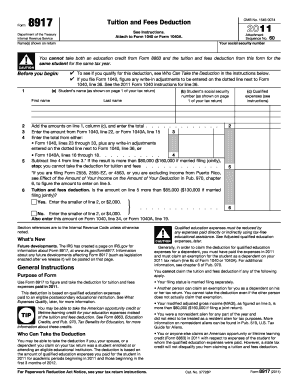

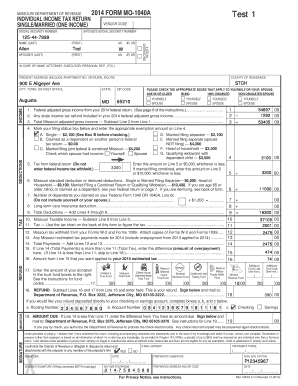

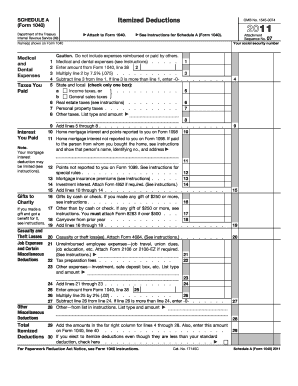

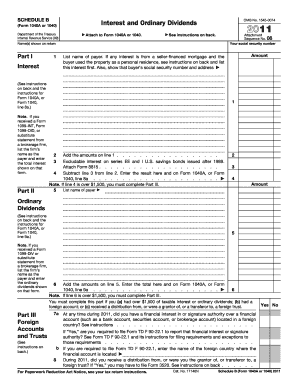

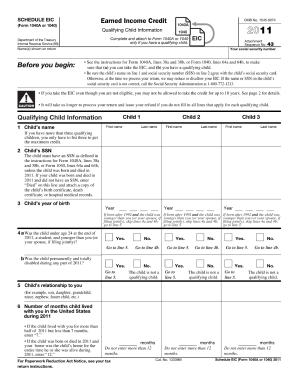

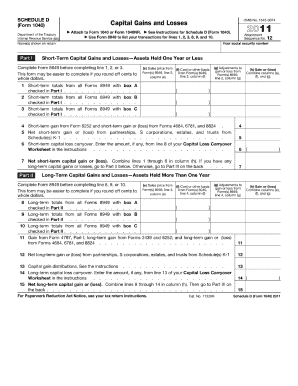

1040a 2011 Tax Form

What is 1040a 2011 tax form?

The 1040a 2011 tax form is a document used by individuals to report their income, deductions, and credits for the tax year 2011. It is a simplified version of the 1040 form and is suitable for taxpayers who meet certain criteria.

What are the types of 1040a 2011 tax form?

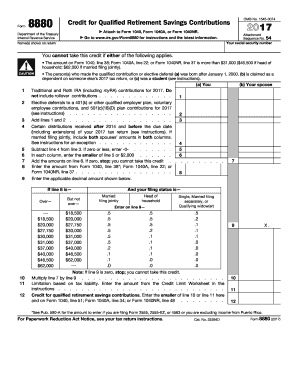

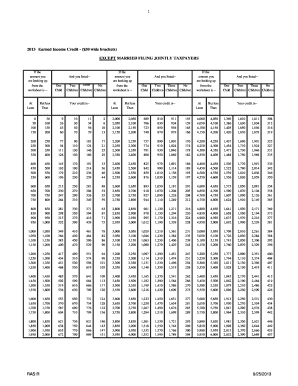

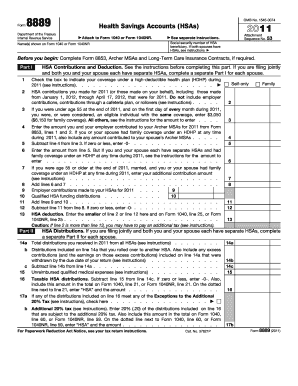

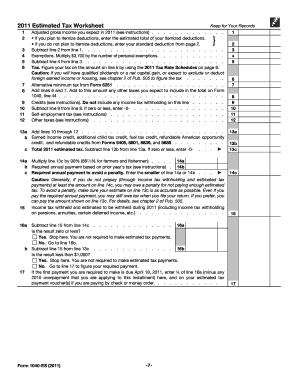

The types of information you need to provide on the 1040a 2011 tax form include your personal information, such as your name, address, and Social Security number. You will also need to report your income from various sources, such as wages, dividends, and interest. Additionally, you may need to claim deductions and credits that you are eligible for, such as the Earned Income Credit or the Child Tax Credit.

How to complete 1040a 2011 tax form

To complete the 1040a 2011 tax form, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.