What is 1040a 2012 instructions?

1040a 2012 instructions refer to the guidelines provided by the Internal Revenue Service (IRS) on how to complete and file Form 1040A for the tax year 2012. These instructions provide detailed information on eligibility criteria, income reporting, deductions, and credits. By following these instructions, taxpayers can accurately and efficiently complete their tax returns for the specified year.

What are the types of 1040a 2012 instructions?

There are several types of 1040a 2012 instructions that cover different aspects of tax filing. Some of the key types include:

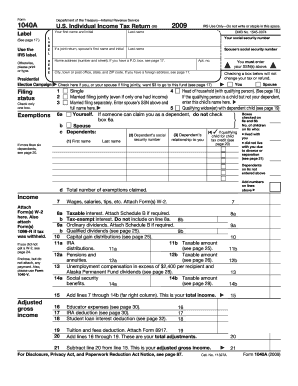

General Instructions: Provides an overview of the form and guidance on how to fill it out correctly.

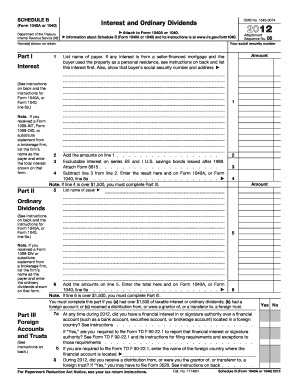

Income Instructions: Explains how to report various types of income, including wages, investment income, and self-employment income.

Deduction and Credit Instructions: Details the deductions and credits available to taxpayers and how to claim them.

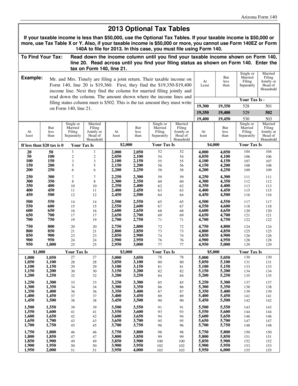

Tax Table and Tax Computation Instructions: Provides the tax tables and formulas needed to calculate the final tax liability.

Signature and Filing Instructions: Guides taxpayers on how to sign and file their tax returns electronically or by mail.

How to complete 1040a 2012 instructions

To complete 1040a 2012 instructions and file your tax return successfully, follow these steps:

01

Gather all necessary documents, such as W-2 forms, 1099 forms, and records of deductible expenses.

02

Read the instructions carefully and familiarize yourself with the different sections of the form.

03

Fill in your personal information, including name, address, and Social Security number.

04

Report your income accurately, ensuring that all sources of income are included.

05

Claim deductions and credits that you are eligible for, making sure to provide supporting documentation.

06

Calculate your tax liability using the provided tax tables or formulas.

07

Sign and date the form, either electronically or manually if filing a paper copy.

08

Choose the appropriate filing method, whether electronically or by mail.

09

Submit your completed form and any required payment to the IRS.

With pdfFiller, completing and filing your 1040a 2012 instructions is made easier. pdfFiller offers unlimited fillable templates and powerful editing tools, enabling users to create, edit, and share documents online. Whether you need to fill out tax forms or any other document, pdfFiller is the only PDF editor you need to get your documents done quickly and accurately.