Get the free Annual Reports and Audits

Show details

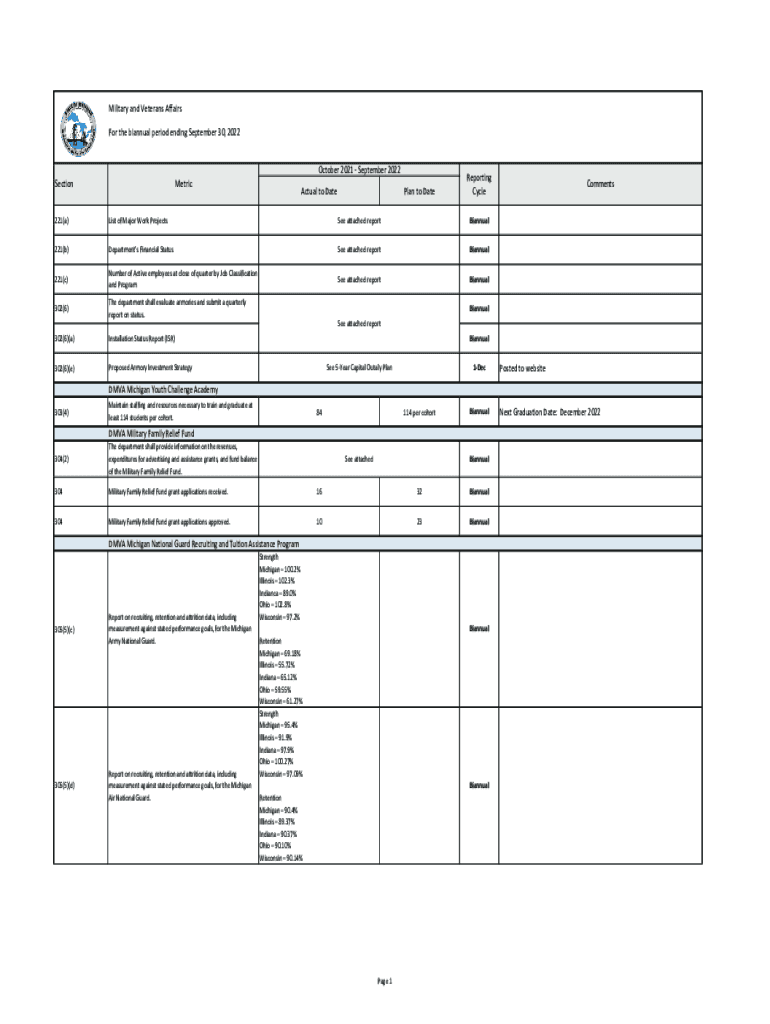

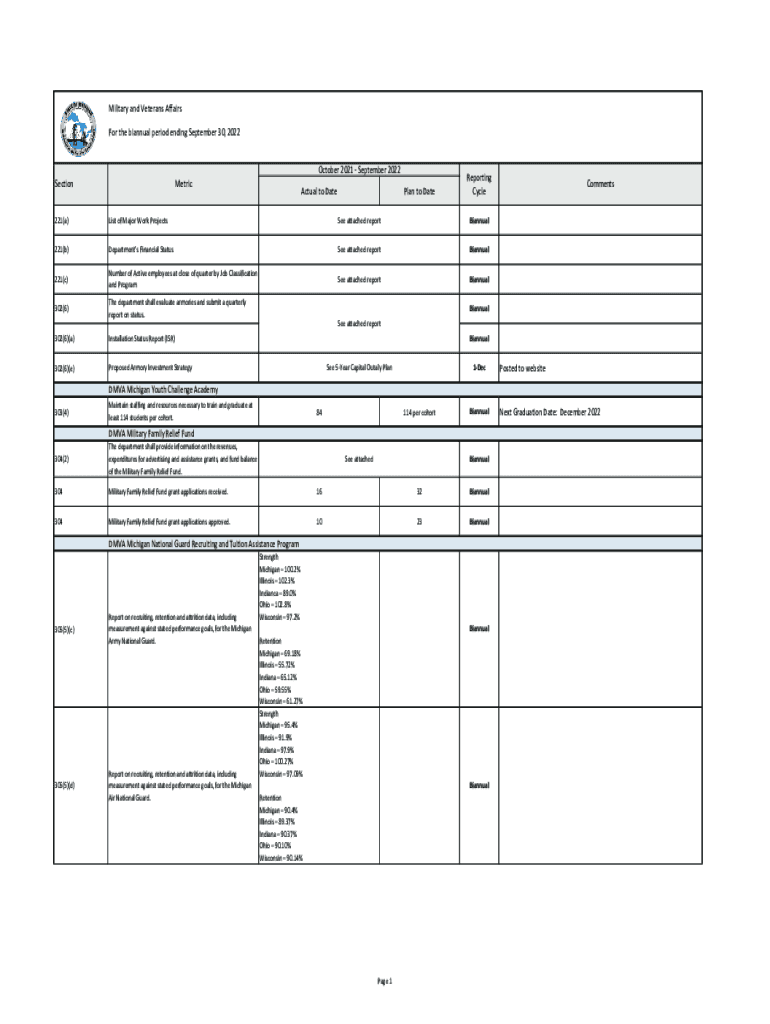

MilitaryandVeteransAffairs ForthebiannualperiodendingSeptember30,2022 October2021September2022 SectionMetricActualtoDatePlantoDateReporting Cycle221(a)ListofMajorWorkProjectsSeeattachedreportBiannual221(b)Department\'sFinancialStatusSeeattachedreportBiannual221(c)NumberofActiveemployeesatcloseofquarterbyJobClassification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual reports and audits

Edit your annual reports and audits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual reports and audits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual reports and audits online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annual reports and audits. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual reports and audits

How to fill out annual reports and audits

01

Step 1: Gather all financial information and documents necessary for the annual report and audit.

02

Step 2: Review previous year's annual report and audit findings to identify any areas that need improvement or attention.

03

Step 3: Prepare the balance sheet, income statement, and cash flow statement for the reporting period.

04

Step 4: Compile supporting documentation such as bank statements, receipts, and invoices to substantiate financial figures.

05

Step 5: Conduct a thorough review of financial records to identify any errors or discrepancies.

06

Step 6: Engage a certified public accountant (CPA) or an auditing firm to perform an independent audit of the financial statements.

07

Step 7: Cooperate with the auditors during their examination, provide requested information, and address any concerns or questions.

08

Step 8: Incorporate the audit findings and recommendations into the annual report, ensuring transparency and compliance with accounting standards.

09

Step 9: File the completed annual report and audit with the appropriate regulatory bodies within the designated timeframe.

10

Step 10: Communicate the findings and conclusions of the annual report and audit to relevant stakeholders such as shareholders, investors, and regulatory authorities.

Who needs annual reports and audits?

01

Publicly traded companies need annual reports and audits to comply with legal and regulatory requirements, provide transparency to shareholders, and attract investors.

02

Government agencies and non-profit organizations often require annual reports and audits to demonstrate accountability and proper utilization of funds.

03

Banks and financial institutions may need annual reports and audits to evaluate the financial health and risk profile of a company before making lending or investment decisions.

04

