Get the free NEW MARKETS CAPITAL INVESTMENT CREDIT WORKSHEET - maine

Show details

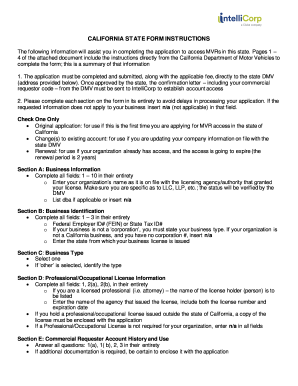

NEW MARKETS CAPITAL INVESTMENT CREDIT WORKSHEET FOR TAX YEAR 2014 36 M.R.S. 5219HH FOR ELIGIBLE INVESTMENTS MADE DURING TAX YEARS BEGINNING IN 2012 Note: You are eligible to claim a 2014 New Markets

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new markets capital investment

Edit your new markets capital investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new markets capital investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new markets capital investment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new markets capital investment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new markets capital investment

01

Identify potential markets: Conduct thorough market research to identify new markets with growth potential and demand for your products or services. Analyze factors such as market size, competition, and consumer behavior to make informed decisions on where to invest.

02

Evaluate market potential: Assess the potential profitability and return on investment of entering new markets. Consider factors such as market saturation, pricing dynamics, and regulatory environment. This evaluation will help determine if new markets capital investment is a suitable strategy for your business.

03

Define objectives and strategy: Clearly define your objectives for entering new markets, such as increasing market share or diversifying revenue streams. Develop a strategic plan that outlines the steps, resources, and timelines required to achieve your objectives. This plan should also include strategies to mitigate risks and challenges associated with entering new markets.

04

Allocate resources: Determine the amount of capital needed to enter new markets successfully. This includes identifying the financial resources required for marketing campaigns, distribution channels, product adaptation, and any legal or regulatory compliance. Allocate resources efficiently to ensure optimal utilization and minimize financial risks.

05

Develop partnerships and alliances: Establishing partnerships with local businesses, distributors, or industry experts can provide valuable insights, market access, and support in new markets. Collaborative efforts can help mitigate risks, expand your network, and build credibility in unfamiliar territories.

06

Customize marketing and communication: Tailor your marketing and communication strategies to suit the new markets' cultural, linguistic, and socio-economic nuances. This includes adapting messaging, product packaging, and promotional activities to resonate with the target audience. Investing in localized branding efforts can enhance your market penetration and customer engagement.

07

Implement a market entry plan: Execute your market entry plan systematically, addressing each element outlined in your strategy. Monitor progress closely, measure key performance indicators, and make adjustments as necessary to optimize your investments. Seek feedback from local partners or customers to fine-tune your approach.

Who needs new markets capital investment?

Businesses that are looking to expand their operations, enter new markets, or diversify their revenue streams may require new markets capital investment. This can include startups aiming to scale up, established companies seeking growth opportunities, or businesses in saturated markets exploring untapped markets for expansion. New markets capital investment allows companies to leverage untapped market potential, increase market share, and sustain long-term growth.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new markets capital investment?

New markets capital investment refers to the financial investments made in emerging or underserved markets with the goal of promoting economic development and growth.

Who is required to file new markets capital investment?

Individuals or organizations that have made capital investments in new markets are required to file new markets capital investment reports.

How to fill out new markets capital investment?

New markets capital investment reports can typically be filled out online through the designated reporting platform provided by the relevant regulatory agency.

What is the purpose of new markets capital investment?

The purpose of new markets capital investment is to encourage investment in areas that are traditionally underserved or underdeveloped, with the aim of stimulating economic growth and job creation.

What information must be reported on new markets capital investment?

Information such as the amount of capital invested, the location of the investment, the expected impact on the local community, and any financial returns expected must be reported on new markets capital investment.

How can I get new markets capital investment?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the new markets capital investment in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit new markets capital investment on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing new markets capital investment right away.

How do I fill out new markets capital investment using my mobile device?

Use the pdfFiller mobile app to fill out and sign new markets capital investment on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your new markets capital investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Markets Capital Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.