Get the free 2012 schedule b form - irs

Show details

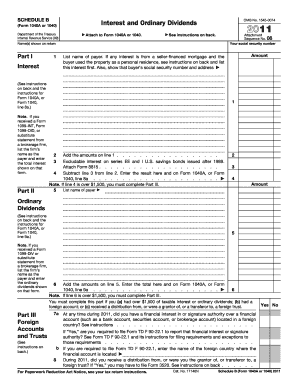

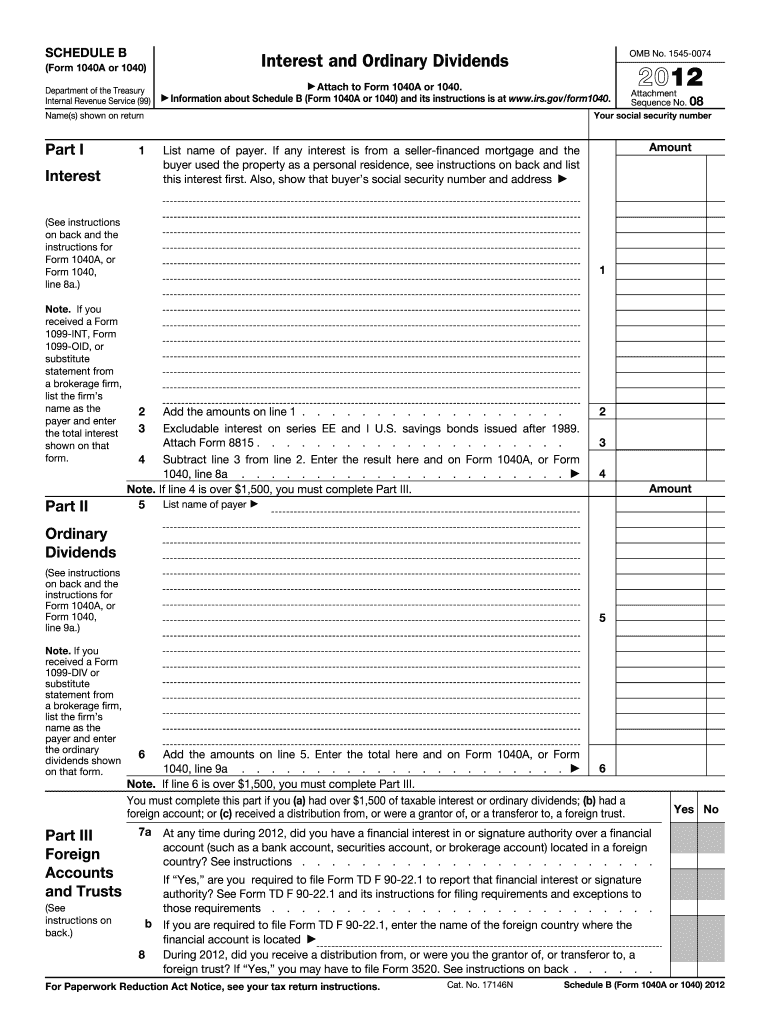

See instructions on back. For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 17146N Schedule B Form 1040A or 1040 2012 Page 2 General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Schedule B Form 1040A or 1040 and its instructions such as legislation enacted after they were published go to www.irs.gov/form1040. SCHEDULE B Department of the Treasury...Internal Revenue Service 99 OMB No* 1545-0074 Interest and Ordinary Dividends Form 1040A or 1040 Information Attach to Form 1040A or 1040. about Schedule B Form 1040A or 1040 and its instructions is at www*irs*gov/form1040. Name s shown on return Part I Interest Amount List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence see instructions on back and list this interest first. Also show that buyer s social security number...and address See instructions on back and the instructions for Form 1040 line 8a* Note. If you received a Form 1099-INT Form 1099-OID or substitute statement from a brokerage firm list the firm s name as the payer and enter the total interest shown on that form* Attachment Sequence No* 08 Your social security number Add the amounts on line 1. Excludable interest on series EE and I U*S* savings Attach Form 8815. Subtract line 3 from line 2. Enter the result here and 1040 line 8a. Note. If line 4...is over 1 500 you must complete Part III. bonds issued after 1989. on Form 1040A or Form Ordinary Dividends 1099-DIV or the ordinary dividends shown on that form* Foreign Accounts and Trusts See back. You must complete this part if you a had over 1 500 of taxable interest or ordinary dividends b had a foreign account or c received a distribution from or were a grantor of or a transferor to a foreign trust. 7a Yes No At any time during 2012 did you have a financial interest in or signature...authority over a financial account such as a bank account securities account or brokerage account located in a foreign country See instructions. If Yes are you required to file Form TD F 90-22. 1 to report that financial interest or signature authority See Form TD F 90-22. 1 and its instructions for filing requirements and exceptions to those requirements. b If you are required to file Form TD F 90-22. 1 enter the name of the foreign country where the financial account is located During 2012...did you receive a distribution from or were you the grantor of or transferor to a foreign trust If Yes you may have to file Form 3520. Purpose of Form Use Schedule B if any of the following applies. You had over 1 500 of taxable interest or ordinary You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond. You are reporting original issue discount OID in an amount less than the amount shown on Form You...are reducing your interest income on a bond by the amount of amortizable bond premium* You are claiming the exclusion of interest from series EE or I U*S* savings bonds issued after 1989.

