AL 40A Booklet 2016 free printable template

Show details

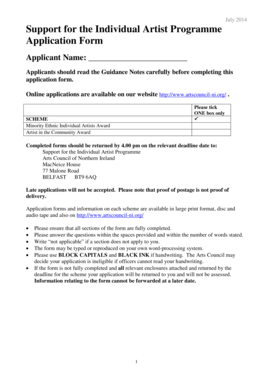

Individual & Corporate Tax Division. P.O. Box 327465. Montgomery, AL 36132 – 7465. Form. 40A. Booklet. 2016 www.revenue.alabama.gov. Alabama. Form. 40A.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL 40A Booklet

Edit your AL 40A Booklet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL 40A Booklet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL 40A Booklet online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AL 40A Booklet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL 40A Booklet Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL 40A Booklet

How to fill out AL 40A Booklet

01

Obtain the AL 40A Booklet from the official source.

02

Read the instructions carefully to understand the requirements.

03

Gather all necessary documentation, such as income statements and deduction records.

04

Fill out the personal information section at the top of the form.

05

Input your income in the designated sections accurately.

06

List any deductions or credits you are eligible for.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the completed AL 40A Booklet by the specified deadline.

Who needs AL 40A Booklet?

01

Individuals who are residents of Alabama and need to report their state income taxes.

02

Taxpayers claiming deductions or credits to reduce their taxable income.

03

Anyone who has earned income in Alabama during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

What are the tax brackets for the 2022 tax year?

The 2022 Income Tax Brackets (Taxes due April 2023) For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

How often is Alabama business privilege tax due?

The return is due three and a half months after the beginning of the taxpayer's taxable year or April 15, 2021. With the exception of the Business Privilege return for Financial Institutions Groups, the Business Privilege tax return due date corresponds to the due date of the corresponding federal return.

How much is 75000 a year after taxes in Alabama?

If you make $75,000 a year living in the region of Alabama, USA, you will be taxed $18,052. That means that your net pay will be $56,948 per year, or $4,746 per month. Your average tax rate is 24.1% and your marginal tax rate is 33.6%.

Who must file Alabama business privilege tax?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

Where do I get Alabama state tax forms?

If you are trying to locate, download, print, or fill state of Alabama tax forms, you can do so on the Alabama Department of Revenue website.

What is Alabama tax form 40A?

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return. The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form).

What is a form 40 for taxes?

More In Forms and Instructions Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is Alabama income tax rate 2022?

For single persons, heads of families, and married persons filing separate returns: 2% First $500 of taxable income. 4% Next $2,500 of taxable income. 5% All taxable income over $3,000.

What is Alabama state income tax rate?

Alabama has a graduated individual income tax, with rates ranging from 2.00 percent to 5.00 percent. There are also jurisdictions that collect local income taxes. Alabama has a 6.50 percent corporate income tax rate.

What is the difference between Alabama form 40 and 40A?

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return. The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form).

What is A or 40 form?

2021 Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040.

Who must file Alabama privilege tax?

A privilege license is a license requirement of every person, firm, company or corporation engaged in any business, vocation, occupation or profession described in Title 40, Chapter 12, Code of Alabama 1975.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AL 40A Booklet in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your AL 40A Booklet and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I edit AL 40A Booklet on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign AL 40A Booklet on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit AL 40A Booklet on an Android device?

You can make any changes to PDF files, such as AL 40A Booklet, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is AL 40A Booklet?

The AL 40A Booklet is a tax form used by individuals and entities in Alabama to report income, deductions, and tax liability during a specific tax year.

Who is required to file AL 40A Booklet?

Individuals, businesses, and organizations that have income generated in Alabama and meet specific criteria set by the Alabama Department of Revenue are required to file the AL 40A Booklet.

How to fill out AL 40A Booklet?

To fill out the AL 40A Booklet, taxpayers should provide accurate personal and financial information, including income, deductions, and tax credits as outlined in the form's instructions. It is important to ensure all figures are correct and any required documentation is included.

What is the purpose of AL 40A Booklet?

The purpose of the AL 40A Booklet is to enable taxpayers in Alabama to report their income and calculate their tax liability for the state, ensuring compliance with Alabama tax laws.

What information must be reported on AL 40A Booklet?

The AL 40A Booklet requires reporting of personal identification information, total income, various deductions, tax credits, and the calculated tax due or refund. Taxpayers must also include any supporting documentation as required by the form.

Fill out your AL 40A Booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL 40a Booklet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.