Get the free Notice to File Inventory/Account

Show details

This document serves as a formal notice to the fiduciary regarding the requirement to file an inventory or annual/final account for an estate, trust, or guardianship within a specified timeframe to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice to file inventoryaccount

Edit your notice to file inventoryaccount form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice to file inventoryaccount form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice to file inventoryaccount online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit notice to file inventoryaccount. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice to file inventoryaccount

How to fill out Notice to File Inventory/Account

01

Begin by downloading the Notice to File Inventory/Account form from the appropriate legal or court website.

02

Fill in the court information at the top of the form, including case number and court address.

03

Provide your name and contact information in the appropriate section.

04

List the parties involved in the case, including their names and addresses.

05

Clearly document the items you intend to inventory or account for, providing details like descriptions, values, and any relevant dates.

06

Verify all information is accurate and complete to avoid delays.

07

Sign and date the form, certifying that the information provided is true to the best of your knowledge.

08

Submit the completed form to the court by the specified deadline.

Who needs Notice to File Inventory/Account?

01

Individuals who are involved in probate cases where an inventory or account of the deceased person's assets is required.

02

Executors or administrators of estates who must file inventory accounting with the court.

03

Beneficiaries who need to ensure the estate is managed transparently.

Fill

form

: Try Risk Free

People Also Ask about

Does a joint account count as a current account?

A joint bank account works the same way as a sole current account except that either of the account holders can use it.

What are the rules for joint bank accounts?

All joint bank accounts have two or more owners. Each owner has the full right to withdraw, deposit, and otherwise manage the account's funds. While some banks may label one person as the primary account holder, that doesn't change the fact everyone owns everything—together.

How to fill out inventory for decedent's estate?

How To Take Inventory of an Estate Identify the Assets. The first step involves listing all the assets that are part of the individual's estate. Note Details of Assets. Once you have a general list of the assets, the next step is to gather information about them. Appraise the Assets. Making a List of Debts and Liabilities.

What does inventory mean in probate?

Inventory in probate means much the same thing as it does in any other context. It's a thorough listing of a decedent's assets.

Does a joint bank account count as income?

If you have a joint account, you both may have to pay taxes on a portion of the interest income. However, the bank will only send one 1099-INT tax form. You can ask the bank who will receive the form because that person has to list the income on their tax return.

How long does an executor have to settle an estate in North Carolina?

While there is no fixed timeline stipulated by North Carolina law, executors are expected to proceed with reasonable diligence. The complexity of the estate, the nature and location of assets, debts and claims against the estate, and legal requirements all influence the timeline.

Do joint bank accounts have to be listed on the inventory and accounting?

Do I Have to List All Bank Accounts on the Inventory? Yes. Any and all bank accounts that the decedent owned must be listed on the inventory. This is true even if the bank accounts were held with payable-on-death (POD) designations or if the bank accounts were jointly held with the right of survivorship.

Are joint accounts considered part of an estate?

A bank account, joint or not, is going to be part of a person's estate. In that sense, if one of the joint owners of the joint account dies, a portion of that account will contribute to the decedent's taxable estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

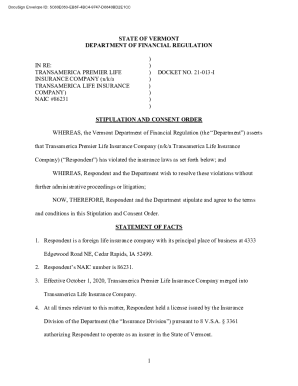

What is Notice to File Inventory/Account?

Notice to File Inventory/Account is a legal document that notifies an estate representative or personal representative that they are required to provide a detailed inventory and accounting of the estate's assets and liabilities.

Who is required to file Notice to File Inventory/Account?

Typically, the personal representative of an estate, which may include an executor or administrator, is required to file the Notice to File Inventory/Account.

How to fill out Notice to File Inventory/Account?

To fill out the Notice to File Inventory/Account, the personal representative needs to provide information such as a detailed list of the estate's assets, their values, liabilities, and any transactions that have occurred during the estate administration.

What is the purpose of Notice to File Inventory/Account?

The purpose of the Notice to File Inventory/Account is to ensure transparency in the administration of an estate, allowing interested parties, such as beneficiaries, to review the financial status of the estate.

What information must be reported on Notice to File Inventory/Account?

The information that must be reported includes a complete inventory of the estate's assets, their fair market values, any debts or liabilities associated with the estate, and a record of financial transactions related to the estate's administration.

Fill out your notice to file inventoryaccount online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice To File Inventoryaccount is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.