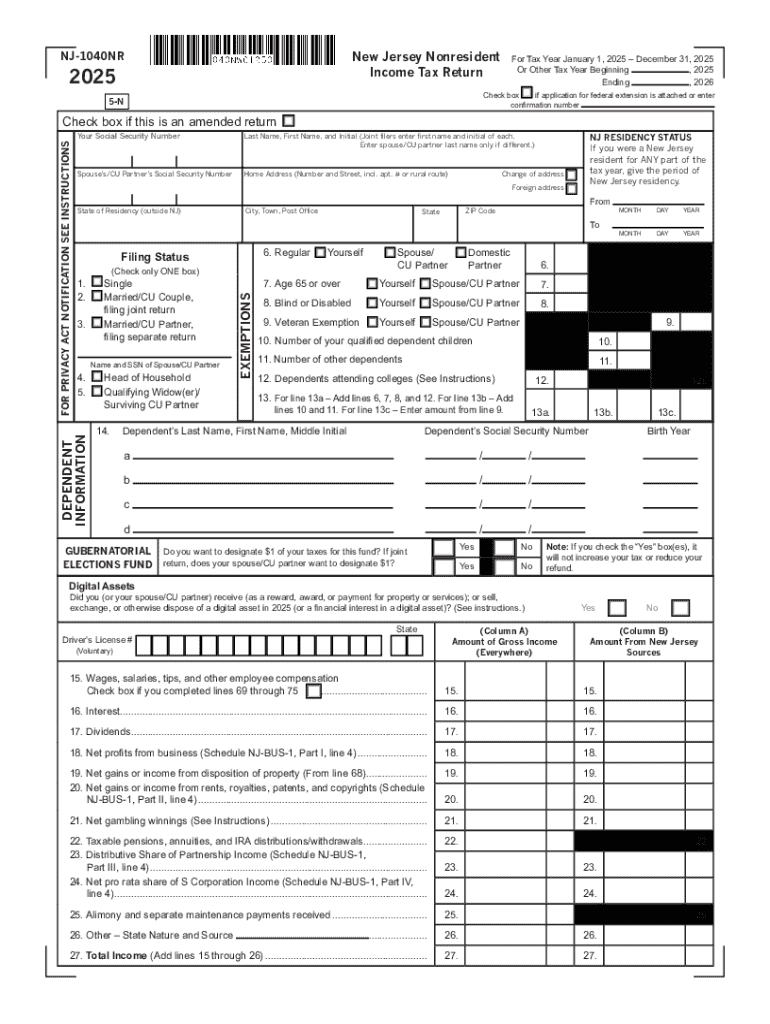

Understanding the 2022 New Jersey Nonresident Form

Nonresidents earning income in New Jersey are subject to tax obligations regulated by the New Jersey Division of Taxation. A nonresident is defined as an individual who does not maintain a permanent home in New Jersey but earns income from sources within the state. Completing a tax return is essential for reporting income correctly, ensuring compliance, and avoiding potential legal penalties.

For the 2022 tax year, there have been key changes aimed at streamlining nonresident taxation. New Jersey has introduced slight adjustments to tax rates and emphasized the importance of timely filing, particularly for those whose income may fluctuate because of varying employment statuses or investment gains.

Key features of the 2022 New Jersey Nonresident Form (NJ-1040NR)

