Get the free 2012 irs form 3903

Show details

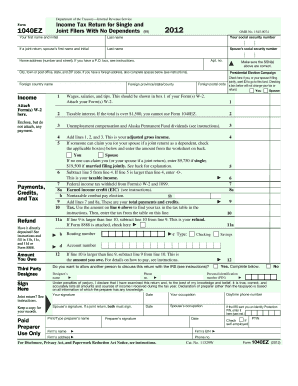

Cat. No. 12490K Form 3903 2012 INTENTIONALLY LEFT BLANK Page 3 General Instructions Time Test Future Developments For the latest information about developments related to Form 3903 and its instructions such as legislation enacted after they were published go to www.irs.gov/form3903. Form Moving Expenses Department of the Treasury Internal Revenue Service 99 OMB No* 1545-0074 Attachment Sequence No* 170 Your social security number Name s shown on return Before you begin Information about Form...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 irs form 3903

Edit your 2012 irs form 3903 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 irs form 3903 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 irs form 3903 online

To use the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2012 irs form 3903. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is classified as a moving expense?

You can deduct certain expenses associated with moving your household goods and personal effects. Examples of these expenses include the cost of packing, crating, hauling a trailer, in-transit storage, and insurance.

Who qualifies for moving expense deduction?

Moving expenses tax deduction – current requirements Active-duty military member, and you permanently move to a new base pursuant to a military order. The dependent or spouse of a military member who moves to a new base. The spouse or dependent of a military member that died, was imprisoned or deserted.

What do you need to qualify for the moving expense deduction?

Moving expenses tax deduction – current requirements Active-duty military member, and you permanently move to a new base pursuant to a military order. The dependent or spouse of a military member who moves to a new base. The spouse or dependent of a military member that died, was imprisoned or deserted.

Why are moving expenses no longer deductible?

Since the Tax Cuts and Jobs Act (TCJA) was passed in 2017 by President Trump, many people are no longer able to deduct moving expenses on their federal taxes. TCJA makes it simple – If you moved after 2018 and are not an active member of the Military or Armed Forces, you cannot deduct moving expenses.

What line on Form 1040 is the moving expense deduction carried from Form 3903?

Shipping and storage costs for packing and moving your household goods and personal effects go on line 1 of Form 3903. Travel, lodging, and gas costs go on line 2. Reimbursements from your employer for any moving expenses are reported on line 4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2012 irs form 3903 for eSignature?

Once your 2012 irs form 3903 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute 2012 irs form 3903 online?

pdfFiller has made it simple to fill out and eSign 2012 irs form 3903. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit 2012 irs form 3903 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 2012 irs form 3903 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is irs form 3903?

IRS Form 3903, also known as the Moving Expenses form, is used to calculate and claim moving expenses that are tax deductible.

Who is required to file irs form 3903?

Individuals who have incurred eligible moving expenses due to a change in their job location, and meet the IRS requirements, are required to file IRS Form 3903.

How to fill out irs form 3903?

To fill out IRS Form 3903, you need to provide your personal information, details about your move, and information about your moving expenses. The form includes instructions to help you accurately fill it out.

What is the purpose of irs form 3903?

The purpose of IRS Form 3903 is to calculate and claim tax deductions for eligible moving expenses incurred due to a change in job location.

What information must be reported on irs form 3903?

On IRS Form 3903, you must report your personal information, details about your move, including the distance and time test, and substantiate your moving expenses with supporting documents.

Fill out your 2012 irs form 3903 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Irs Form 3903 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.