We are not affiliated with any brand or entity on this form

Instructions and Help about IRS 1040 - Schedule B

How to edit IRS 1040 - Schedule B

How to fill out IRS 1040 - Schedule B

Instructions and Help about IRS 1040 - Schedule B

How to edit IRS 1040 - Schedule B

Editing the IRS 1040 - Schedule B requires accurate updates to ensure compliance with tax regulations. To edit this form, obtain a copy, either printed or digital. Use tools such as pdfFiller to make changes, ensuring all information is current and correct before submission. Save the edited form in a secure location for your records.

How to fill out IRS 1040 - Schedule B

Filling out IRS 1040 - Schedule B involves several key steps. Start by providing your personal information at the top of the form. Next, accurately report your interest and dividend income. Make sure to include all required amounts from your financial statements. Review your entries for accuracy and completeness before filing the form with your tax return.

About IRS 1040 - Schedule B 2012 previous version

What is IRS 1040 - Schedule B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule B 2012 previous version

What is IRS 1040 - Schedule B?

IRS 1040 - Schedule B is a tax form used by U.S. taxpayers to report interest and ordinary dividends. This form complements the main 1040 tax return and is required for those who have earned income from these sources during the tax year. Accurate completion ensures proper reporting of your income.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule B is to provide the IRS with information about your interest and dividend income. It ensures that taxpayers report all sources of income, which are necessary for accurate tax assessment. By completing Schedule B, filers help maintain transparency and compliance with tax laws.

Who needs the form?

Taxpayers who receive interest or dividends need to fill out IRS 1040 - Schedule B. If your total interest income exceeds $1,500 or if you received dividends from stocks, this form is required. Additionally, anyone who had foreign accounts or received interest from these accounts must use this form.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1040 - Schedule B if your interest and dividend income total less than $1,500 for the tax year. If you did not earn interest or dividends during the year, you also do not need to complete this form. Staying informed of these thresholds can simplify the filing process.

Components of the form

IRS 1040 - Schedule B consists of sections for personal information and detail areas for reporting interest and dividends. The form includes parts to identify each source of income, the amounts earned, and any foreign accounts held. It is critical to provide accurate information to avoid penalties.

What are the penalties for not issuing the form?

Failing to submit IRS 1040 - Schedule B when required can lead to significant penalties. The IRS may impose fines for undisclosed interest and dividend income, which can accumulate over time. Furthermore, inaccurate information can result in an audit or further scrutiny from the IRS.

What information do you need when you file the form?

When filing IRS 1040 - Schedule B, you need reports of all interest and dividend income received during the tax year. Gather 1099 forms from financial institutions and any other documents that provide details about your income sources. Accurate documentation is essential for compliance and ease of filing.

Is the form accompanied by other forms?

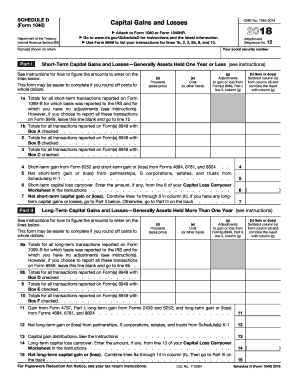

IRS 1040 - Schedule B is typically accompanied by Form 1040 since it is a supplemental form for reporting income. Depending on your situation, additional forms may also be required, such as Schedule D for capital gains or losses. Check IRS guidelines for specifics regarding your filing requirements.

Where do I send the form?

Once you have completed IRS 1040 - Schedule B, submit it along with your main tax return (Form 1040). The mailing address varies based on your state of residence and whether you are enclosing payment. Consult the IRS website or instructions for the specific mailing address directed by your filing status.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.