Get the free Financial Policy and Medical Insurance

Show details

This document outlines the financial policy for patients regarding insurance claims, payment responsibilities, and privacy practices concerning the use and disclosure of medical information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial policy and medical

Edit your financial policy and medical form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial policy and medical form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial policy and medical online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit financial policy and medical. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial policy and medical

How to fill out Financial Policy and Medical Insurance

01

Gather necessary documents: Collect all relevant financial documents, including income statements, expenses, and existing insurance policies.

02

Understand the policy requirements: Review the guidelines provided by your insurance provider regarding the financial policy and medical insurance.

03

Complete the application form: Fill out the financial policy application accurately, ensuring all required fields are completed.

04

Provide supporting documentation: Attach any necessary documentation, such as proof of income, medical records, or previous insurance policies.

05

Review and submit: Double-check all information for accuracy before submitting your completed application to the insurance provider.

Who needs Financial Policy and Medical Insurance?

01

Individuals seeking financial security and protection against medical expenses.

02

Families who want to ensure their loved ones have coverage in case of unforeseen health issues.

03

Employees whose employers provide options for financial policy and medical insurance benefits.

04

Self-employed individuals who require coverage to protect their health and finances.

Fill

form

: Try Risk Free

People Also Ask about

Why is it important to include health insurance in your financial planning?

No one plans to get sick or hurt, but most people need medical care at some point. Health insurance covers these costs and offers many other important benefits. Health insurance protects you from unexpected, high medical costs. You pay less for covered in-network health care, even before you meet your deductible.

What are the basic elements of a medical office financial policy?

Explain that you're partnering to serve patients through their healthcare and financial experience. Specify which insurance details and patient demographic information you need. List your accepted payment methods. Do you accept cash, check, credit cards, credit cards on file, healthcare gift cards, digital vs.

Why is it important for a medical practice or organization to have a specific policy regarding write offs?

Write-offs are important for maintaining accurate financial records and ensuring compliance with various contractual or regulatory standards. Instead of continuing to pursue payment for these uncollectible amounts, providers “write them off” as unpayable.

Why is it important for a medical practice to share its financial policy with patients?

Payment policy essentials A well-crafted policy will prevent patients from being surprised about their financial obligation when they receive your services. It will also give your practice some legal protection should a patient fail to pay what you are entitled to collect.

What is a policy in health insurance?

When you purchase a health insurance policy, your insurance company agrees to financially protect you if you get sick or hurt by helping to pay for healthcare services you need. They also agree to provide preventative services and screening tests, which must be provided at no cost to you.

Why do medical practices and healthcare organizations need patient financial policies?

In conclusion, patient financial policies are an essential tool for managing the financial health of a medical practice or health care organization. They provide transparency, help manage the revenue cycle, and ensure legal compliance.

Why is it important for a health informatics professional to understand a financial statement, budget, net bad debt, NBD, and other financial measures?

Understanding financial statements helps shared decision-making between clinicians and their administrators—strengthening partnerships that synergistically drive revenue, profitability, and growth.

What should a practice's financial policy tell patients?

List what resources are available if a patient needs financial assistance or alternative payment options. Provide a contact (staff name, phone, and email) so the patient knows where to direct any payment questions. Clearly state your practice's penalties for no-shows, cancellations, missed payments, and any other fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Policy and Medical Insurance?

Financial Policy refers to the guidelines and procedures set by a healthcare provider regarding payment for medical services, including the costs and terms of medical insurance. Medical Insurance is a contract between an individual and an insurance company that provides financial coverage for healthcare expenses.

Who is required to file Financial Policy and Medical Insurance?

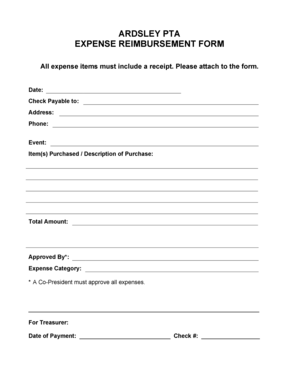

Typically, healthcare providers, medical offices, and patients seeking reimbursement for medical expenses are required to file Financial Policy and Medical Insurance.

How to fill out Financial Policy and Medical Insurance?

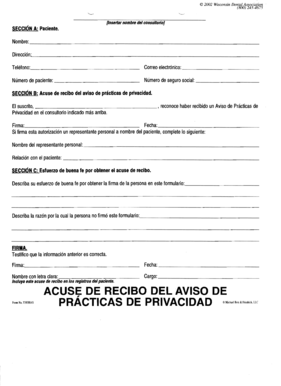

To fill out Financial Policy and Medical Insurance, individuals must provide personal information, insurance details, and consent permissions to disclose financial and medical information, ensuring all fields are accurately completed.

What is the purpose of Financial Policy and Medical Insurance?

The purpose of Financial Policy and Medical Insurance is to outline the expectations for payment for medical services, to clarify the coverage provided by insurance plans, and to ensure that patients understand their financial responsibilities.

What information must be reported on Financial Policy and Medical Insurance?

Information that must be reported includes patient personal details, insurance company information, policy numbers, methods of payment, and any agreements regarding financial responsibilities for medical care.

Fill out your financial policy and medical online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Policy And Medical is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.