Potential stakeholders, including prospective investors or business partners, may request annual reports and audits to assess the financial performance and stability of a company.

05

Some jurisdictions may mandate annual reports and audits for all registered companies regardless of their size or legal structure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete annual reports and audits online?

pdfFiller makes it easy to finish and sign annual reports and audits online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my annual reports and audits in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your annual reports and audits right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the annual reports and audits form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign annual reports and audits and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is annual reports and audits?

Annual reports are comprehensive documents that summarize a company's activities and financial performance over the past year. Audits are formal examinations of an organization's financial statements and accounting practices, typically conducted by external auditors to ensure accuracy and compliance with accounting standards.

Who is required to file annual reports and audits?

Publicly traded companies and certain private companies, along with non-profit organizations, are typically required to file annual reports and undergo audits as mandated by federal or state laws and regulations.

How to fill out annual reports and audits?

To fill out annual reports, organizations must gather financial data, operational metrics, and other relevant information, then compile it into a structured format as per regulatory requirements. For audits, organizations must prepare all financial statements, accounting records, and supporting documents to facilitate the auditor’s examination.

What is the purpose of annual reports and audits?

The purpose of annual reports is to inform shareholders and stakeholders about the company’s financial health and strategic direction. Audits serve to verify the accuracy of financial statements and enhance credibility with investors and regulatory bodies.

What information must be reported on annual reports and audits?

Annual reports must include financial statements (income statement, balance sheet, cash flow statement), management discussion and analysis, and notes to the financial statements. Audits must report on the fairness of the financial statements, the effectiveness of internal controls, and compliance with applicable laws and regulations.

Fill out your annual reports and audits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Reports And Audits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.