AL 40A Booklet 2012 free printable template

Show details

Revenue. alabama.gov/ incometax/PCONLINE.htm to see a listing of Approved On-Line Service Providers. If you do not want to file electronically these programs will print out a 2-D Barcode. 2-D Barcode Filing Program All the programs above should produce a 2-D Barcode for you. Also you can print a 2-D Barcode by using our fillable Form 40 or Form 40NR which you can obtain at http //www. Use the envelope you received with this booklet or follow the mailing instructions on your return. Filing...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL 40A Booklet

Edit your AL 40A Booklet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL 40A Booklet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL 40A Booklet online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AL 40A Booklet. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL 40A Booklet Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL 40A Booklet

How to fill out AL 40A Booklet

01

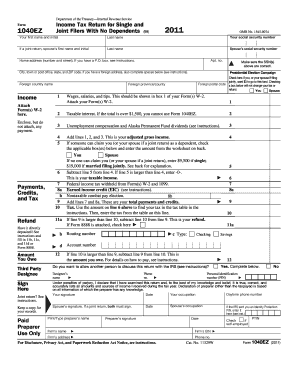

Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

02

Obtain a copy of the AL 40A Booklet from the Alabama Department of Revenue website or your local tax office.

03

Read the instructions carefully to understand each section of the form.

04

Fill out your personal information, such as your name, address, and Social Security number on the front page.

05

Report your income accurately in the designated sections, ensuring that all figures are correct and match your documents.

06

Complete any applicable deductions and credits, following the guidelines provided in the booklet.

07

Double-check all calculations to ensure there are no errors.

08

Sign and date the form in the appropriate areas.

09

Make a copy of the completed booklet for your records before mailing it to the appropriate address.

Who needs AL 40A Booklet?

01

Residents of Alabama who must file a state income tax return.

02

Individuals earning taxable income who wish to claim deductions and credits.

03

Taxpayers seeking to receive a refund or fulfill their legal obligations under Alabama tax law.

Fill

form

: Try Risk Free

People Also Ask about

What are the tax brackets for the 2022 tax year?

The 2022 Income Tax Brackets (Taxes due April 2023) For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

How often is Alabama business privilege tax due?

The return is due three and a half months after the beginning of the taxpayer's taxable year or April 15, 2021. With the exception of the Business Privilege return for Financial Institutions Groups, the Business Privilege tax return due date corresponds to the due date of the corresponding federal return.

How much is 75000 a year after taxes in Alabama?

If you make $75,000 a year living in the region of Alabama, USA, you will be taxed $18,052. That means that your net pay will be $56,948 per year, or $4,746 per month. Your average tax rate is 24.1% and your marginal tax rate is 33.6%.

Who must file Alabama business privilege tax?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

Where do I get Alabama state tax forms?

If you are trying to locate, download, print, or fill state of Alabama tax forms, you can do so on the Alabama Department of Revenue website.

What is Alabama tax form 40A?

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return. The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form).

What is a form 40 for taxes?

More In Forms and Instructions Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is Alabama income tax rate 2022?

For single persons, heads of families, and married persons filing separate returns: 2% First $500 of taxable income. 4% Next $2,500 of taxable income. 5% All taxable income over $3,000.

What is Alabama state income tax rate?

Alabama has a graduated individual income tax, with rates ranging from 2.00 percent to 5.00 percent. There are also jurisdictions that collect local income taxes. Alabama has a 6.50 percent corporate income tax rate.

What is the difference between Alabama form 40 and 40A?

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return. The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form).

What is A or 40 form?

2021 Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040.

Who must file Alabama privilege tax?

A privilege license is a license requirement of every person, firm, company or corporation engaged in any business, vocation, occupation or profession described in Title 40, Chapter 12, Code of Alabama 1975.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AL 40A Booklet directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your AL 40A Booklet and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit AL 40A Booklet on an iOS device?

You certainly can. You can quickly edit, distribute, and sign AL 40A Booklet on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete AL 40A Booklet on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your AL 40A Booklet, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is AL 40A Booklet?

The AL 40A Booklet is a tax form used by residents of Alabama to report their income and calculate their state tax liability.

Who is required to file AL 40A Booklet?

Residents of Alabama who have a combined income that exceeds the state's filing threshold are required to file the AL 40A Booklet.

How to fill out AL 40A Booklet?

To fill out the AL 40A Booklet, gather income documentation, complete the form by following instructions provided, report all relevant income, deductions, and credits, and review for accuracy before submission.

What is the purpose of AL 40A Booklet?

The purpose of the AL 40A Booklet is to help Alabama residents calculate their state income tax obligations and ensure compliance with state tax laws.

What information must be reported on AL 40A Booklet?

The AL 40A Booklet requires reporting of total income, deductions, exemptions, tax credits, and any other income sources relevant to the taxpayer's financial situation.

Fill out your AL 40A Booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL 40a Booklet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.