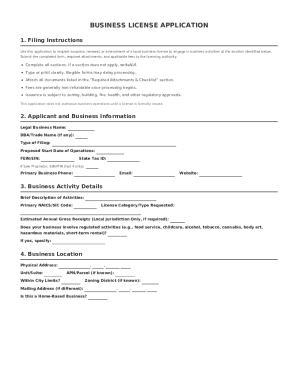

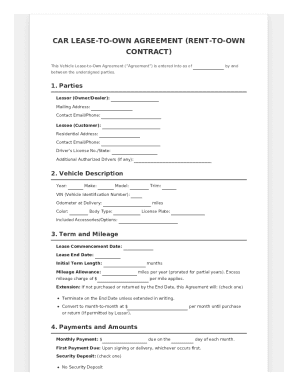

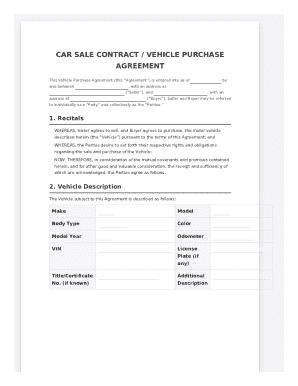

The NJ-1040NR form is specifically designed for nonresidents to complete their New Jersey income tax returns. Unlike the NJ-1040 form used by residents, the NJ-1040NR allows taxpayers to report only the income earned within the state boundary. This tailored approach helps to ensure accuracy and compliance for nonresidents.

When preparing to file, ensure you collect all necessary personal identification details such as Social Security numbers, along with specific income sources like wages, salaries, and interest earned from investments in New Jersey.

Step-by-step guide to completing the 2022 NJ-1040NR

Before you dive into filling out the NJ-1040NR, gather all required documents. This includes W-2 forms, 1099 statements, and any other relevant tax documents that detail your income. Having these documents at your fingertips will simplify the filing process.

Completing the form requires attention to detail. Start with the Personal Information Section, ensuring your name, address, and identification numbers are correct. Next, move to the Income and Adjustments Section. Report job income as per the W-2 forms and specify any investment income from New Jersey. Furthermore, explore the deductions and credits available exclusively to nonresidents. Eligible deductions include property taxes, health expenses, and educational tax credits, which may reduce your tax liability significantly.

Before submitting, double-check each section for accuracy. Common mistakes include incorrect social security numbers and misreported income sources, all of which can delay processing and lead to potential penalties.

Filing options for the 2022 Nonresident Form

You can file the NJ-1040NR either electronically or via traditional paper filing. E-filing is increasingly popular due to its convenience, allowing you to complete the form directly through online platforms like pdfFiller. It often results in faster processing times and immediate confirmation of submission.

Regardless of your filing method, keep in mind the deadlines. Nonresident tax returns must be postmarked by April 18, 2023, for those on a calendar year. Late filings can incur penalties, so it's crucial to stay informed and submit on time.

What to do after filing the 2022 NJ-1040NR

After filing, it's important to verify the status of your return. Utilize the tools available through pdfFiller to track your filing status and confirm receipt. This adds a layer of security and peace of mind.

If you receive inquiries or notices from the state tax agency about your filing, promptly address them to avoid complications. Lastly, consider planning for future tax years by maintaining organized records and understanding any changes in tax laws that might affect you.

Leveraging pdfFiller’s tools for your nonresident tax needs

pdfFiller offers robust tools to simplify your tax documentation. Editing and reviewing features enable you to streamline your tax forms, ensuring all details are accurate. The platform also allows for secure collaboration with tax professionals, providing seamless sharing options for advice and consultation.

Additionally, the cloud-based management of your tax documents supports efficiency and ease of access, especially beneficial for nonresidents who may live or work far from New Jersey.

Frequently asked questions about the 2022 New Jersey Nonresident Form

Nonresidents often have questions about what it means to file taxes for New Jersey, particularly around common concerns such as which income is taxed, the types of deductions available, and the potential credits they can claim. Understanding these aspects can alleviate confusion and ensure compliance.

For nonresidents needing additional information, the New Jersey Division of Taxation website and pdfFiller’s resources provide valuable insights. Seeking assistance from tax professionals can also be a wise investment to navigate these complexities.

Conclusion

Submitting the 2022 New Jersey Nonresident Form can be a daunting task but is manageable with the right guidance and tools. By understanding the filing requirements, utilizing resources offered by pdfFiller, and keeping your records organized, you can ensure an efficient tax return process. Proactive planning and precise filing will pave the way for smoother tax seasons in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2022 new jersey nonresident from Google Drive?

How do I complete 2022 new jersey nonresident on an iOS device?

How do I edit 2022 new jersey nonresident on an Android device?

What is 2022 new jersey nonresident?

Who is required to file 2022 new jersey nonresident?

How to fill out 2022 new jersey nonresident?

What is the purpose of 2022 new jersey nonresident?

What information must be reported on 2022 new jersey nonresident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.