Get the free Standard Stop Loss Disclosure Form

Show details

This document is designed for Plan Sponsors to disclose known health risks associated with their plan participants for the purpose of evaluating the acceptability of stop loss insurance coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard stop loss disclosure

Edit your standard stop loss disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard stop loss disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing standard stop loss disclosure online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit standard stop loss disclosure. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

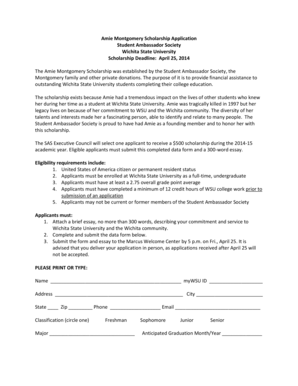

How to fill out standard stop loss disclosure

How to fill out Standard Stop Loss Disclosure Form

01

Obtain the Standard Stop Loss Disclosure Form from your insurance provider or regulatory authority.

02

Read the instructions carefully to understand the information required.

03

Fill in your personal and company information, including name, address, and contact details.

04

Provide details about the stop loss plan, such as coverage limits and specific terms.

05

Complete any financial information required, including premium amounts and claims history.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form where indicated.

08

Submit the form to your insurance provider as per their guidelines.

Who needs Standard Stop Loss Disclosure Form?

01

Employers offering self-funded health plans.

02

Insurance agents or brokers assisting clients with stop loss insurance.

03

Health plan administrators needing to disclose stop loss policy terms.

04

Regulatory authorities requiring disclosure for compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a stop-loss claim?

Stop-loss insurance can be attractive if you have a self-funded health benefit plan at your organization. It can help you combat rising medical costs and lower your company's financial liability for expensive medical claims. The right stop-loss coverage can make or break a self-funded health insurance plan.

How do you write a disclosure form?

An effective disclosure statement should do the following: Identify all relevant parties involved. Determine and state the purpose of the disclosure. Outline and provide the information that needs to be included in the disclosure. Be written using straightforward, non-technical, and easy-to-understand language.

What is a stop-loss form?

Under a stop-loss policy, the insurance company becomes liable for losses that exceed certain limits called deductibles. There are two types of self-funded insurance: Specific Stop-Loss is the form of excess risk coverage that provides protection for the employer against a high claim on any one individual.

What is an example of a stop-loss?

For example, if an employer elects that their maximum liability per person on their benefits plan for that policy year be $100,000, and a specific claimant exceeds that liability and their total claims are $102,000, the stop-loss policy will reimburse them for claims in excess of that amount, the $2,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Standard Stop Loss Disclosure Form?

The Standard Stop Loss Disclosure Form is a document used by insurance providers to disclose specific information about stop-loss insurance policies, ensuring transparency and compliance with regulatory requirements.

Who is required to file Standard Stop Loss Disclosure Form?

Insurance companies that offer stop-loss insurance policies are required to file the Standard Stop Loss Disclosure Form to meet regulatory standards.

How to fill out Standard Stop Loss Disclosure Form?

To fill out the Standard Stop Loss Disclosure Form, providers must complete all relevant sections with accurate policy details, including coverage limits and exclusions, and submit it to the appropriate regulatory body.

What is the purpose of Standard Stop Loss Disclosure Form?

The purpose of the Standard Stop Loss Disclosure Form is to provide a clear understanding of the terms and conditions of stop-loss insurance policies, aiding in informed decision-making by employers and ensuring compliance with state regulations.

What information must be reported on Standard Stop Loss Disclosure Form?

The Standard Stop Loss Disclosure Form must report information including coverage terms, premiums, deductible amounts, exclusions, conditions for policy termination, and any limitations related to the stop-loss insurance.

Fill out your standard stop loss disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Stop Loss Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.