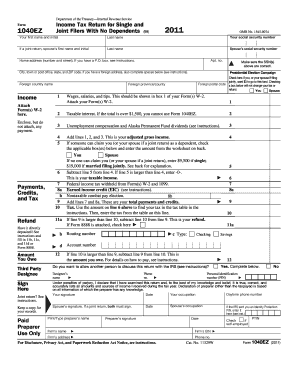

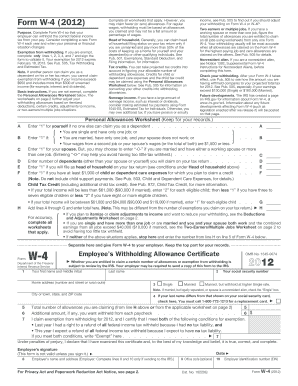

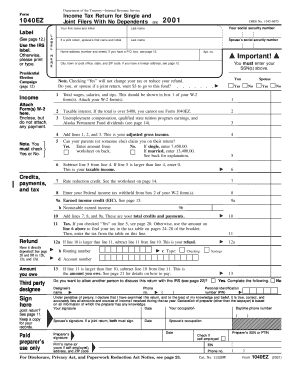

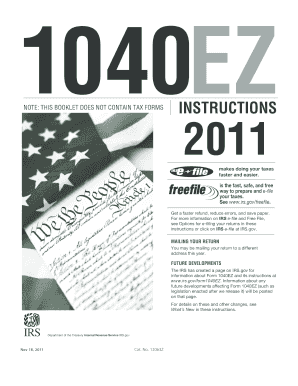

2012 Tax Forms 1040ez

What is 2012 tax forms 1040ez?

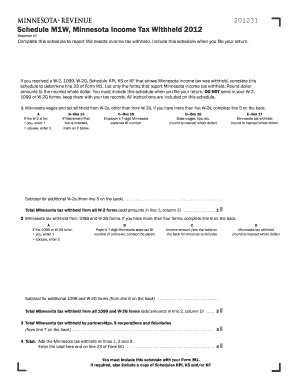

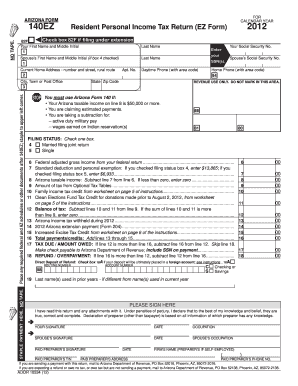

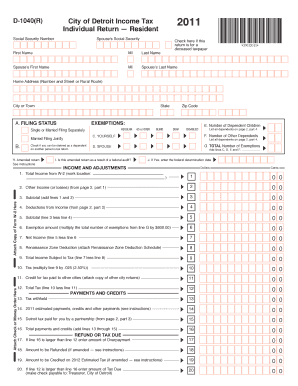

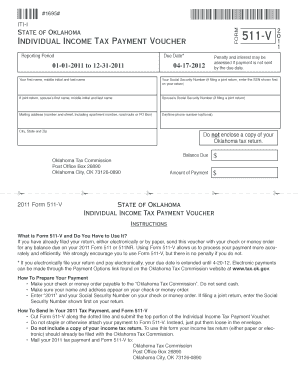

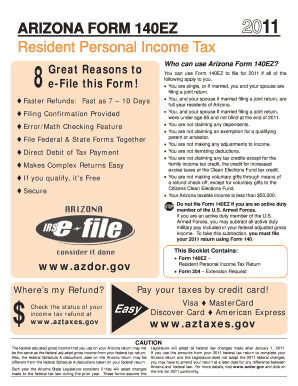

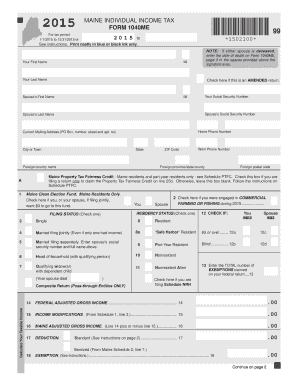

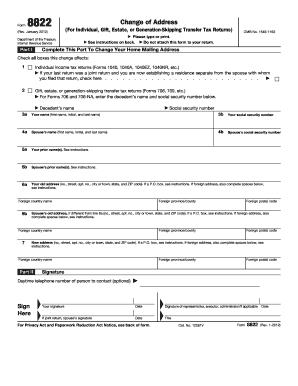

The 2012 tax forms 1040ez is a simplified version of the 1040 form used for filing individual income tax returns. It is specifically designed for taxpayers with uncomplicated tax situations. The 1040ez form allows eligible taxpayers to file their taxes quickly and easily, without the need for complex calculations or additional schedules. It is important to note that the use of this form is limited to specific criteria, such as single or married filing jointly status, no dependents, and certain income limitations.

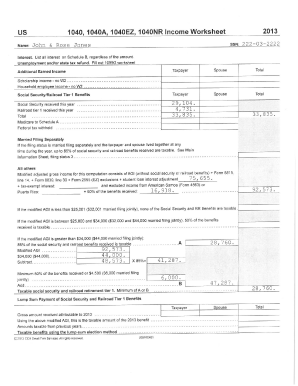

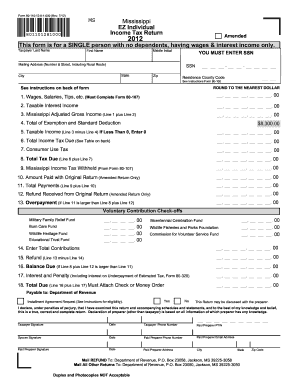

What are the types of 2012 tax forms 1040ez?

The types of 2012 tax forms 1040ez include:

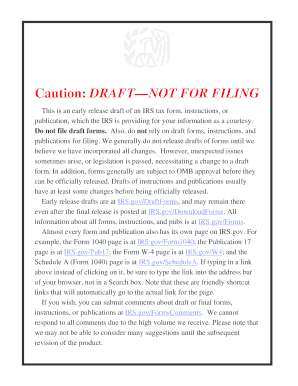

How to complete 2012 tax forms 1040ez

Completing the 2012 tax forms 1040ez is a straightforward process. Here is a step-by-step guide to help you:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.