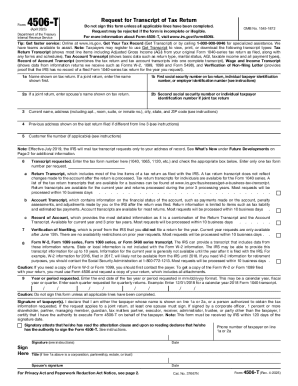

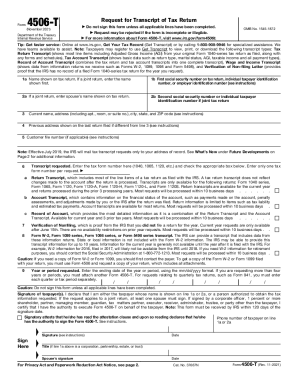

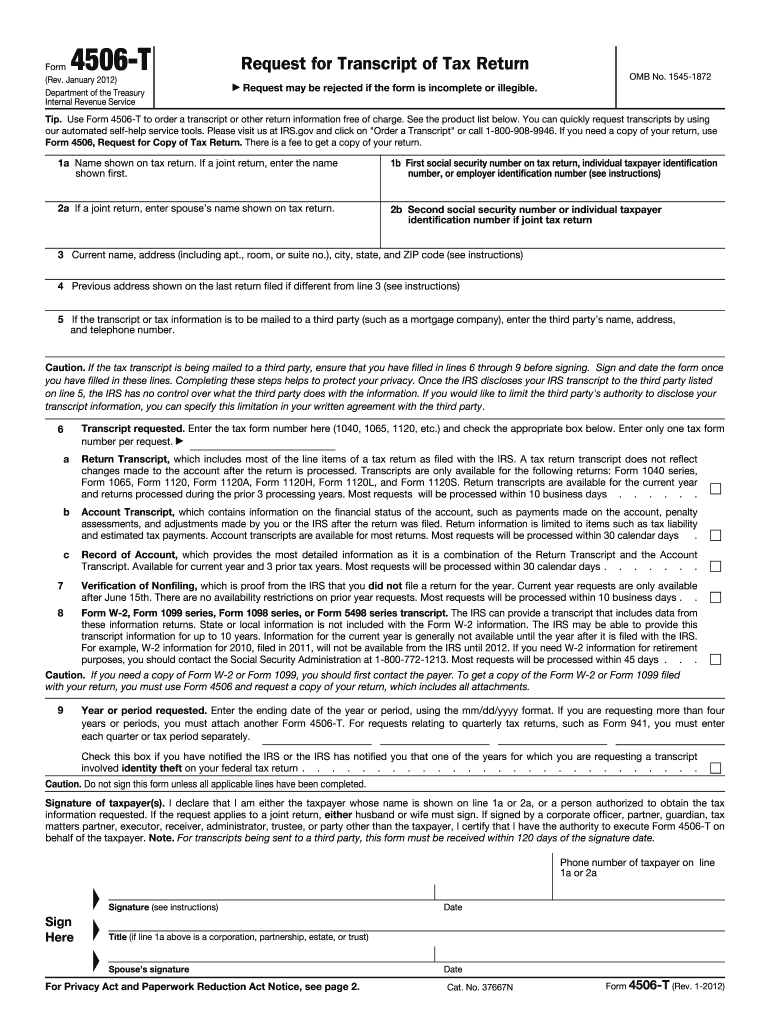

IRS 4506-T 2012 free printable template

Instructions and Help about IRS 4506-T

How to edit IRS 4506-T

How to fill out IRS 4506-T

About IRS 4506-T 2012 previous version

What is IRS 4506-T?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4506-T

What should I do if I make a mistake on my IRS 4506-T after submission?

If you need to correct mistakes on your IRS 4506-T after submission, you should prepare an amended form to reflect the accurate information. It’s crucial to indicate clearly that it is a correction and provide any necessary explanation for the adjustments. Ensure you also maintain copies of both the original and amended forms for your records.

How can I verify the status of my submitted IRS 4506-T?

To verify the status of your submitted IRS 4506-T, you can contact the IRS directly or use online tools provided by the IRS for tracking purposes. Be prepared with details such as your name, Social Security Number, and any confirmation you have regarding your submission for effective support.

Are electronic signatures accepted on the IRS 4506-T?

Yes, electronic signatures are accepted on the IRS 4506-T, provided they meet the IRS e-signature criteria. Ensure that your e-signature complies with the standards set by the IRS to avoid processing issues associated with your form.

What common errors should I avoid when submitting the IRS 4506-T?

Common errors to avoid when submitting the IRS 4506-T include entering incorrect identification information, failing to sign the form, or leaving required fields blank. Double-check all entries for accuracy to ensure a smooth submission process and minimize potential rejections.

What steps should I take if my IRS 4506-T submission is rejected?

If your IRS 4506-T submission is rejected, review the rejection notice carefully to identify the reason for the rejection. Rectify the identified issues and resubmit the form as soon as possible. Maintaining communication with the IRS can help clarify any additional steps you might need to take.

See what our users say